The UK's new million pound housing markets

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Million pound markets

During the most recent two years, demand for homes spread further from urban centres and house price growth became more evenly distributed amid an affordability squeeze and a ‘race for space’.

As the pandemic winds down and new work/life patterns establish themselves, we have updated our analysis of new £1 million property markets in England and Wales to better understand these trends. To qualify as a new £1 million market, at least 20% of sales had to be above that threshold in two or more quarters in the year to March 2022. This cannot have happened in a single quarter over the previous 12 months.

South-east England dominates the eight-strong list of new £1 million markets, according to the analysis. More than half the areas are located outside the M25, underlining how demand has strengthened in leafier parts of the commuter belt as buyers balance the desire for more space and proximity to the capital.

“A heat map of house price growth would show a gradual retreat towards the capital over the course of the pandemic,” says Tom Bill, head of UK residential research at Knight Frank. “After the early days of strong demand in remote picture-postcard locations, property markets encircling the M25 have thrived as offices re-open and new working patterns are established. London’s commuter belt has widened and prices there should continue to outperform the capital over the next five years.”

Rates and borrowing

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 18 basis points to 2.33% in July and now sits at its highest level since 2016, according to Bank of England figures published yesterday.

A month is a long time in today's property market. Borrowers currently agreeing new mortgages are facing fixed rates of anywhere between 3.2% and 3.5%, Hina Bhudia of Knight Frank Finance tells The Irish News. These are often people that locked in two-year fixes of between 1.2% and 1.8% a couple of years ago, which for average loan sizes amounts to hundreds of pounds a month in extra interest payments.

The same Bank of England figures show a steady uptick in consumer borrowing during July. Individuals borrowed an additional £1.4 billion on net, following £1.8 billion of borrowing in June. The pre-pandemic average is about £1 billion. The annual growth rate of credit card borrowing was 13%, the highest since 2005.

The figures are part of a slew of figures released in the past 24 hours. Data from Lloyds Bank’s latest Business Barometer puts business confidence at its lowest level since the third lockdown in early 2021. Shops and supermarkets in Britain increased prices by 5.1% in the 12 months to August, the largest rise in records dating back to 2005, according to the British Retail Consortium. Meanwhile, Goldman Sachs outlined a worst case scenario in which inflation hits 22% in the new year on the back of record energy costs.

Housebuilding

Housebuilders had a strong first six months of the year, whether you measure it by demand, sales or delivery. Limited supply in the second-hand market, a flight to quality among buyers, and a push to complete sales using Help to Buy before the scheme ends are all encouraging more purchasers to look at new homes.

The industry now faces the same headwinds as the wider housing market, with the addition of a creaking planning system that is weighing meaningfully on volumes. Detailed planning permissions (DPP) in England slumped 9% in the first quarter of the year due to a mixture of resource constraints, a Covid-19 backlog and added complexities such as nutrient neutrality, according to research from UBS published in the Telegraph. The bank expects total delivery to fall 5% next year as a result.

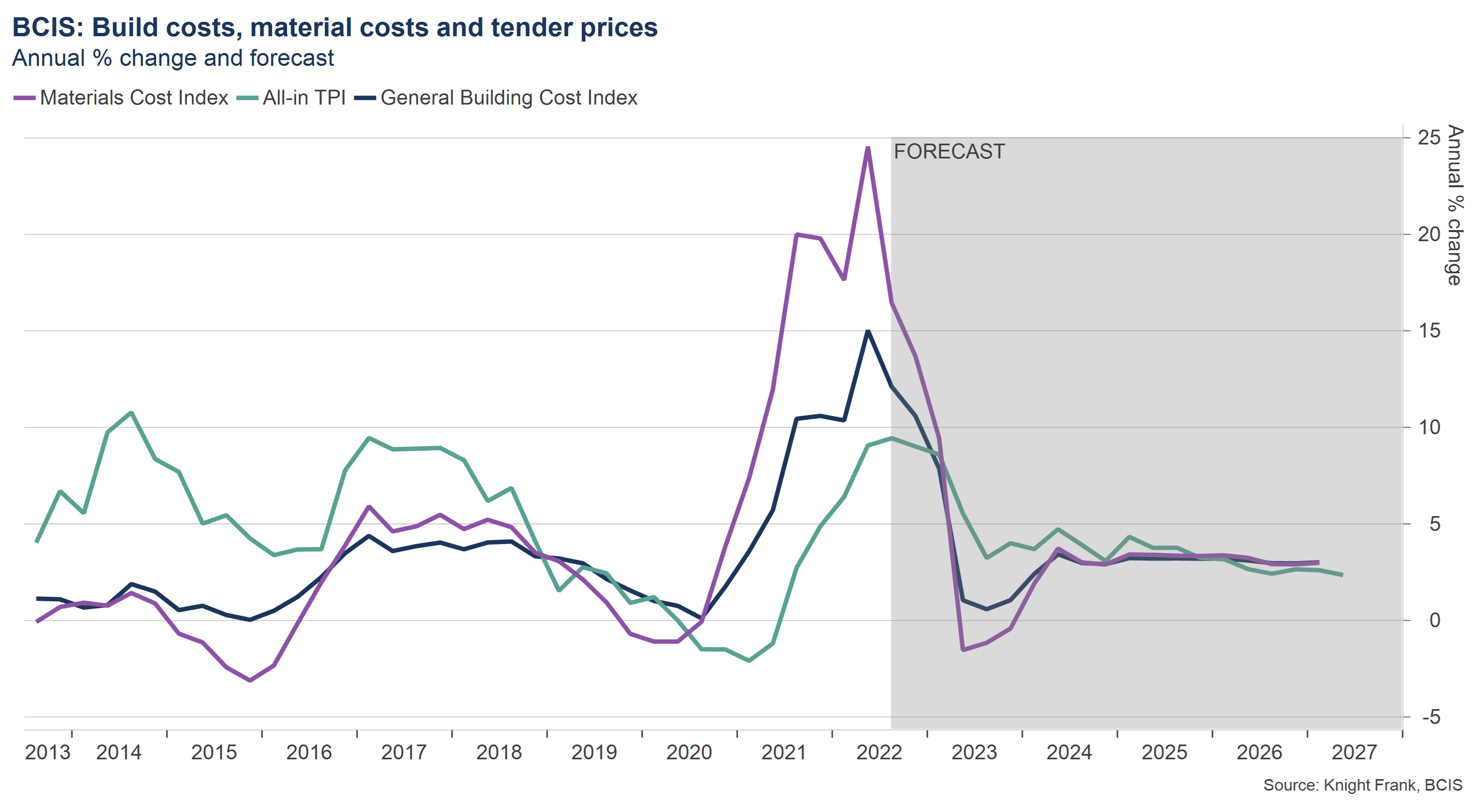

There had been tentative signs of an easing in materials prices (see chart below), however that may be short lived. Albert Manifold, the chief executive of CRH - the world's largest building materials company - tells the FT that he's now seeing a “second wave of cost increases” following the surge in gas prices that accelerated after Russia’s invasion of Ukraine.

Global inflation

German inflation rose to a 50-year high of 8.8% during August, according to official figures published yesterday. The Bundesbank sees that number hitting about 10% in the final quarter of 2022, though much remains uncertain due to volatility in commodity markets.

The reading heaps pressure on European Central Bank officials, who will make a decision on whether to hike its key interest rate next week. Markets are expecting a half-a-basis-point raise, some ECB policymakers have floated the idea of a 75 basis-point hike. The cost of new loans to households for house purchases in the Eurozone increased by 16 basis points between May and June to 1.94%, according to European Central Bank data published in the FT earlier this month.

More encouraging news came from across the pond this week. The Personal Consumption Expenditures index, the Fed's preferred measure of inflation, eased to an annual rate of 6.3% in July, from 6.8% a month earlier. The jobs market continues to run hot, however. Job openings ticked up to 11.2 million, the Labor Department reported yesterday. That's closing in on the 11.8 million all-time-high posted in March.

In other news...

In a new Rural Market Update, Andrew Shirley considers Defra's proposals to help producers cut their animals’ carbon emissions.

Elsewhere - UK government considers rent caps to protect social housing tenants (FT) and finally, equity release loans surge as older homeowners raise funds (FT).