A strong half year for new homes

Despite a host of issues new home supply remains stable.

3 minutes to read

Housing delivery

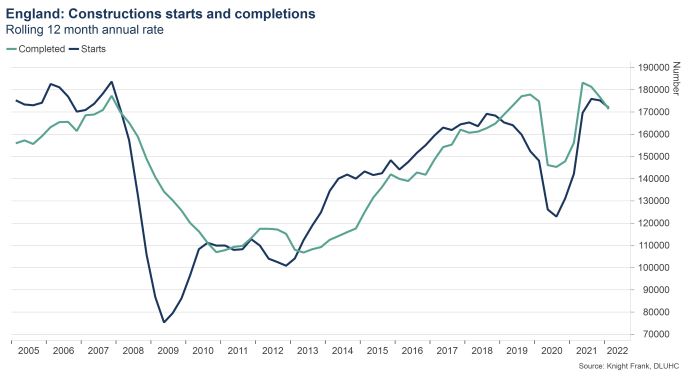

These are all issues housebuilders have been grappling with in recent months. So far, the supply of new homes has remained largely stable. Energy Performance Certificate (EPC) data points to around 240,000 completions in the year to Q2 2022, for example. Still below government targets, but in line with pre-pandemic delivery.

The medium-term outlook is less certain, however. Both starts and completions dropped back very slightly on an annualised basis in the first quarter of this year, according to official figures.

Build Costs

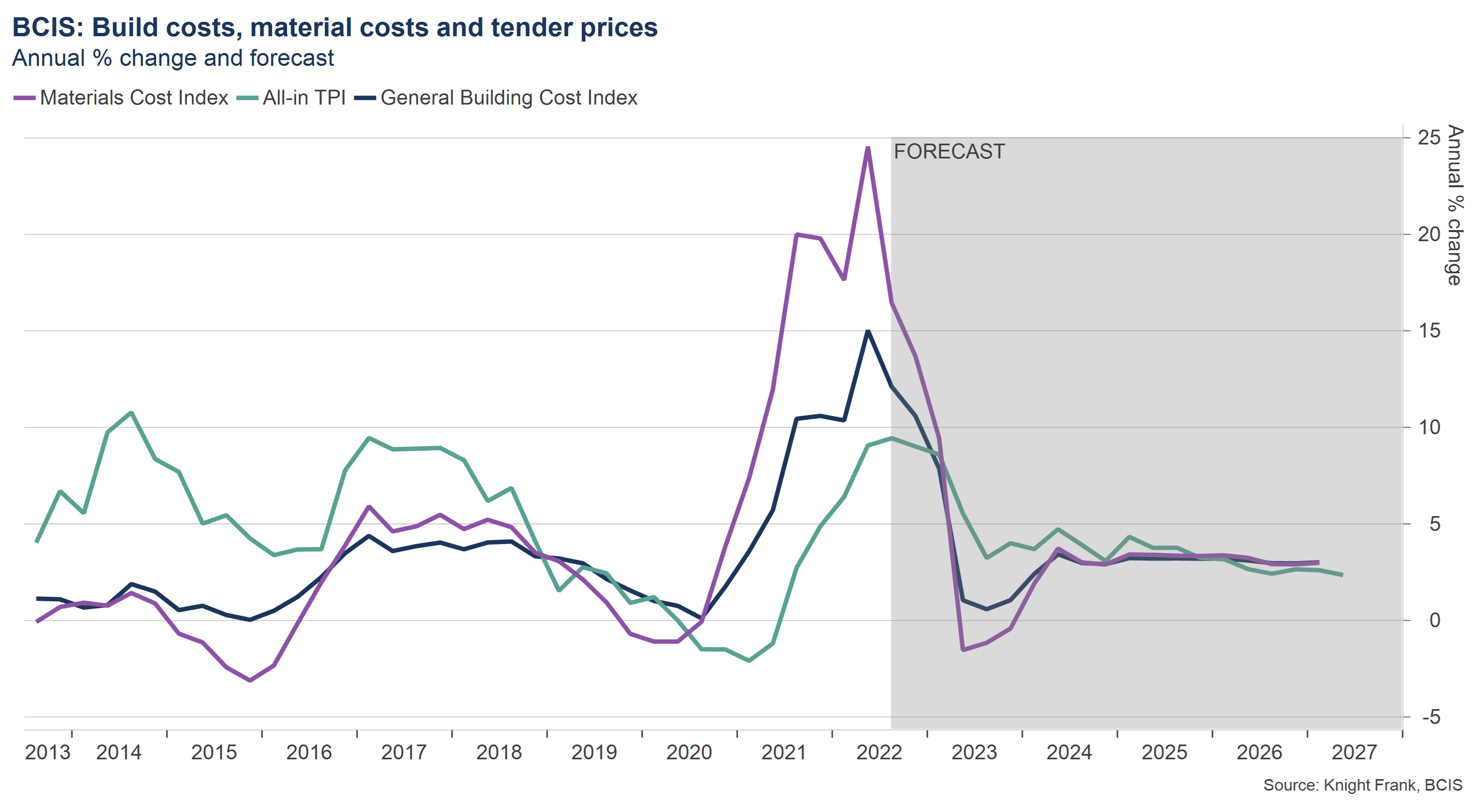

There have been tentative signs of an easing in input prices (see chart below). But material costs alone have risen by more than 20% in a year. These increases have largely been covered by house price inflation, particularly outside of London, but with a falling number of homes gaining planning consent, slowing price growth, as well as economic uncertainty, we may see development activity fall back later in the year.

New homes demand

Rising costs aren’t just a problem on the supply side. Prospective buyers are also under pressure from rising interest rates, especially as the cost of living continues to spiral.

So far, the forward-looking indicators we track remain positive. The number of prospective buyers registering their interest in buying a new home in the capital over the first six months of 2022 was 46% higher versus H1 2021, and 83% higher than the five-year pre-pandemic average.

Limited supply in the second-hand market, a flight to quality among buyers, and a push to complete sales using Help to Buy before the scheme ends, are all encouraging more purchasers to look at the new homes market. The (gradual) return of international buyers has also buoyed interest, as my colleague Tom Bill has noted.

Our view remains that we will see a slowdown in the UK housing market, before a return to more seasonal patterns, even if interest rates rise to 3%. House prices have largely been subject to similar influences as inflation – namely supply chain disruption resulting in a lack of stock relative to demand. With higher rates and more supply, the distortions of the past few years should ease.

Student rents

Despite the aforementioned headwinds, institutional investors remain hungry for the UK living sector, thanks to a combination of predictable demographic drivers, secure income streams and expected strong rental growth, all of which have supported yields.

We may well even see demand strengthen further on the back of further energy-cost inflation. Take purpose-built student accommodation (PBSA), for example. Historically, there has been a perception PBSA is the more expensive option relative to renting on the private market, but rising costs are tipping the balance due to the all-inclusive nature of PBSA rents, which include utilities and Wi-Fi.

Our analysis suggests that PBSA could offer a more cost-effective option in 80% of the 16 university towns and cities looked at compared to the wider rental market. London offered the greatest difference in price, but other university cities like Liverpool, Sheffield, Glasgow and Leicester also offered students noticeable savings.