House prices play catch up with the economy

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Inflation expectations

Annual growth in UK house prices slowed to 10% in August, down from 11% a month earlier, according to Nationwide's latest index published yesterday.

That's another robust reading considering the circumstances. The housing market is “playing a slow game of catch-up with the economy”, Knight Frank's Tom Bill tells the FT: “As supply continues to build this autumn and mortgage rates rise, demand will soften and annual price growth will fall.”

Indeed, various data points suggest the Bank of England has further to go before it can slow the pace of interest rate hikes, which will be felt in the mortgage market through the autumn and winter. Respondents to the Bank of England's monthly survey of 2,500 chief financial officers expect inflation to be running at 8.4% a year from now, up from 7.3% in July. Another closely-watched measure from YouGov and Citi, out yesterday, showed households' expectations for inflation over the next five to 10 years hit a record-high 4.8% in August.

For more on the outlook for housing markets in the UK and globally, please listen to today’s episode of our Intelligence Talks podcast, I’m joined by Tom Bill and Kate Everett-Allen to assess the risks to prices in the world’s key markets.

A steady hand

Stewardship of the economy under the UK's next prime minister, likely to be Liz Truss when it is announced Monday, is now the key risk facing the housing market.

Investors are particularly jittery as winter approaches amid months-long surges in the prices of food and fuel. Europe’s bond market is on course for its worst month on record amid solidifying expectations that both the Bank of England and the European Central Bank will have to tighten monetary policy aggressively during the months ahead.

UK, German and French debt have all fallen heavily, but the uncertain political outlook in Britain made it a particular target during the selloff. Ms Truss has hinted at providing both tax cuts and direct support for households to offset the cost of living crisis. Analysts quoted by Reuters suggest investors are concerned that incoming policies could fuel inflation and add to Britain's significant post-pandemic debt pile.

The cover of this morning's Times reports that the chancellor Nadhim Zahawi has drawn up plans for a multibillion-pound package of tax cuts to help businesses facing bankruptcy due to rising energy costs.

We'll take a closer look at the new PM and the implications for the housing market on Monday.

Europe's energy spike

Energy prices have endured wild swings across Europe this week, underlining the degree to which one of the most significant contributors to the cost-of-living crisis is subject to significant uncertainty.

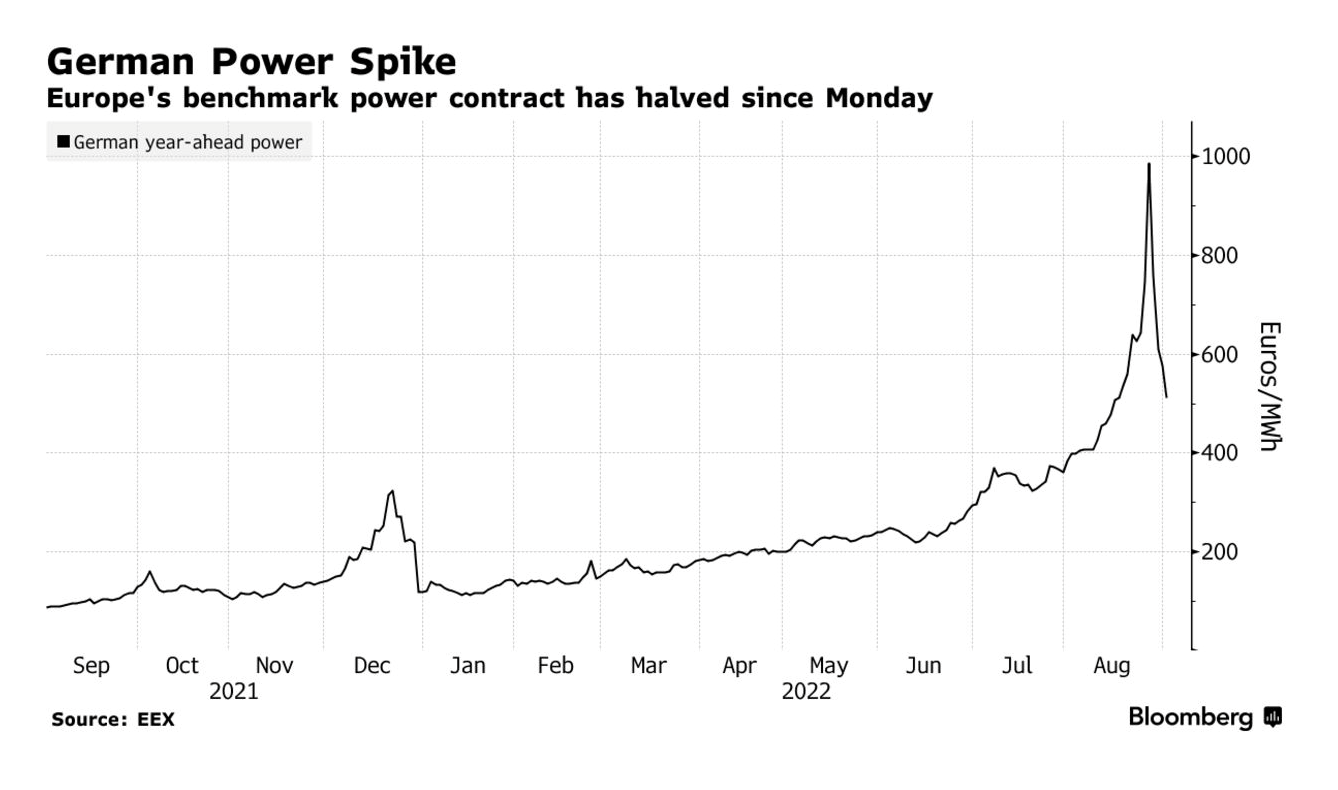

German year-ahead electricity futures, regarded as Europe's benchmark power price, plunged as much as 54% from Monday’s peak above 1,000 euros, according to Bloomberg (see chart). Winter gas prices for the UK also dropped significantly. Much of this comes on the back of news that Germany has been more successful than it had anticipated in filling its stores of natural gas. The European Union is mulling an unprecedented intervention in the energy market that could include price caps and windfall taxes.

Still, ratings agency Fitch believes it “increasingly looks like a reasonable assumption” that Russia will opt for a full shut down of its gas supplies to Europe this winter. That outcome would hit eurozone GDP by 1.5-2 percentage points, rising to 2.5% in Italy and 3% for Germany.

Back to the office

A number of Wall Street banks have issued calls to staff to reoccupy offices during the past fortnight.

The tone has ranged from Jefferies suggesting staff return on a "consistent basis" though they aren't "going to look at individual names on the turnstiles,” to the Goldman Sachs memo that the media interpreted as a call to return five days a week.

Investment banking is very client facing, so some of this is sector specific, but the fact that organisations are issuing these memos illustrates the degree to which a disconnect remains between employers and employees in relation to future workstyles. Lee Elliott expanded on this in his July update to our House View.

The fact that sectors also seem to move in similar directions is also revealing, and peer pressure will be felt in office markets in all sorts of ways during the months again. Again, here's Lee in the House View:

"With the office being viewed strategically as a means of securing competitive advantage, many of those who have taken a flight to better quality space in the last two years will be followed by their peers. Tight global labour market conditions and the continuing war for talent will require those not offering best in class space to staff to do so.

"Second, and conversely, if the macro-economic environment leads to labour market distress, we may well see human nature generate greater presenteeism and visibility in the formal workplace. The return to the office sought by some business leaders might in fact emerge through an understandable and keenly felt peer pressure."

In other news...

Loss of Chinese tourists forces Europe’s luxury retailers to rethink (FT).