UK seniors housing property prices rise

Sales volumes in UK seniors housing bounced back strongly after Covid and prices for new and resale stock have continued to rise.

3 minutes to read

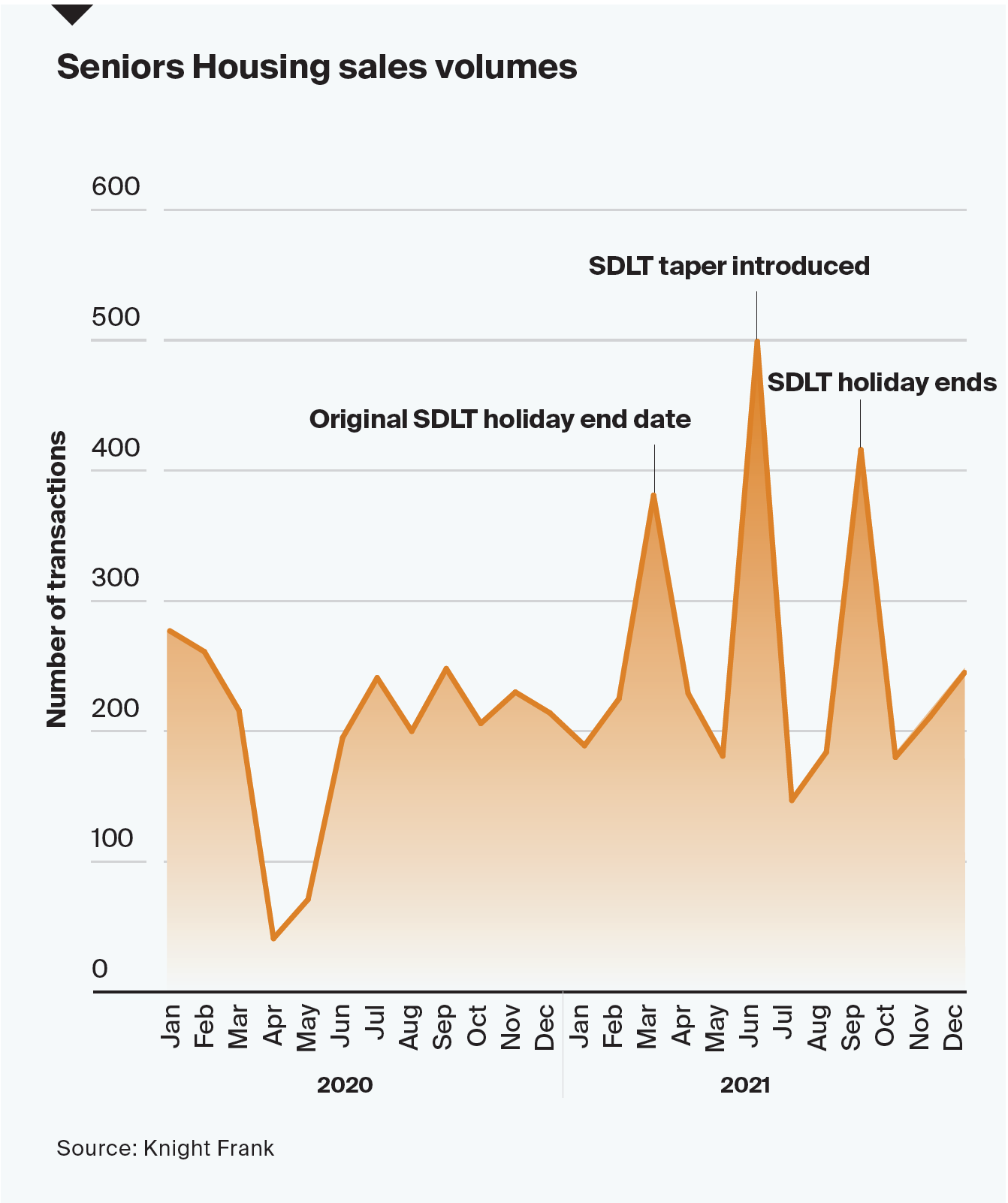

Sales volumes for seniors housing units have broadly followed the same pattern as the wider housing market over the last few years.

Having initially fallen while the housing market was temporarily shut because of Covid, demand and activity bounced back quickly, confirming the resilience of the sector.

As with the wider housing market, spikes in activity were seen in March, June, and September 2021, coinciding with key changes and end dates of the UK’s stamp duty holiday, first announced in July 2021.

Such a pattern suggests there is a strong appetite for more seniors to downsize (particularly when incentivised), but many feel constrained by the up-front cost of moving.

Sales volumes rising

Nonetheless, sales volumes have risen noticeably over the last five-years.

Analysis of these sales shows a steady increase in the average price paid and a widening of the range in prices achieved, with a growing number of transactions of IRC stock at the upper end of the market.

Sales momentum is expected to pick-up further as the market continues to expand and there is a greater understanding of the product by consumers.

Price performance

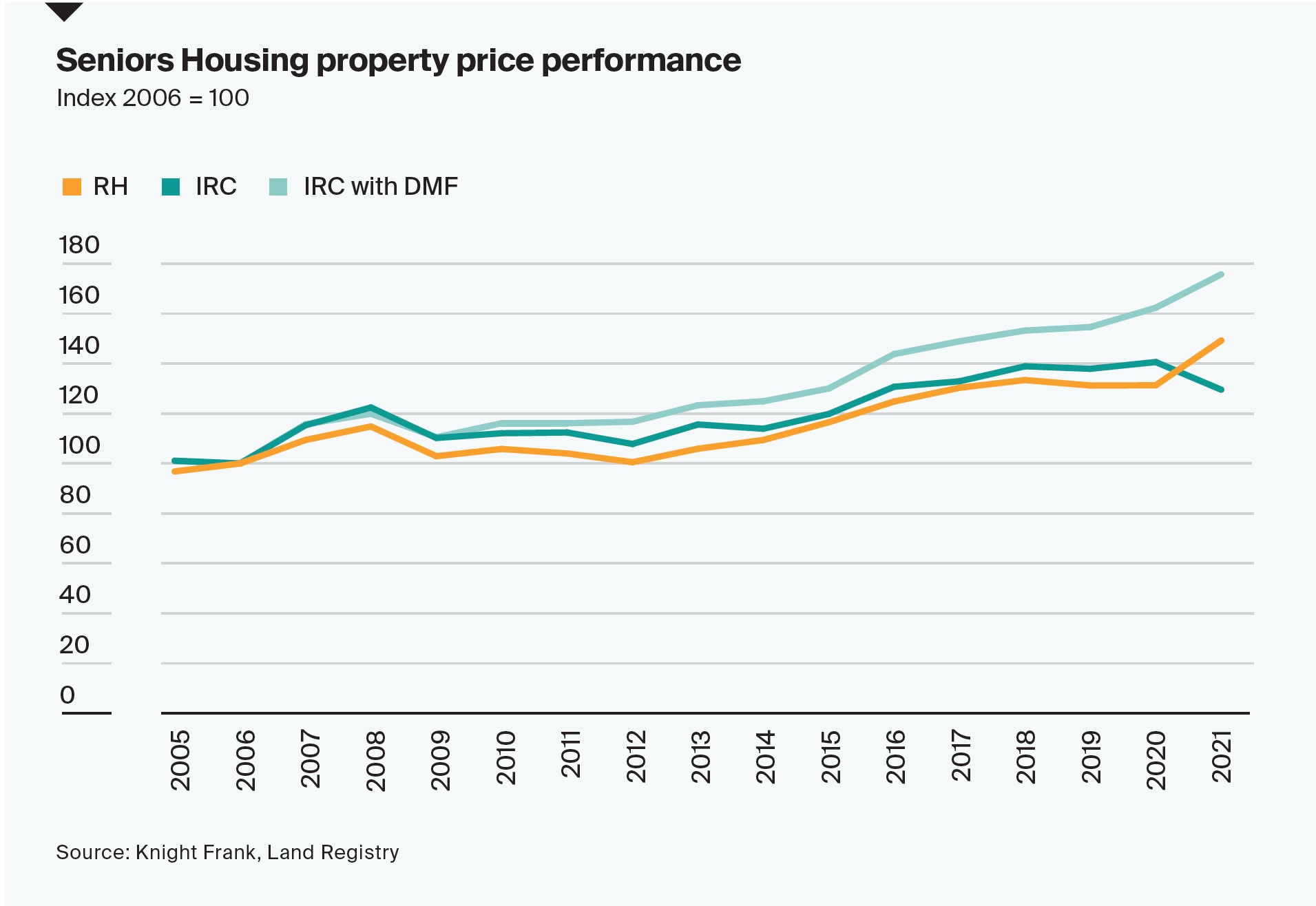

Our Seniors Housing House Price Index (HPI), which draws on analysis of more than 36,000 seniors housing transactions which have taken place since 1995, shows that over the last five years average prices for all types of seniors housing (Retirement Housing and IRC stock) have risen by more than 14%.

Breaking this down shows stronger performance has been recorded in the IRC sector over this time.

The house price index uses hedonic regression based on price and controlling for characteristics such as region, property type and size. The dataset has a bias due to the nature of a sample, with this being heavily weighted towards the South East and South West and to flats. We have allowed for this weighting within our calculations.

For the first time we have been able to split this in order to look at price performance of IRC units with and without DMFs, with the DMF model seeing the strongest long-term price growth of 22% over the last five years.

Performance across models has largely been in line with average house price growth for England over the last five years, though it should be noted that this is largely due to the exceptionally strong performance of the residential property market over the last 24 months.

Seniors housing outperforming

The seniors cohort is the wealthiest in the UK in terms of property assets, with an estimated £1.5 trillion of equity.

As a result, older, wealthier downsizers tend to be less constrained by mortgage debt. We expect this will lead to a period of price outperformance relative to the mainstream housing market in the medium term, given rising mortgage costs.

Encouragingly for long-term owners of stock, our data points to the average resale price of both IRC and Retirement Housing schemes also increasing.

Knight Frank sales database:

Our pricing analysis is based on a sample of over 1,000 schemes across the country developed since 1995, split between Retirement Housing and IRCs.

The schemes comprise more than 10,000 individual units, which we tracked from original sales through to today, including re-sales. This provided us with data for more than 36,000 seniors housing unit sales.

This analysis includes schemes from all the major private seniors housing operators, which combined have delivered almost 65% of private units in schemes of 20+ units.