Tiered market emerging in seniors housing sector

As the sector matures, we expect to see the emergence of a more tiered market.

1 minute to read

Current trends include a move to higher specification and larger schemes, higher price point locations (including suburban destinations), higher ESG credentials and re-investment and flexibility in design.

From an operations perspective, there is a focus on a brand recognition, staff training, marketing and sales processes and operational efficiencies.

Tiered investment market

Investors are increasingly happy to take on more operating cost risk through lower service/management charges, as well as higher Deferred Management Fees (DMF) and an increasing rate of DMF rising at the start of tenancies. The net impact of this will be the emergence of a tiered investment market.

Different models already exist, with investors in retirement housing focussed on maximising development returns and Integrated Retirement Communities (IRC) on the profitability and sustainability of long term cashflows.

As more schemes open, performance will vary depending on the success of operators to meet the myriad of new trends and challenges, with a lot to get right to optimise cashflows.

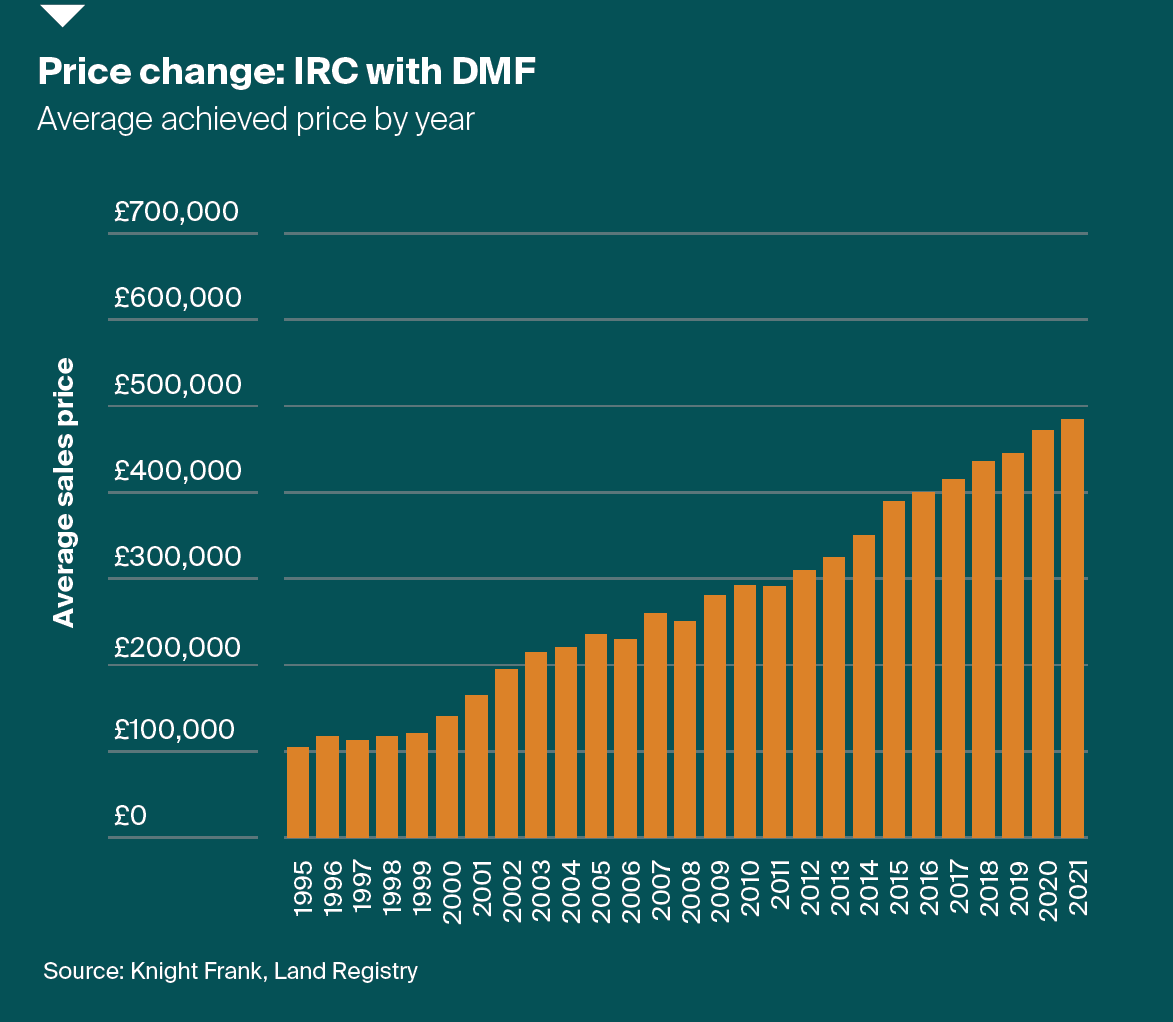

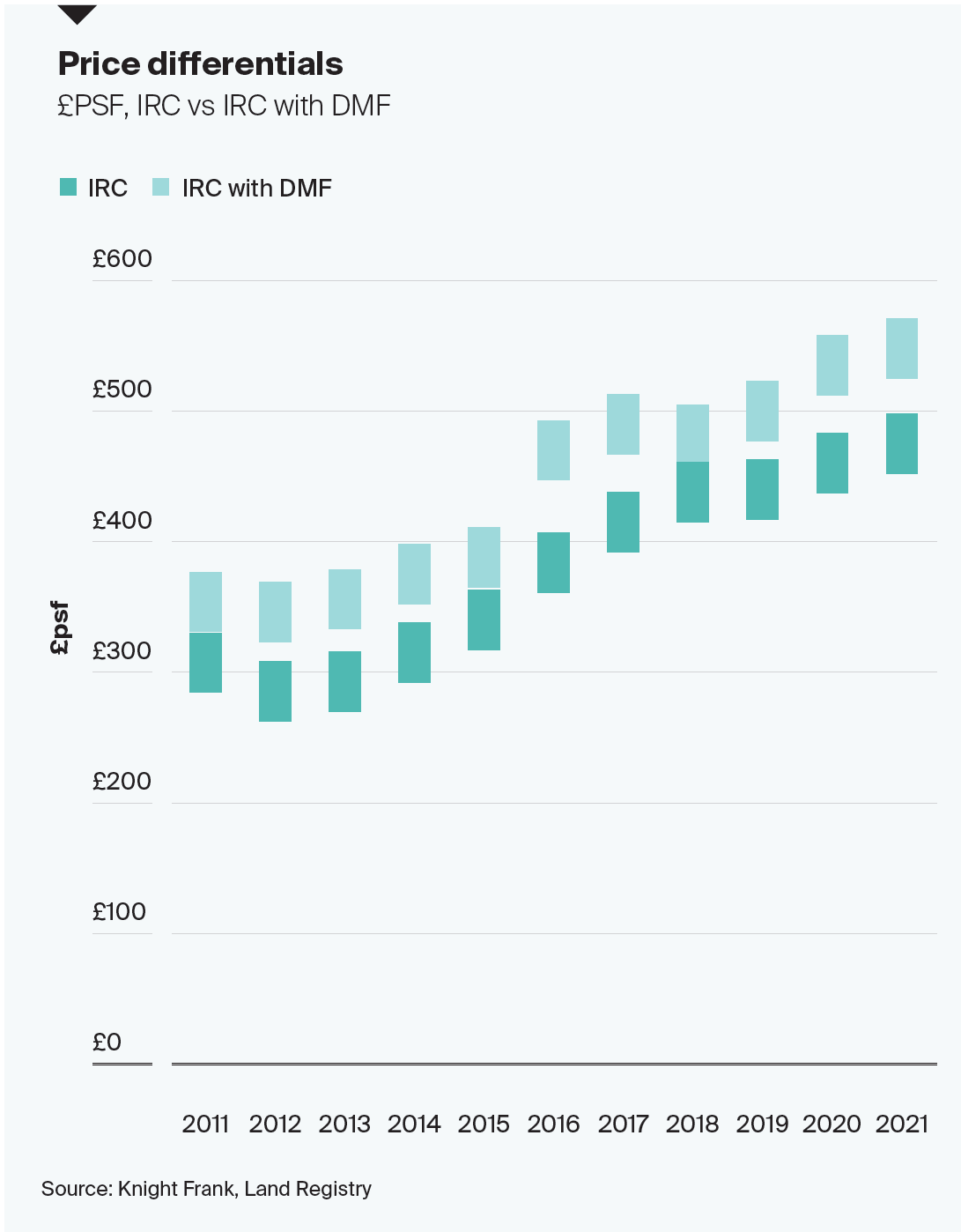

Our research shows that a tiering of the market can also been seen in pricing.

In 2021, units in IRC which include a DMF commanded the highest prices in the sector, at £485,000. That is 39% higher than standard IRC stock, and 60% higher than the average price for a Retirement Housing unit, largely reflecting the higher value areas where IRC with DMF are located.

Freeing up capital

The analysis also suggests that seniors are able to free up significant capital when moving into seniors housing, with the average price of an IRC unit 30% below the average value of a house owned by seniors.