Shrinking China

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Population shrinkage

China's population shrank last year for the first time in 60 years, marking the beginning of a structural shift that will have profound implications for the global economy.

The population stood at a little over 1.4 billion in 2022, a decline of about 850,000, according to official figures. The shrinking pool of working age people will, over the long term, constrict the economy, weighing on growth and placing huge pressure on a welfare system that is already creaking.

The one child policy, introduced in 1979 to slow growth and scrapped in 2016 to little effect, had a large hand in shaping China's demographic landscape. The cost of rearing children is another significant factor - last year the YuWa Population Research Institute, a think-tank in Beijing, reported that child rearing costs as a ratio of GDP per person were higher in China than in several advanced economies, including America.

India will soon overtake China as the world's most populous nation, in fact it may already have. More than a quarter of its population are aged between 15 and 29 years, making it among the youngest countries in the world. Along with eight other countries, it is expected to be responsible for more than half the projected increase in global population between now and 2050.

London offices

Just £400 million of London offices changed hands in the final quarter, according to Costar data covered by Bloomberg.

The weeks after the mini-budget represented peak uncertainty for interest rates, making underwriting difficult and causing transactions to fall sharply. The volatility complicated a process of value-adjustment that was already underway as buyers and sellers realign to the new, higher interest rate environment. That process will run its course and deal volumes will recover. We'll have more on this when we publish The London Report on February 2nd.

The leasing market stands in contrast to the investment market as occupiers seek to secure space that better suits new working habits. A lack of supply of best in class space is underpinning rental growth and take up is running at around 3 million square feet, only narrowly below long run averages. See this note from last Wednesday for more.

UK interest rates

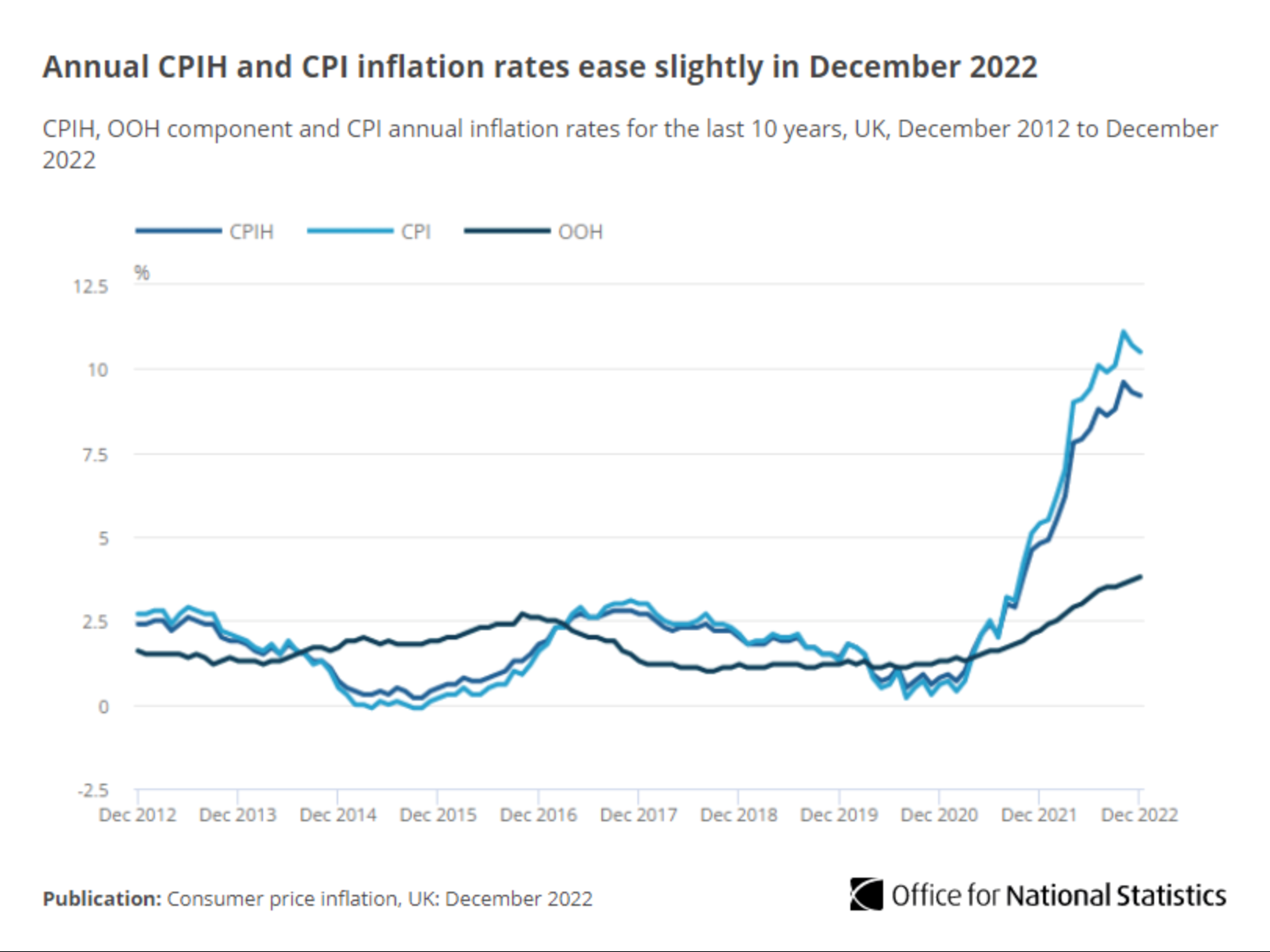

The UK Consumer Price Index dropped to 10.5% in December, down from 10.7% in November. That's the second consecutive monthly drop and was broadly in-line with expectations.

Core inflation, which strips out volatile food, energy, alcohol and tobacco prices was unchanged at 6.3%.

It's a positive reading but is unlikely to turn the Bank of England more dovish, particularly in light of wage data published earlier this week. That showed average pay climbing 6.4% in the three months to November compared to the same period a year earlier. It's "very hard" to see the MPC voting for a 25bps hike on February 2nd under these circumstances and a 50bps "looks highly likely", according to Samuel Tombs, Chief U.K. Economist at consultancy Pantheon Macroeconomics.

Locking in bills

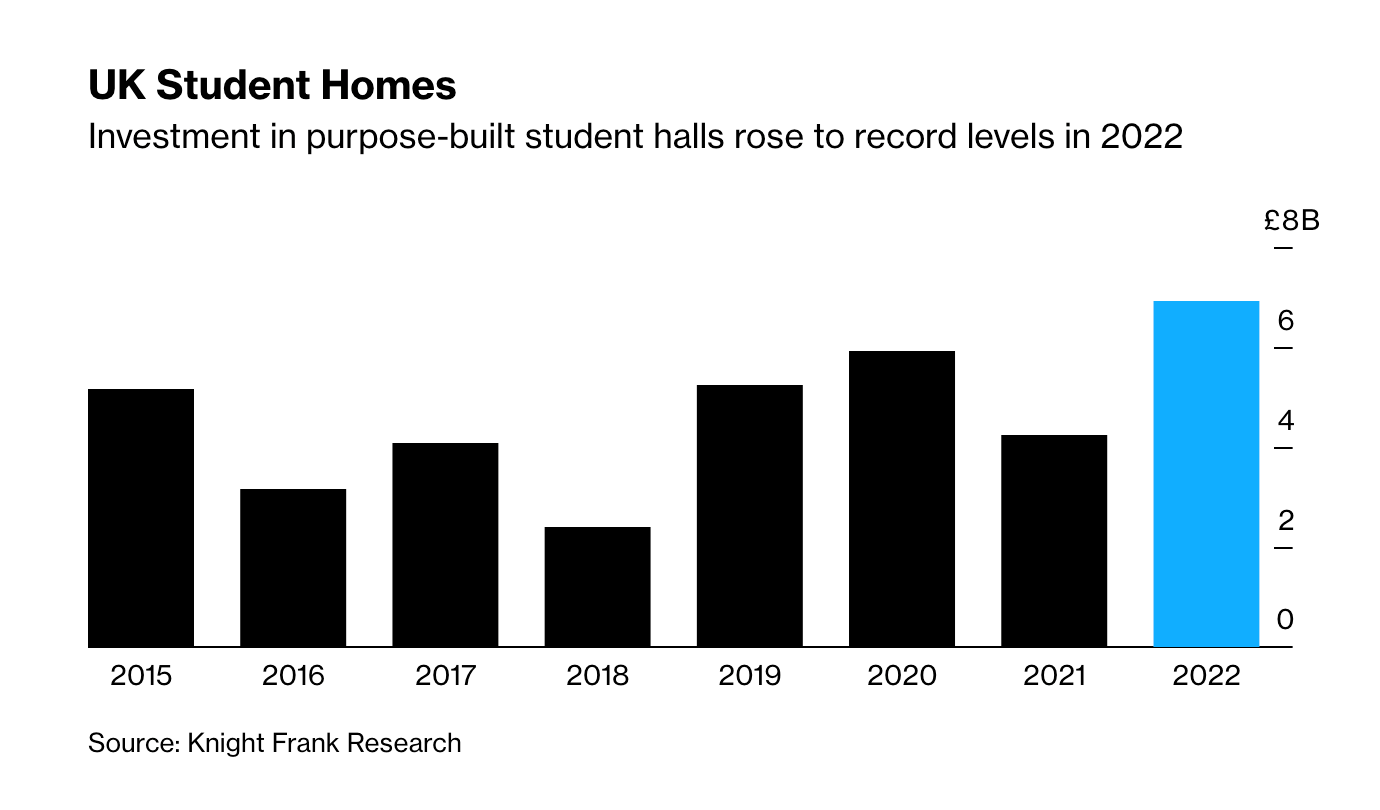

Almost £7 billion was invested in purpose-built student accommodation (PBSA) in 2022, a 62% year-on-year rise, according to Knight Frank data shared with Bloomberg (see chart). Inflation has been a factor driving investment into the sector as students opt for more certainty over their outgoings.

“An unanticipated positive stemming from the cost-of-living crisis has been a change in student sentiment toward PBSA versus that of the private rented sector,” says Katie O’Neill, head of student property research at Knight Frank . “More students are opting for the fixed cost model of professionally managed PBSA as they seek to maximize value for money.”

Our analysis of ONS population projections, along with entry rates from university admissions service UCAS, suggests there will be a 16% increase in full-time undergraduates between now and 2030, representing an extra 263,000 students. Meanwhile, new supply will lag demand, with only 25,700 beds under construction for the 2023 academic cycle.

In other news...

IMF signals upgrade to forecasts as optimism spreads at Davos (FT).