Scotland country house market finishes 2022 with strong trading

Market has normalised but remains active ahead of winter break.

2 minutes to read

Prime Scottish Index 109/ Small Country House 107.3/ Large Country House 103.4

Scotland’s country market capped an active year with a final burst of activity, after September’s mini-Budget initially caused some buyers to take fright.

The Scottish rural market is traditionally highly seasonal with limited activity during the winter.

However, while the bulk of fresh supply will come next spring, some sellers have decided not to wait in the face of increasing interest rates and a tougher economic outlook.

After a busy autumn, sales instructions were up by 50% in November versus the five-year average.

“We did have a few deals fall out of bed as a result of the mini-Budget. However, these returned to the market, later than normal, and are now under offer,” said Tom Stewart-Moore, head of Knight Frank’s rural business in Scotland.

The tax-cutting mini-Budget at the end of September triggered market volatility and a spike in interest rates.

After the appointment of Prime Minister Rishi Sunak and an Autumn Statement, mortgage markets have started to calm down as interest rate expectations have been rowed back.

Demand has been underpinned by Scotland’s relative affordability compared with other parts of the UK as well as the so-called ‘race for space’.

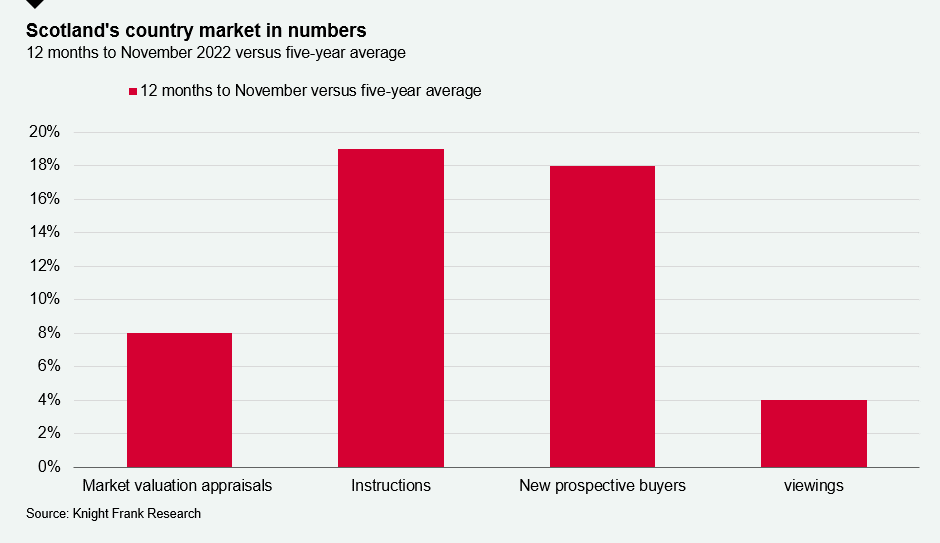

New prospective buyers were up 18% in the 12 months to November versus the five year-average, and sales instructions by 19% in the same period, indicating a relatively healthy pipeline of transactional activity.

“We’re not seeing the same sort of traffic that we did last year, and property is selling for closer to the Home Report value than we saw during the ‘escape to the country’ peak, but it’s a return to a healthy, normal market,” added Tom.

The average price of a property in the Scottish country market has been unchanged since September 2021, although it stands 6.7% higher than before the start of the pandemic.

We expect prices to fall 5% in prime regional markets next year as economic uncertainty and the end of ultra-low borrowing rates feed through to the residential property market.

Second home tax change

The Scottish Government has increased the additional dwelling supplement element of the Land and Buildings Transaction Tax. It means that second home purchases now face a levy of 6% rather than 4%, something that is likely to lead to a further softening in demand next year.