Why investors spent £1.5 billion on BTR assets in just three months

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

BTR

Investors spent £1.5 billion on Build to Rent assets in the third quarter, making it the second strongest quarter on record, according to our new 2022/2023 Multihousing report. That brings total committed capital for the first nine months of the year to £3.2 billion, up 10.2% on the same period a year earlier.

The sector isn't immune to higher borrowing costs - we expect a slowdown in the final three months of the year as some highly leveraged investors take a pause - but there are numerous tailwinds driving capital to the sector.

The rental market is generally resilient during turbulent times, for example. The peak to trough fall in rents during the Global Financial Crisis was just 1.4%. Meanwhile, unemployment remains close to record lows, the population continues to grow, wages are climbing and higher mortgage rates are cutting into affordability and swelling the pool of renters. That's all happening as landlords sell up amid a much less favourable tax environment. There have been more than 260,000 buy-to-let mortgage redemptions over the last five years alone.

Investors that were previously looking to use debt to finance purchases are in many cases drawing on cash reserves with a view to refinancing later. There are £650 million in deals in solicitors hands which could trade by year-end. That would take the full year investment figure to £3.8 billion - down slightly year-on-year but about a third higher than the long-run average.

We identify the next growth markets here. You can read the full report here.

Pent up demand

Several real estate sectors saw a surge in activity during the reopening of the economy following the worst of the pandemic. In most cases that has now subsided, but not all.

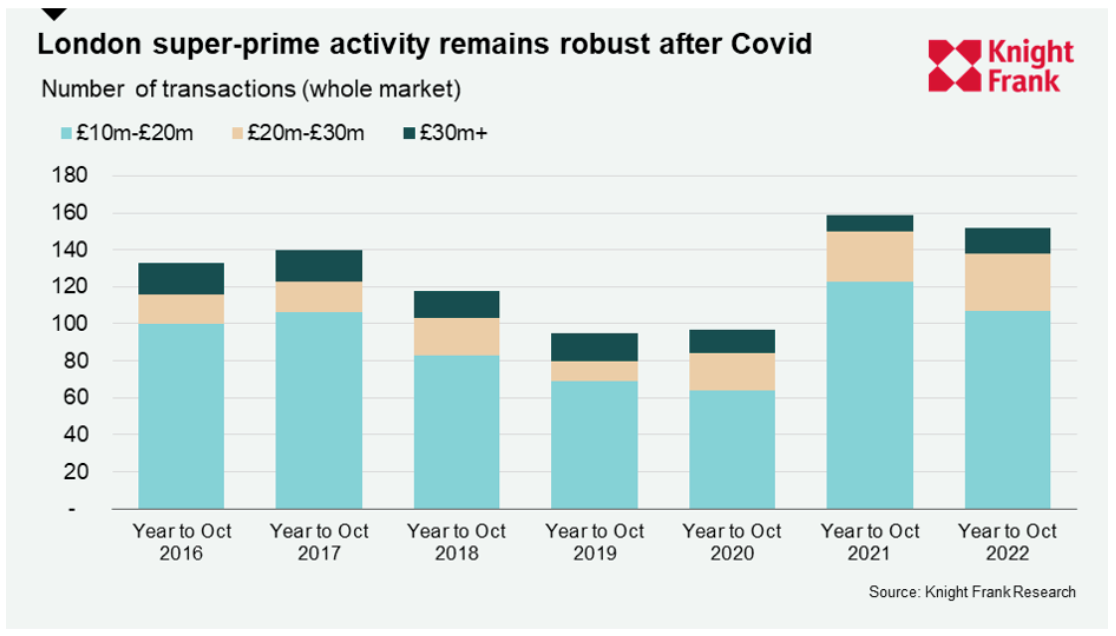

There were 152 super-prime (£10 million-plus) sales in London during the year to October 2022, whole-market data shows. That's down slightly on the previous 12 months (see chart), though it may rise as Land Registry records update. Regardless, the tally is higher than any of the previous five years. A total of £2.8 billion was spent in the latest 12-month period, the most in seven years.

“Brexit made buyers hesitate and Covid forced them to stay at home, so frustrated demand is still working its way through the system,” says Paddy Dring, Knight Frank's global head of prime sales. “However, other risks are now on the horizon, including rising mortgage rates and speculation that house prices will fall. It can lead to expectation gaps, however marginal, between what buyers and sellers perceive as fair value.”

House prices

Earlier this week, Bank of England data laid bare the impact of the mini-budget on property market activity. Mortgage approvals fell 11% below the long run average as the average interest rate paid on newly drawn mortgages surged 25 basis points to 3.09%.

Higher borrowing costs are now weighing on prices. Annual UK price growth slowed to 4.4% during the year to November, down from 7.2% a month earlier, according to Nationwide data out yesterday. Prices declined 1.4% during the month.

Activity is going to remain subdued, but there is still room for borrowing costs to ease further. Much will depend on the path of the base rate over the coming couple of quarters and the data increasingly suggests the Bank of England has more breathing room than it did just a few weeks ago.

Inflation expectations eased notably during November, according to Bank data out yesterday. Businesses expect to raise prices 5.7% over the next twelve months, down from 6.2% in October. The FT makes that the lowest pace since the start of the Ukraine war.

Pivot latest...

Inflation in the eurozone fell for the first time in 17 months during October, according to official figures published Wednesday. That adds to a growing body of evidence suggesting global inflation is peaking.

The Fed's preferred measure of inflation eased to 6% in October, down from 6.3% a month earlier, according to figures published yesterday. Meanwhile, data due out later today is likely to show that the jobs market cooled further in November.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Fed chair Jerome Powell said during an appearance at the Brookings Institution on Wednesday.

Those comments led to a further easing of mortgage rates this week. The 30-year rate now sits at 6.49%, down from a peak of 7.08%, according to Freddie Mac.

In other news...

Despite the slowing economy, estate staff availability remains extremely limited according to our biennial Estate Staff Salaries Survey. Pay is on the rise, writes Andrew Shirley.

We’d like to hear if the changing outlook has affected your plans to buy or sell a home in 2023 - as a thank you for taking part in our survey, one lucky survey respondent will win a Fortnum & Mason Christmas Collection hamper.

Photo by Anete Lusina