Your Leading Indicators | 'Mini-budget' Reversals & Market Reactions

2 minutes to read

Discover key economic and financial metrics, and what to look out for in the week ahead.

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

The new Chancellor has reversed most of the ‘mini-budget’

The new UK Chancellor, Jeremy Hunt has reversed almost all of the tax cuts announced in the mini-budget on 23rd September. The only policies to remain are the cuts to National Insurance tax and stamp duty. Hunt has also cancelled the scheduled decrease of income tax, with the basic rate of income tax now remaining at 20% “indefinitely”. The consumer energy price guarantee has also been scaled back. It was originally set to run for two years, however the new energy price guarantee will last for six months until April 2023, instead of until October 2024.

Markets respond to ‘mini-budget’ reversals

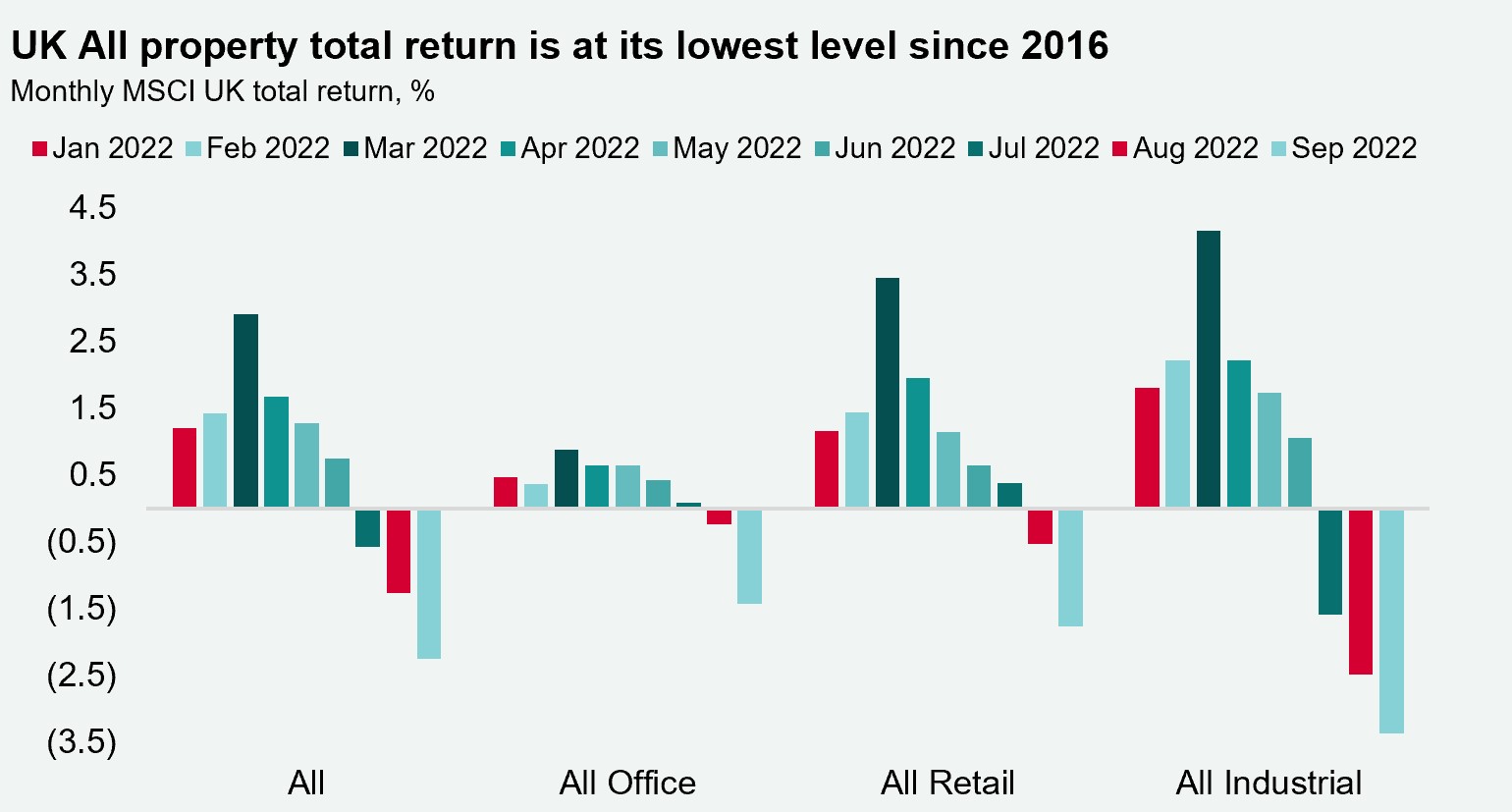

In the aftermath of Jeremy Hunt’s announcements, sterling has appreciated to $1.14 from $1.13 on Friday. The risk free rate has also seen improvement, with the UK 10-year gilt yield down from 4.32% at the end of last week, to 4.06% currently. The yield gap between the UK All Property yield and the 10-year gilt yield is currently 1.41%. In the run up to the GFC, the yield gap fell to as low as -0.7%. 5-year SONIA swap rates are also lower, down 46bps from Friday to 4.55% currently.

UK remains a top destination for global real estate capital

Despite moderation from the second strongest Q2 on record, the UK remains the second most invested location globally in Q3, after the US. While Q3 data remain preliminary and are subject to slight upward revisions, the numbers point to a moderation in investment, as investors assessed the changing global landscape. An early cut of the Q3 2022 data indicates £8.2 billion of investment, just over half the investment recorded in Q3 2021 and 29% below the Q3 LTA. Inbound investment has also moderated into the UK, however, this is a global trend. Global cross border investment is down -50% in Q3 2022 compared to the same quarter last year. Despite this, the UK remains the most invested market globally for cross border capital year to date.

Download the latest dashboard