The worst in-tray since Thatcher?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Crisis packages

European leaders stepped up plans to intervene in energy markets over the weekend after Russia indefinitely shut down a key pipeline used to shuttle gas to Germany.

It can be hard to judge the seriousness of an issue like the energy crisis until you see the scale of the response. The Times devotes its cover this morning to a vast support deal to be proposed by Liz Truss that would include freezing gas and electricity bills. The costs of the proposals, according to insiders quoted, would be equal to - if not more - than the £69 billion spent on the furlough scheme. Truss did not deny that costs could reach £100 billion during TV interviews yesterday.

The UK would join Germany, Austria and some Nordic countries in fleshing out new support packages. Germany's plan comes in the form of a €65 billion package funded in part of windfall taxes on energy producers. Under the proposals, consumers would receive a basic volume of electricity at reduced prices. All of that is in addition to a proposal from the G7 to move ahead with a price cap on Russian oil exports that could be in place as early as December.

The euro fell below $0.99 for the first time in two decades this morning.

The in-tray

Liz Truss will likely be announced as PM shortly and will inherit what yesterday's Sunday Times called "the worst in-tray for a new prime minister since Thatcher".

Indeed, when weighing the impact the Truss and her team are likely to have on the housing market - as Tom Bill does this morning - it's clear that the effectiveness with which the new administration deals with the cost-of-living crisis will have a far greater impact than any targeted housing policy.

We talked on Friday about growing concern among investors that tax cuts and direct support for households could fuel inflation and add to Britain's already significant post-pandemic debt pile. Balancing those concerns with the necessity to shore up the finances of those most in need presents quite a tightrope for Truss to walk.

Shares in UK housebuilders fell across the board on Friday on the back of bearish HSBC research suggesting housing demand would fall by a fifth for a year starting in the Autumn.

European hawks

"Even if we enter a recession, we have little choice but to continue the normalization path," European Central Bank board member Isabel Schnabel told the Fed's Jackson Hole gathering last week.

Schnabel's comments brought the ECB into line with the Fed, which for some time now has been signalling that it would bring down inflation whatever the costs. The speech also prompted a rapid increase in betting that the ECB will hike its key rate by 0.75% when it meets this Thursday, bringing the deposit rate to 0.75%. The ECB's 0.5% hike in July, its first raise in more than a decade, moved the rate to its current level of zero.

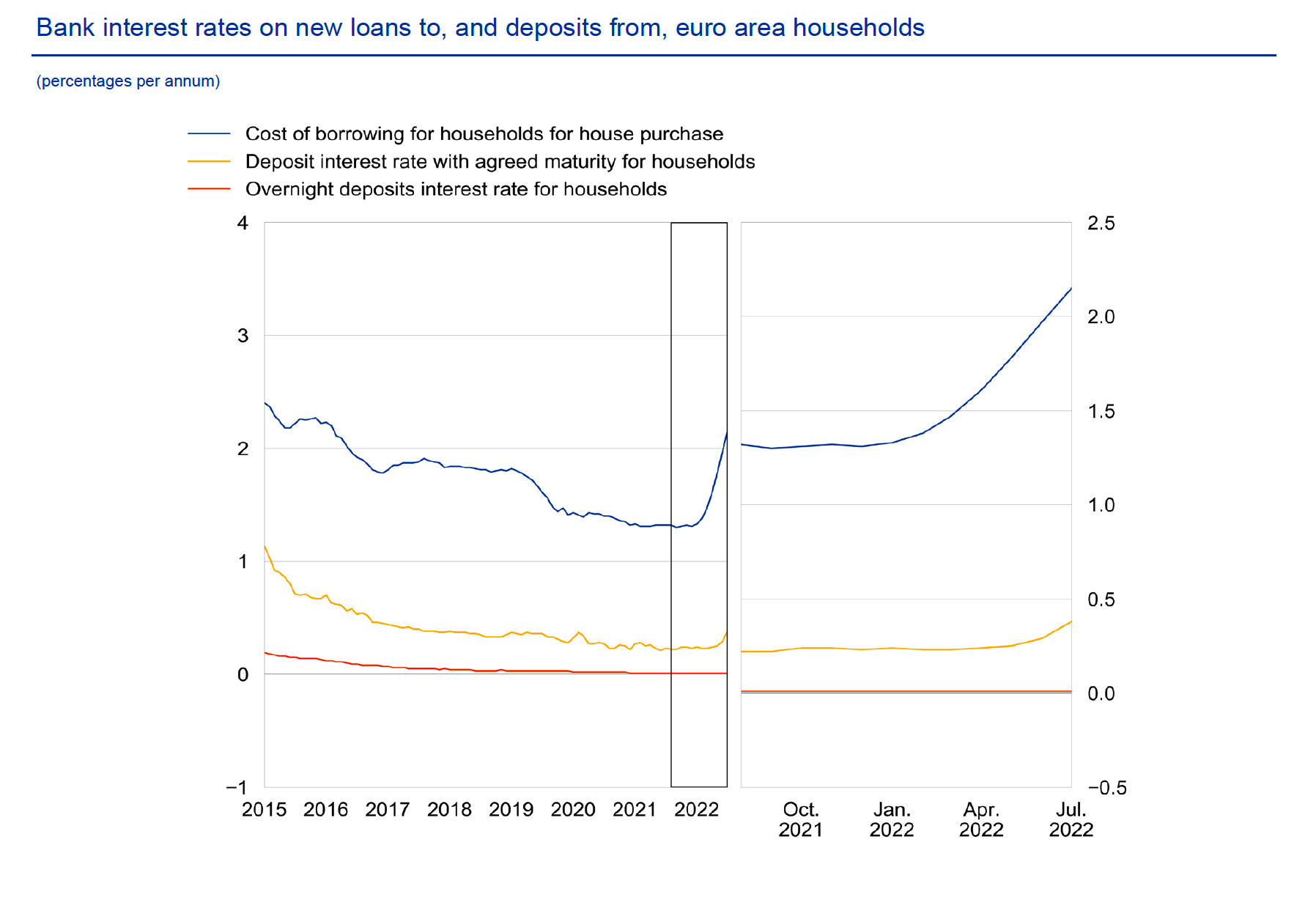

Eurozone inflation hit 9.1% during the year to August, according to official figures published last week. EU data published Thursday showed another steep rise in mortgage rates during July (see chart). Interest rates on loans for house purchase with an initial rate fixation period of over five and up to ten years increased by 25 basis points to 2.53%. Those on one to five year fixed rate periods rose by 20 basis points to 2.26%.

Bright spots

US employers added 315,000 jobs during August, a strong increase but a marked slowdown from the half a million jobs added the previous month.

That's another very tentative signal that the Fed stands a chance in its quest to bring down inflation without pitching the economy into recession. We talked last week about signs that US inflation may be peaking: the Personal Consumption Expenditures index, the Fed's preferred measure of inflation, eased to an annual rate of 6.3% in July, from 6.8% a month earlier.

The housing market continues to slow as mortgage rates surge. The average US home is selling below its asking price for the first time in nearly 18 months, according to Redfin data covered by Bloomberg.

In other news...

In his latest retail update, Stephen Springham weighs reports that Amazon is pausing expansion of Fresh in the UK.

In a new rural market update, Andrew Shirley considers the latest wake up call for polluters.

Elsewhere - Portugal could hold an answer for a Europe captive to Russian gas (NYT), California fights its NIMBYs (NYT), The property market built on digital assets (FT), and finally, Vistry plots takeover of £1.1bn rival housebuilder Countryside (Times).