Jakarta Property Highlights H1 2022

The Jakarta Property Highlights provide a concise synopsis of occupier activity in the Indonesian market. Discover vacancy rates, up take and prime rents across Jakarta in more detail by accessing the detailed H1 2022 reports available.

2 minutes to read

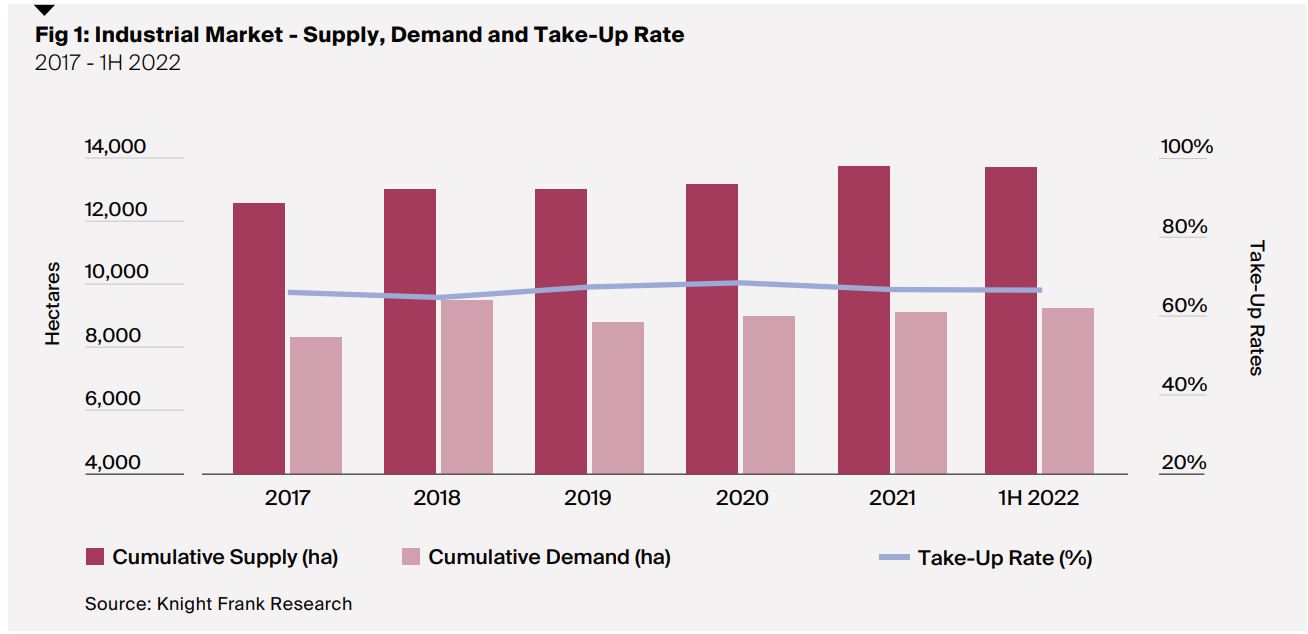

Industrial market overview

Following the lifting of lockdown measures, pent-up demand has strengthened the industrial land sales volumes in the first half with data center and chemicals industries continuing to emerge as key sources of demand.

Market highlights:

- 63.7% stable average land sales rate as of 1H 2022

- Data center and chemical sectors continue to be a major demand driver for 1H 2022

- Bekasi-Karawang recorded as the largest share of existing industrial land supply

- 134 hectares of overland land net sales activity as of 1H 2022

Download latest report

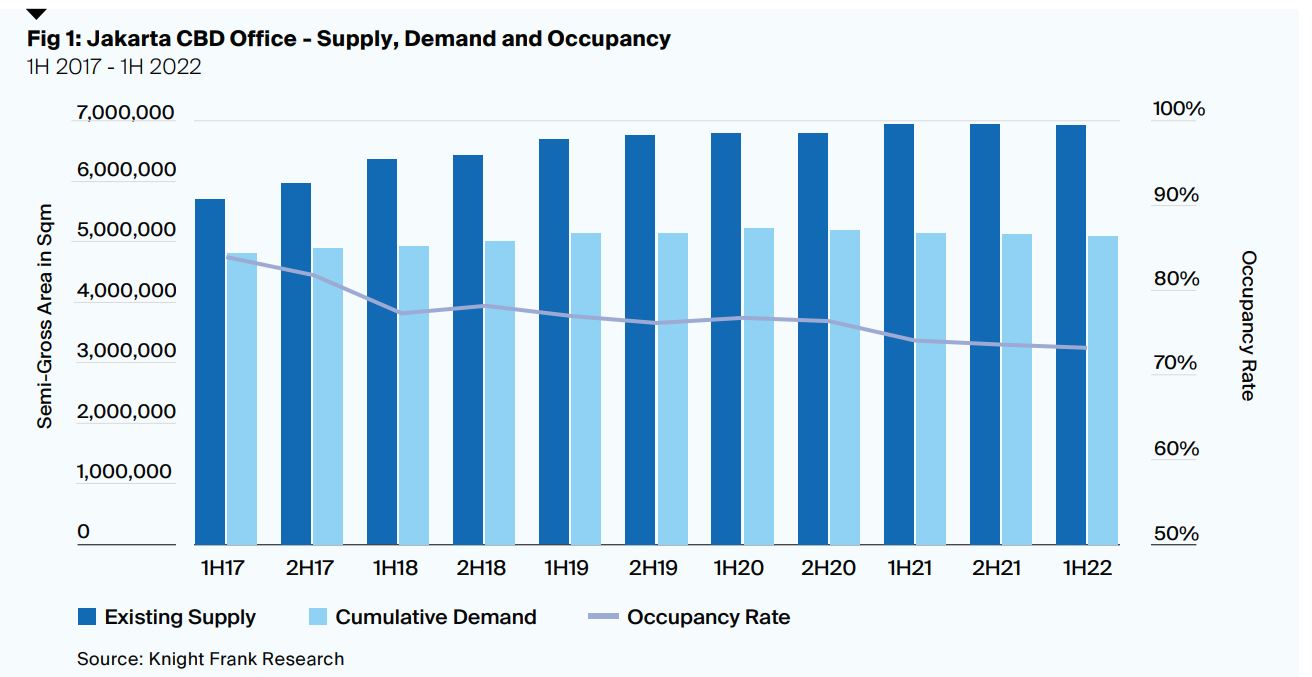

CBD office market overview

The improving pandemic situation in early part of 2022 has led employees to gradually return to office, along with the resurgent of market activities. However, excess new supply and double-digit vacancies will put further downward pressure on rents.

Market highlights:

- 26.7% double-digit vacancy rate as of 1H 2022

- 539,147 square meters of new supply in the pipeline until 2023

- -33,106 square meters of overall take up as of 1H 2022

Download latest report

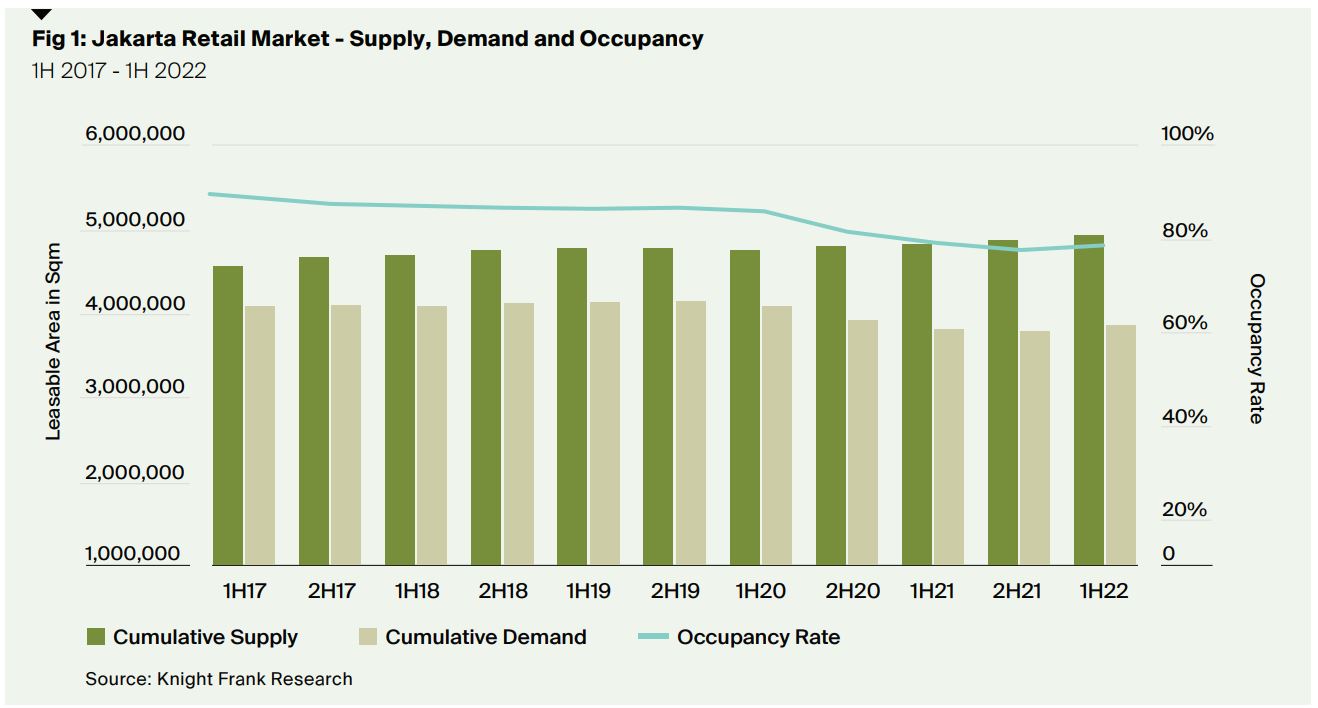

Retail market overview

Two years after the pandemic emerged, the market recovery continued to gain positive momentum in the first half, leading to increased mall foot traffic and higher spending. After all, potential inflationary headwinds may hold back the revival in the near term.

Market hightlights:

- 96% of new leased malls are located within mixed-use development

- 78.5% decrease in overall occupancy in 1H 2022

- -2.9% year-on-year gross rental growth in U.S Dollar terms

Download latest report

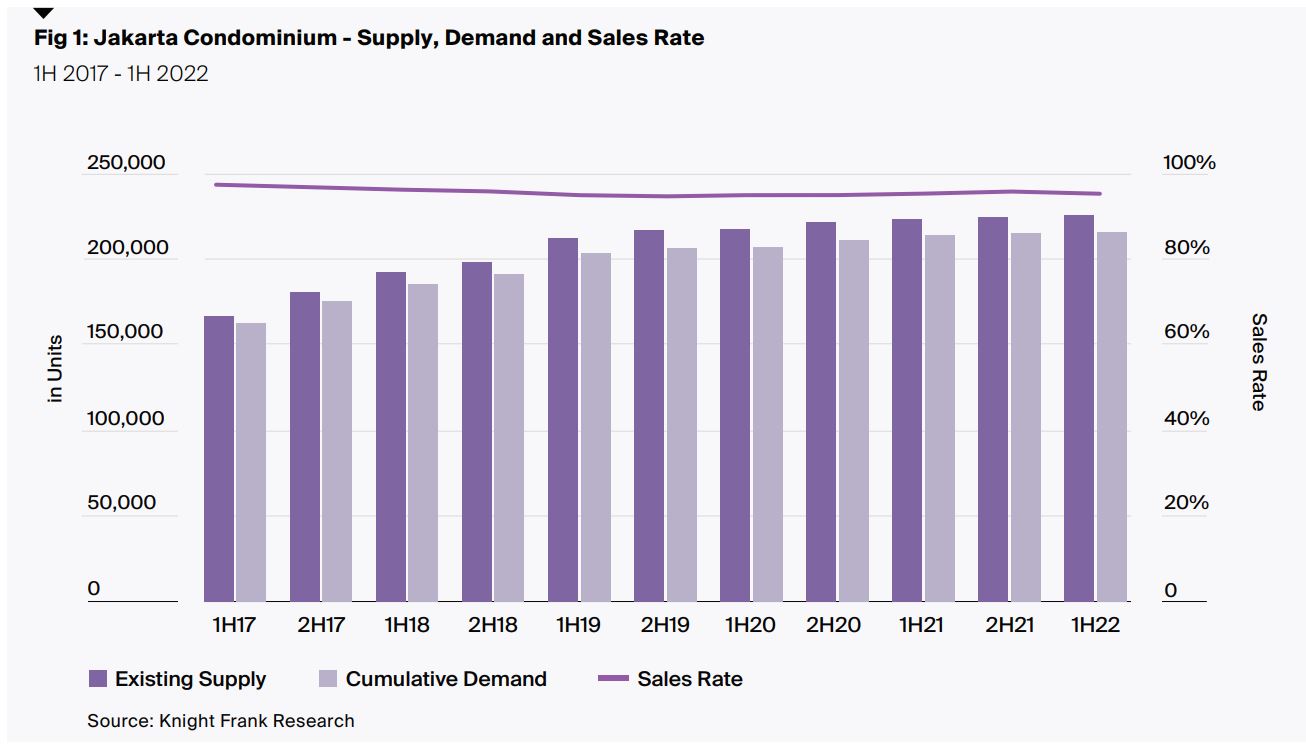

Strata condominium market overview

The pre-sales rate in the first half of 2022 was registered flat, with the market expected to remain sluggish despite increased activities and the extended VAT waiver. Excess supply, increased cost of construction and potential rising interest rates may impede the recovery and affect the confidence.

Market hightlights:

- 42% of existing supply dominated by middle segment

- 26,723 units of new supply in the pipeline in the period of 2H 2022-2025

- -5.5% average price decrease (YoY) in the CBD area

- 65.5% average pre-sales rate to proposed supply

Download latest report

We like questions, if you've got one about our research, or would like some property advice, we would love to hear from you.