The inflation question – is residential property a hedge?

Your monthly question on economic trends shaping housing markets.

5 minutes to read

The inflation question – is residential property a hedge?

Got a minute? Here’s the top-line. For the full analysis, read below and click here to subscribe and ensure these updates are sent direct to your inbox each month.

- There are two key arguments for residential property being an inflation hedge. A pure hedge in that rental income rises in line with, or faster than, inflation, and that capital appreciation over the hold period outpaces inflation, providing the investor with a real, inflation-adjusted gain.

- Rental income is not always a pure hedge, but much of the time it has been. Growth in average residential rents has exceeded inflation in 71% of the quarters analysed over the past 60 years in the UK and 74% of the quarters in the US over the past 50 years.

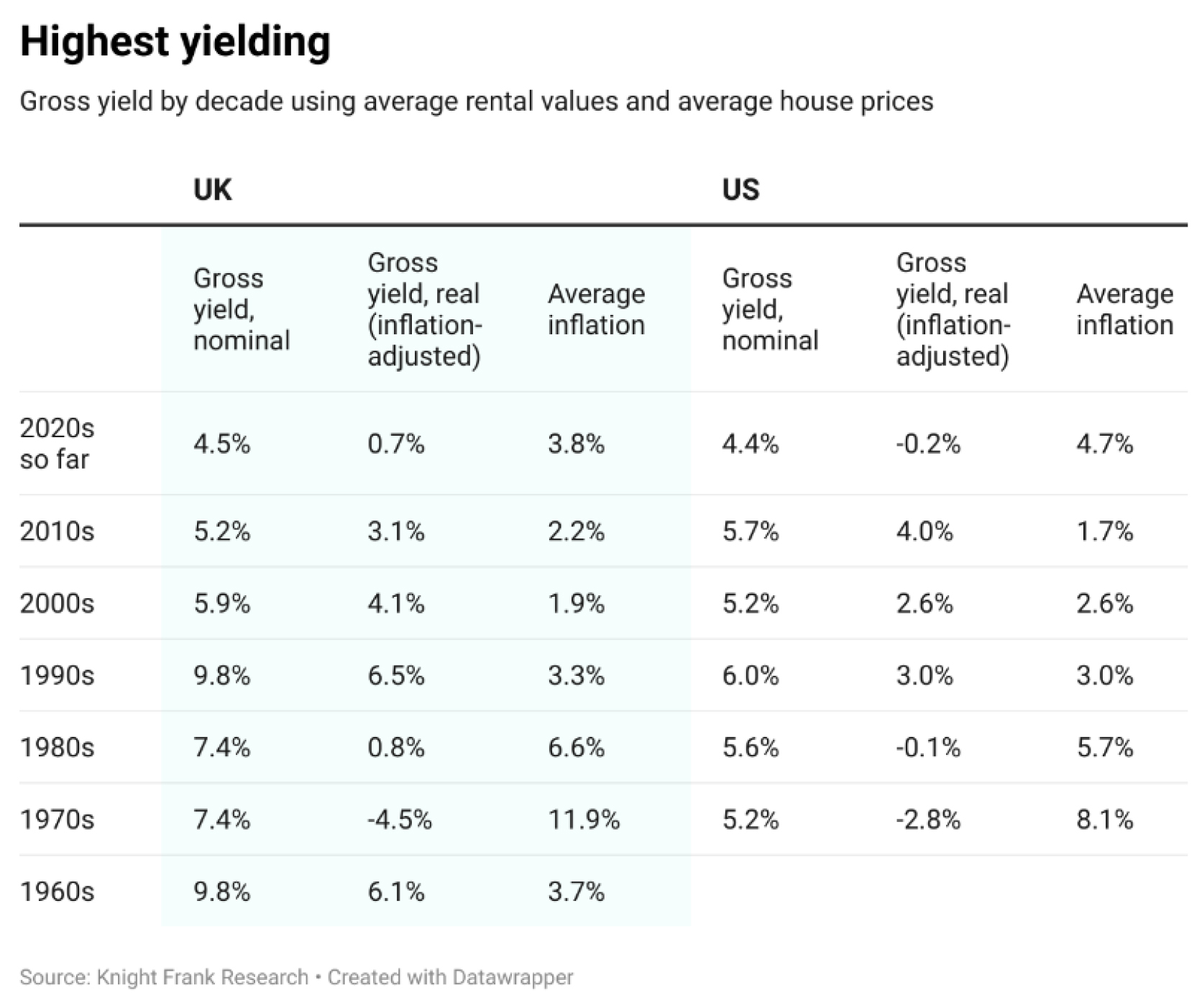

- The real, inflation-adjusted, gross yield over the same periods, averaged 2.5% in the UK and 1.7% in the US – with nominal equivalents at 7.4% and 5.5% respectively.

- In the UK, assuming a median hold time of 11 years, there were 24 quarters (six out of 60 years) where capital values would have fallen when adjusting for inflation – only 10% of the time.

- Assuming the same hold period in the US, then in just over a third (36%) of the quarters analysed, owners would have seen a fall in real capital returns. However, this would have required selling in two prolonged periods – in the wake of the Global Financial Crisis, 2009 to 2018, and from 1996 to 2001.

- The general investment rule that – the longer you stay invested, the greater likelihood of positive returns – holds true for residential real estate. Depending on what matters most to the individual, (yield, rent keeping pace or real capital returns) then residential property has previously held some hedging benefits.

What are the arguments for property being a hedge?

There is a perception that property is an inflation hedge. Putting aside the many nuances of residential property – hold time, borrowing circumstances, location etc – we crunched the numbers from the past 60 years in the UK, and just under 50 years in the US, to explore this question.

The Investment Property Forum (IPF) put it best; yes, UK property, and to a lesser extent US property, delivers positive long-run real returns. But in the strictest sense of the word ‘hedge’, with returns moving at the same time as inflation or reacting to it – property is only sometimes successful.

In summary, rental markets can be viewed as a hedge provided rental income rises in line with, or higher than, inflation. Additionally, when purchasing with leverage, and at a fixed rate, the investor’s monthly payment is based on the value of money at the time of purchase. As the investor makes payments over time, they are paying with cheaper pounds as inflation rises – in theory as the value of the asset rises. As a result, any capital appreciation over the hold period provides the investor with a real, inflation-adjusted gain.

Let’s take the first point on rents and inflation

An analysis of the OECD’s rental index over the last 60 years shows annual rental growth has exceeded inflation in 71% of the periods (we analysed quarterly data) in the UK. In the US, rental growth exceeded inflation in 74% of the period analysed. In conclusion, rental income is not always a pure hedge, but much of the time it has been.

But that’s only part of the picture. We also need to assess the overall return, or gross yield, which in simple terms is the rent received divided by the value of the property. The real, inflation-adjusted, gross yield over the same 60-year period, averaged 2.5%, with the nominal equivalent at 7.4%. The corresponding figures for the US were an average real yield of 1.7%, and nominal of 5.5%.

Drilling down decade by decade, in the UK only one saw a negative average real yield, and that was the 1970s when inflation averaged almost 12%. Even in the 1980s, with average inflation of 6.6%, nominal yields averaged 7.4% - therefore real yields were just shy of 1%. For the US, the picture is slightly different with real yields negative in the 1970s, 1980s and 2020s so far.

Overall, a relatively good hedge.

Real long-term returns in the UK

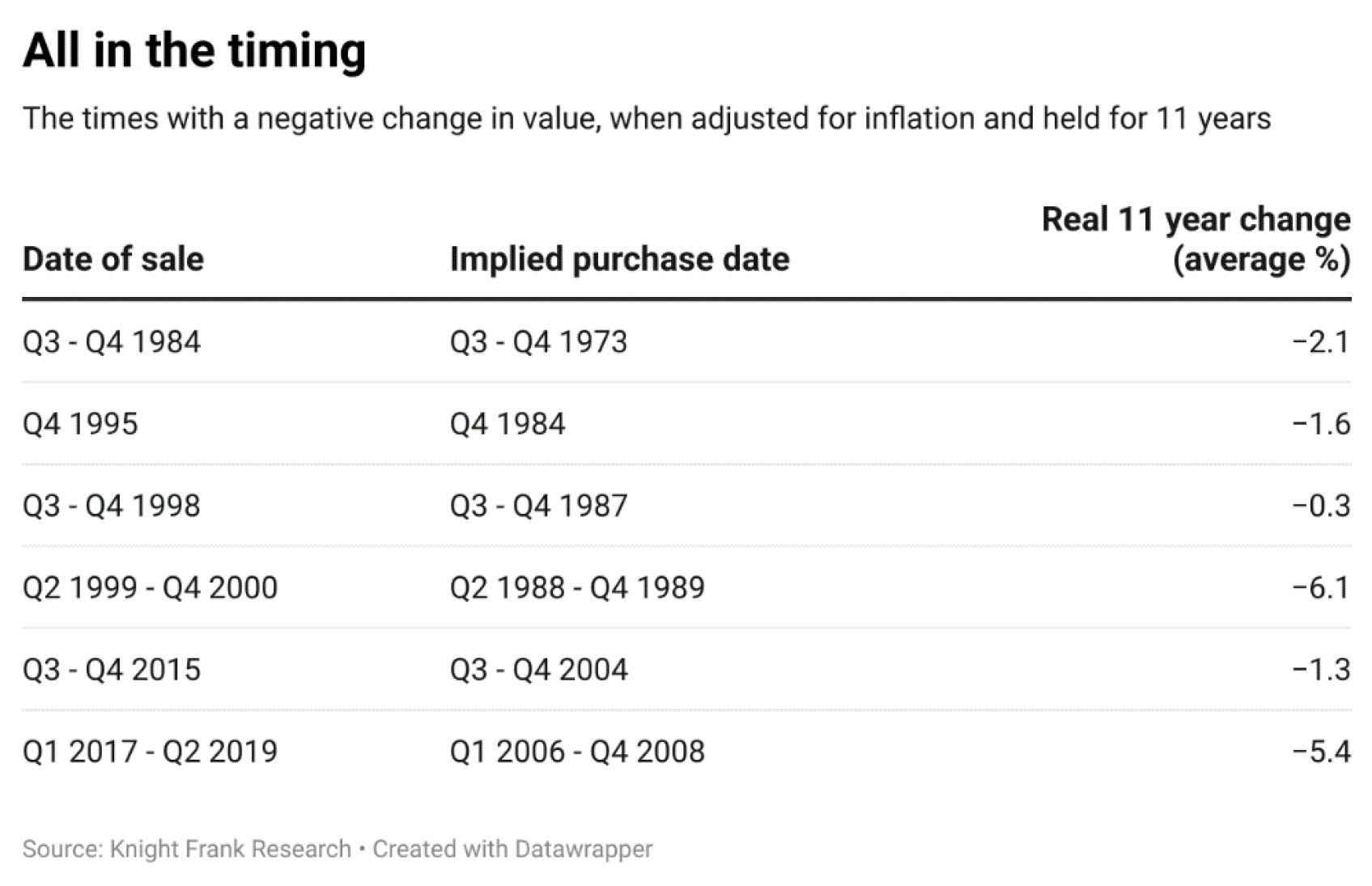

Our analysis confirms the real returns on capital appreciation holds true for the median hold period. There are only a few occasions (10% of periods) where selling would have lost you money in real terms.

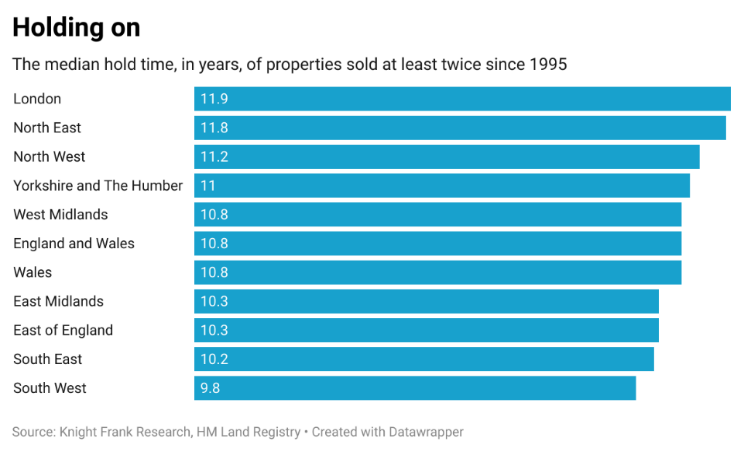

According to our analysis of Land Registry data, of those homes in England and Wales that have changed hands at least twice since 1995, the median hold time is just short of 11 years (see chart). On this basis, there were 24 quarters (6 out of 60 years) where capital values would have fallen when adjusting for inflation. These periods are shown in the table below as well as the average decline in real values.

In the US, it is a little different. If we were to assume the same hold period, 11 years, then in 36% of the quarters analysed the owner would have seen a fall in real capital returns. However, this would have been selling in two prolonged periods – in the wake of the Global Financial Crisis, 2009 to 2018, and from 1996 to 2001.

As with most investments, timing is everything

The longer you stay invested, the greater likelihood of positive returns. Residential real estate is no exception. For example, in the UK if we look at an average hold period of five years then real returns are negative in 52 quarters, or 23% of the periods analysed. In the US, there is less of a jump for shorter hold periods, rising to only 37% of periods for a five-year hold time.

Depending on what measure (yield, rent keeping pace or real capital returns) matters most, residential property has previously held some hedging benefits. Inflation has come to the fore in the past 18 months. The consensus is that, globally, it will start to fall in 2023 and beyond - quicker in the US (where signs are that it is already slowing) than the UK, for more analysis visit our House View and for the response to the Autumn Statement and OBR forecasts see here. As for values and rents, our latest UK forecast can be found here, with our global residential forecasts coming soon (sign up to Kate Everett-Allen’s newsletter for more on this).