Demand in Edinburgh strong at end of the year

Deal activity continues despite an increase in buyer caution.

2 minutes to read

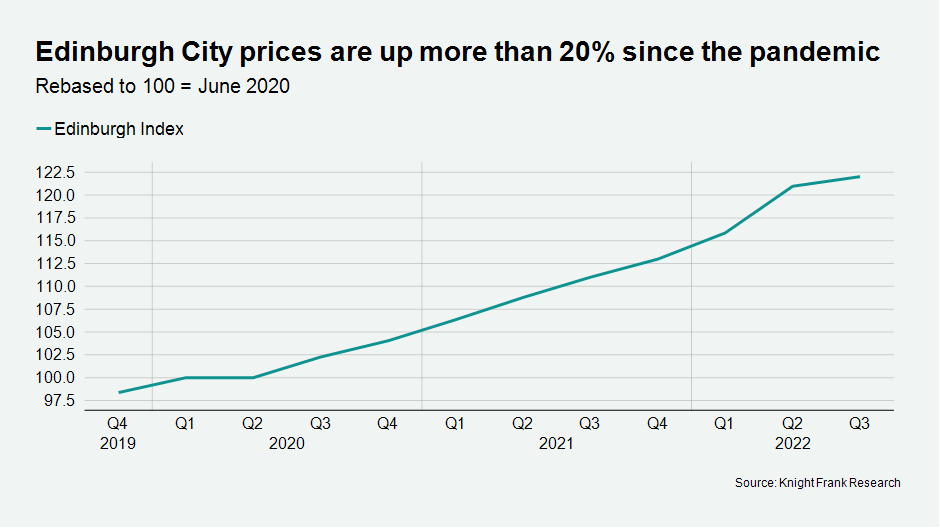

Edinburgh Index 132.8 / Quarterly change 0% / Annual change 8%

Demand for residential property remained strong in Edinburgh heading into the winter months, even as price growth slowed.

New instructions were up 62% in November versus the five-year average, in a market characterised by tight supply since the pandemic.

As in other UK markets, the prospect of rising mortgage rates – albeit peaking lower now than initially feared after the shock of the shock of the mini-Budget - has motivated buyers and sellers to get deals done.

Offers accepted were up 16% in November and by 11% in the 12 months to November, both against the five-year average.

With buyers increasingly circumspect due to the weakening economy in the UK, there was no change in average quarterly price growth. This took the annual rate of change to 8% in the fourth quarter, down from 9.9% in the third quarter.

We expect prices to fall 5% in prime regional markets next year as economic uncertainty and the end of ultra-low borrowing rates feed through to the residential property market.

However, supply in central Edinburgh – which as a UNESCO World Heritage Centre is always limited – is likely to remain tight next year, which will provide insulation from downwards price pressure.

The average price of a property in Edinburgh is up 22% since the reopening of the market in June after the first national lockdown.

Another busy year

The Scottish capital recorded another strong year of transactional activity with exchanges (concluded missives) up 24% in the 12 months to November versus the five-year average.

The number of exchanges in the period was also the second highest in seven years, as the return to the office continued to drive demand.

“We’ve seen a slight softening in prices for city centre flats as demand from investors has weakened due to rising interest rates and new regulations such as the rental price cap,” said Ricardo Volpi at Knight Frank Edinburgh.

“However, larger flats as a main residence are still doing well and attracting premiums, and the family house market continues to be a strong performer aided by tight supply. Looking to 2023, buyers are more cautious and sellers are more realistic,” Ricardo added.

Second home tax change

The Scottish Government has increased the additional dwelling supplement element of the Land and Buildings Transaction Tax. It means that second home purchases now face a levy of 6% rather than 4%, something that is likely to lead to a further softening in demand next year.