Which areas of the UK housing market are most resilient to rising mortgage rates?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Pivot latest...

Will monetary policy become more favourable as inflation slows? This is the key question facing property markets in Europe and the United States. The Federal Reserve, the European Central Bank and the Bank of England have all released a selection of speeches and minutes in the past 48 hours that prompt more speculation as to when 'the pivot' might arrive.

Granted, it's only really in the US that we've seen concrete signs that the worst has passed. Rising energy prices ensured that October's inflation readings in the UK and Eurozone were awful, but there is unquestionably a growing sense that we may be at the crest of the wave.

Whether to slow the pace of monetary tightening is now a key point of debate among rate setters at the Fed, according to minutes out yesterday. Bank of England Deputy Governor Dave Ramsden made the usual comments about needing to be vigilant during a speech yesterday, but he became the second MPC member to entertain the possibility of rate cuts as the data turns. The ECB is lagging and consequently the latest minutes are the most hawkish, but even there several rate setters want to ease off a little after back-to-back 75bps hikes. Markets are now expecting a more modest, 50 basis point move on December 15.

It's all very early and none of this is an exact science, and rates are going to remain elevated for the foreseeable in any scenario, but the tone has moved meaningfully over the course of the past four weeks. Talk of wage-price spirals has largely stopped and most of 2022's worst case scenarios seem to be off the table.

Mortgage debt

Conditions in the UK mortgage market have improved notably during the past fortnight - see Wednesday's note. The 5-year swap rate dipped below 4% on Wednesday and Thursday, suggesting more lenders could make more rate cuts next week.

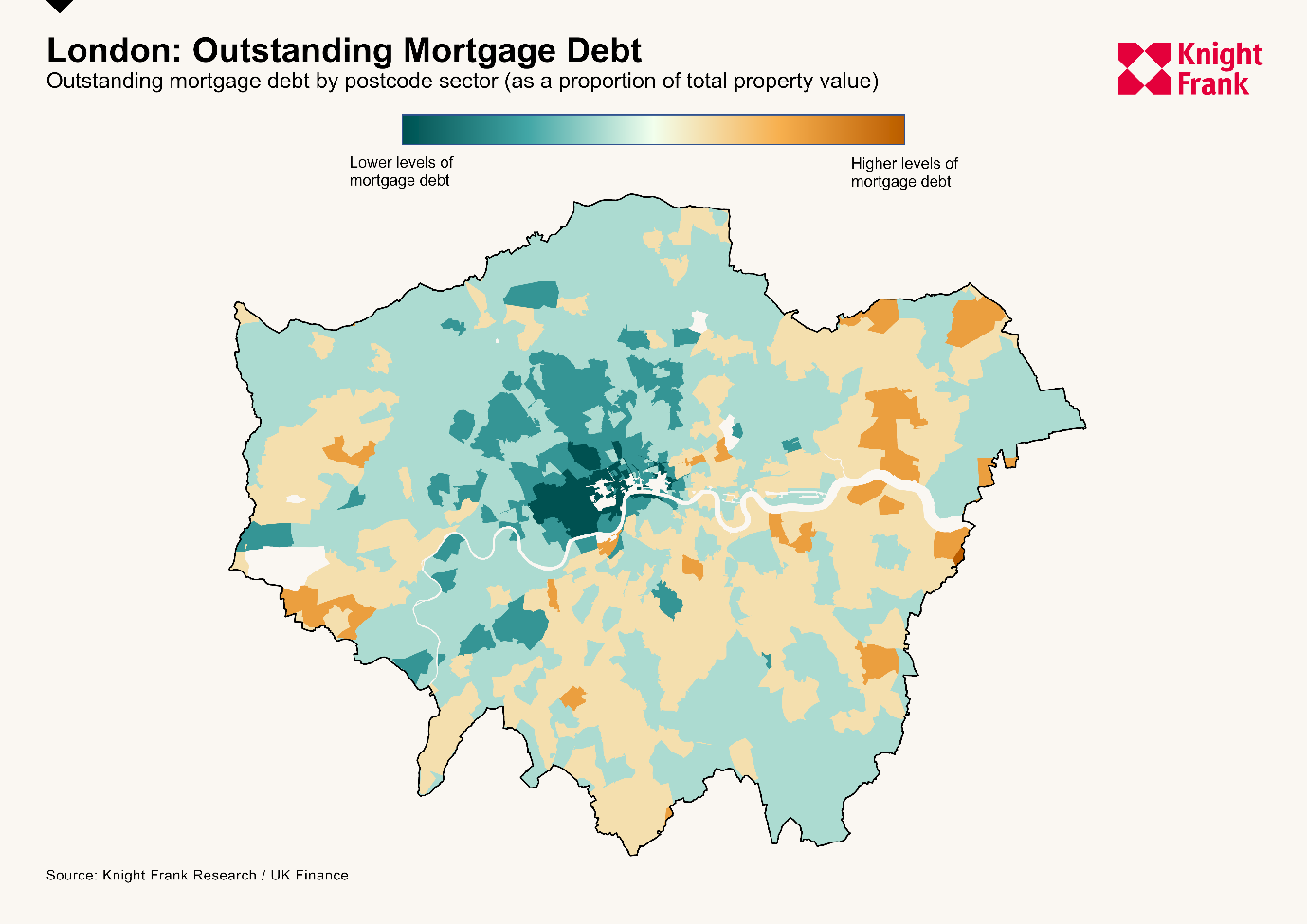

Still, the cost and availability of mortgage debt is going to exert downward pressure on house prices over the coming months, though high levels of equity and low levels of debt mean that some parts of the country are going to fare better than others.

Ollie Knight has run the numbers. The markets with the lowest levels of mortgage debt are a combination of affluent London boroughs (see map) and more rural areas with older populations who are likely to have paid down the bulk of their mortgage debt. See the piece for more.

Housebuilding

Earlier this week, some 50 Conservative MPs - including eight former Cabinet ministers - signed an amendment to the Levelling-Up and Regeneration Bill that would abolish centrally set housing targets. The vote on the bill that was scheduled for Monday "may slip" but is still likely before Christmas, the government tells the BBC.

It's hard to see how housebuilding increases in line with demand without enforceable targets.

Official figures published yesterday revealed that 232,820 net additional dwellings were completed in England during 2021-2022, a 10% increase from the very low base set during the pandemic the previous year. Some 210,070 of those net additions were new build homes. Mr Gove said yesterday that the annual target of 300,000 net additions remains the government's ambition.

Retiring baby boomers

Delivery of dedicated UK seniors housing is rising rapidly despite the rising cost of land and building materials.

There are more than 39,000 seniors housing units in planning, up from 31,000 last year. The current inflationary environment may impact how quickly some of these sites are delivered, but we forecast accelerated year-on-year delivery through to at least 2026 (see chart) as developers attempt to satisfy demand from the retiring baby boomer generation.

Data from the 2021 Census confirmed that nearly one in five people in England and Wales is now aged 65 or older, the highest proportion of older people ever recorded. In total, there were 11.1 million individuals aged 65+, up 20% from 9.2million in 2011. The number of people aged 75+ increased by 18% over the same period.

In other news...

Is residential property a hedge against inflation? Flora Harley tries to settle the debate.

State elections and property tax changes in Australia - Michelle Ciesielski has the latest.

Elsewhere - high mortgage rates push UK first-time buyers towards the rental market (Reuters), and finally, Hong Kong demand for British Visas plunges (Bloomberg).