Deal activity resumes after mini-Budget shock

UK market outside of London demonstrates resilience.

3 minutes to read

Prime Country House Index 288.8 / Quarterly price change -0.9% / annual price change 3.1%

Activity resumed in prime UK regional markets in November after buyers hesitated in the weeks after the mini-Budget.

The low-tax economic plan set out by the previous government caused a spike in borrowing costs of around 150 basis points as inflation expectations rose sharply.

With financial markets calmed after a change of prime minister and economic policy, the pattern seen throughout this year of resilient demand being met by improved supply re-established itself in prime property markets outside of London.

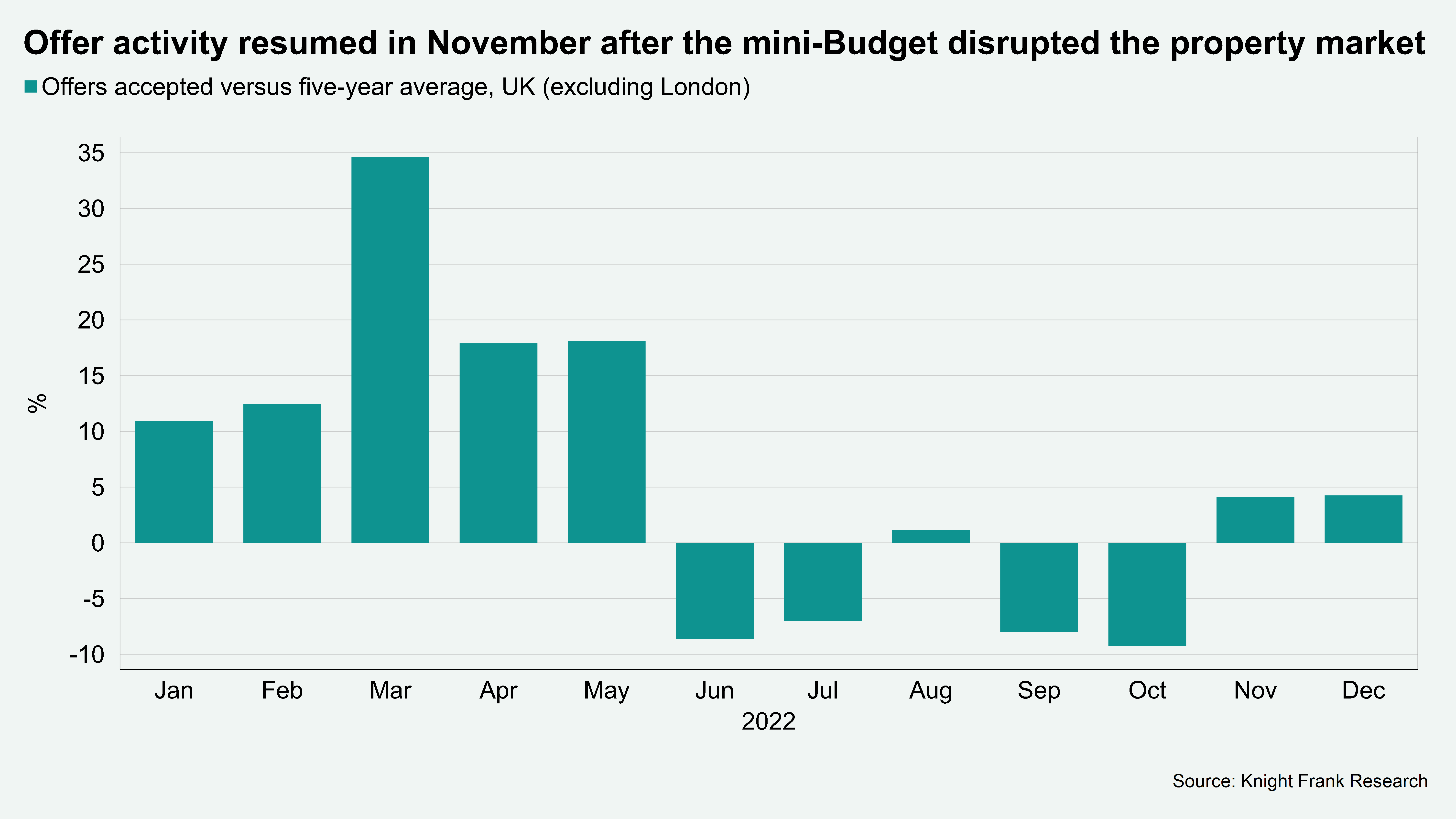

Accepted offers were up 4.1% versus the five-year average in November and by 4.3% in December, after a dip of 9% in October (see chart). June deal volumes, and to a lesser degree July and September, were negatively affected by comparison to 2021’s stamp duty deadlines.

In the 12 months to November, exchanges stand at the third highest in 15 years.

Average price growth fell 0.9% in the fourth quarter, taking the annual rate of change in the prime regional market to 3.1%. It was the largest quarter on quarter fall since the start of the pandemic.

The average price of a prime regional property remains 18% higher than before the start of the pandemic.

“The prime regional market is shifting back to something closer to pre-pandemic normality as the ‘escape to the country’ trend fades after what has been a record-breaking period. However, transaction volumes are resilient despite an increase in buyer caution,” said Chris Druce, senior research analyst at Knight Frank.

While some sellers in more rural markets will wait until next spring to list their property, others are keen to capitalise on the strong price growth seen since the pandemic – something that has seen a surge in downsizers in the market over the past year - and new sales instructions were 10.9% above the five-year average in November.

Town and city markets, which have seen their own renaissance since the first lockdowns of the pandemic, are typically less seasonal and remain busy as the year ends.

Escape to the country fades

Ultimately, we except the combination of higher borrowing costs and a shallow recession to put downwards pressure on prices next year, with average values expected to fall by 5%.

However, some parts of the UK will also be more insulated from higher interest rates due to lower levels of mortgage debt and a higher proportion of cash buyers, as we explored here.

While supply outside of the capital continues to improve it remains tight. It was down 13% in the 12 months to November compared to the previous year, and this will continue to support pricing.

Meanwhile, the ‘escape to the country’ trend has yet to fully play out as people recalibrate their work/life balance, a process that will take years.

“People still want to move, and it remains a supply and demand issue,” said Leigh Glazebrook, office head at Knight Frank Stow-on-the-Wold. “Properties in the right spot will sell, not least because in what had been a busy period not everyone has had an opportunity to purchase.”