Development land prices supported by a lack of supply

Land shortages across the country are supporting prices, but the market is expected to come under pressure later this year as house price inflation cools and build costs continue rising.

2 minutes to read

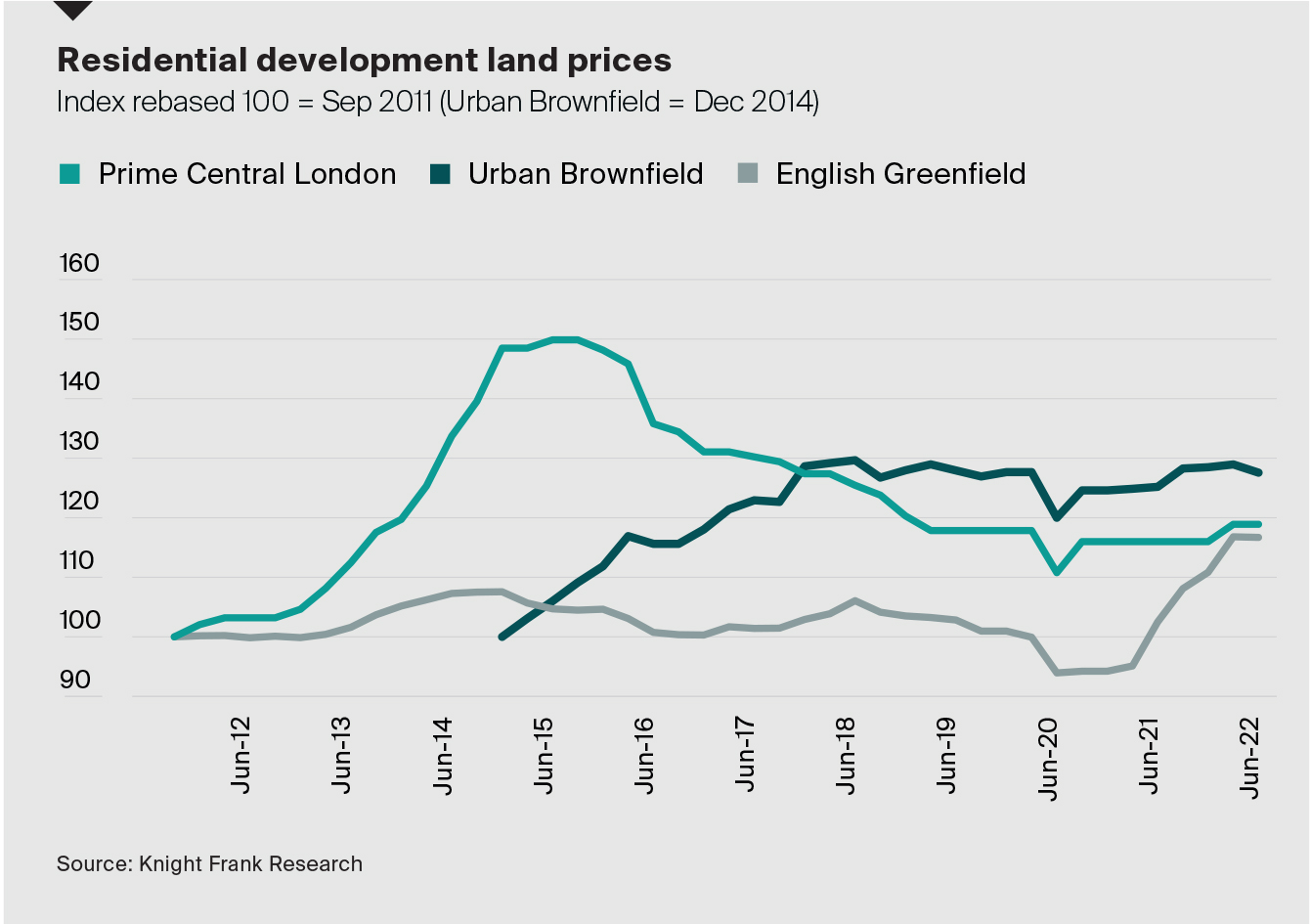

Development land prices in prime central London (PCL), greenfield and urban brownfield sites all increased year-on-year in Q2, supported by a lack of supply and ongoing robust demand in the sales market.

Greenfield land remained the strongest performer, up 13.9% annually, followed by PCL (+2.5%) and urban brownfield (+1.9%).

There are several reasons for continued annual growth. Generally, across the market there remains a shortage of development opportunities relative to demand with both major housebuilders and Housing Associations looking to build pipelines. Competition from other use classes including hotels, offices and industrial is also putting further pressure on values in some markets. The shortage of development opportunities is such that 74% of the SME and volume housebuilders who responded to our latest survey suggested that they were actively looking at land with any level of planning status, including strategic land.

Weakening economic outlook

Demand generally has been very strong for housing-led greenfield sites, although we expect this to cool off as the weakening UK economic outlook impacts housing demand and house price inflation begins to moderate (as we set out in our latest forecasts).

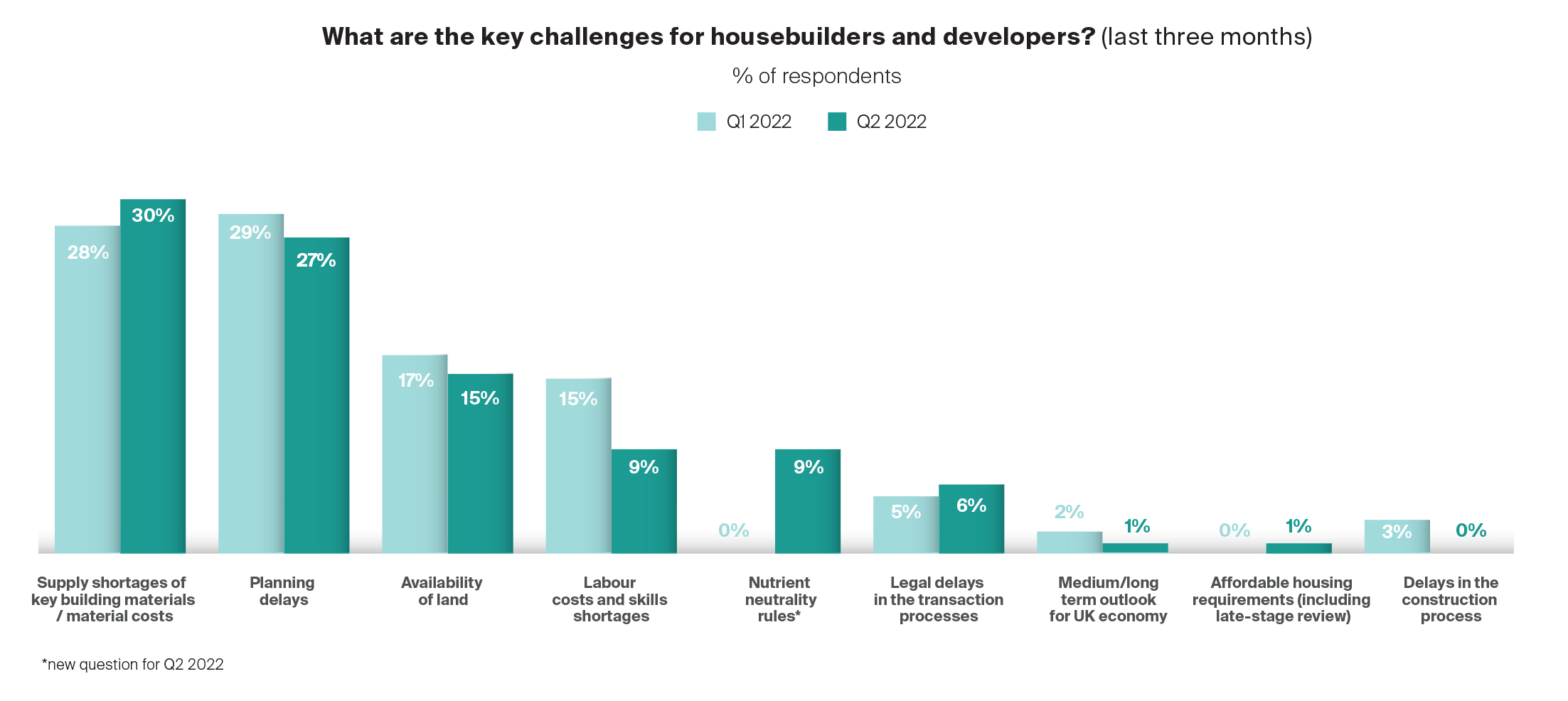

Pressures on the economy were a theme throughout the survey responses, with particular apprehension about short-midterm demand and inflation. The survey showed that while increasing costs of living pressures were weighing on buyer sentiment, build cost inflation and pressures on the supply chain continue to have the biggest impact on the sector.

This is substantiated by the Building Cost Information Service (BCIS) General Building Cost Index, which forecasts build costs to increase 11.4% in 2022 (up from 6.9% last year), before easing to 2.8% in 2023.

In this environment, signs are already emerging that housing delivery rates could slow moving forward. Nearly 40% of our survey respondents said they expected new starts to fall in the third quarter, as a result of land shortages (only 14% of responses suggested land supply was adequate), the end of help-to-buy and the effect of the Department of Fisheries and Rural Affairs (DEFRA) Nutrient Neutrality rules on schemes gaining approval.

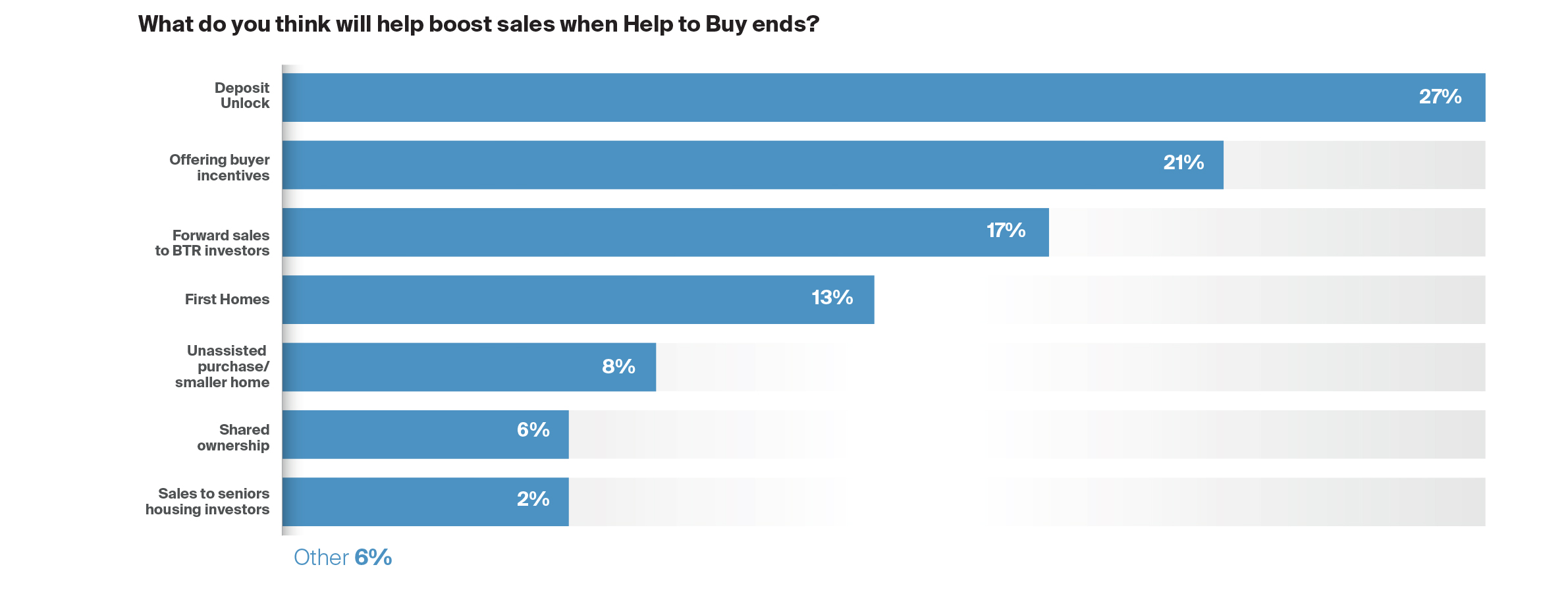

Responses to our survey suggested that the Deposit Unlock scheme would help boost new home sales, and this, together with inflation easing in early 2023 indicates a positive longer-term outlook.