Prime London sales market gains momentum as overseas travel returns

July 2022 PCL sales index: 5475.5

July 2022 POL sales index: 275.6

2 minutes to read

The pipeline of transactions in prime London residential markets expanded further in July as supply continued its game of catch-up with demand.

The number of offers accepted across the capital last month was the highest figure in a decade, underlining the current strength of appetite for higher-value property in London.

A combination of factors has led to the pipeline being stronger than it was in the final months of the stamp duty holiday in 2021.

First, international travel is resuming, as we discussed last month. The number of international arrivals at Heathrow in June was only 17% down on the same month in 2019. Compare that to an equivalent drop of 87% last June.

Regional differences remain due to varying Covid restrictions, with travel from Asia still half the level it was three years ago.

Second, prime London markets are relatively good value as buyers continue to reassess how and where they live after Covid. While all the attention was on the escape to the country trend during the pandemic, price growth in London was lacklustre, even after six subdued years.

Average prices in prime central London are still 15% down on their previous peak seven years ago.

There is also a creeping sense that investors are looking more closely at safe-haven assets, which has traditionally benefitted the prime London property market.

Investor nerves have been clearly on display in 2022 as central banks attempt to avoid stagflation. After steep declines this year due to a strengthening US dollar, the gold price has risen modestly since mid-July against a backdrop of geopolitical tension.

There are risks for the market on the horizon, but they are not yet looming large.

The first is the changing rate environment, which means mortgages have become notably more expensive since the low-point last September. However, the impact has not yet had a material impact on UK property markets, with mortgage offers standing for six months and most people on fixed-rate mortgages.

Rising mortgage rates is one of the reasons prime prices have slowed down in global markets, as we explore in more detail here.

However, prime London markets are also likely to be more insulated from rising borrowing costs than other UK locations due to higher levels of affluence.

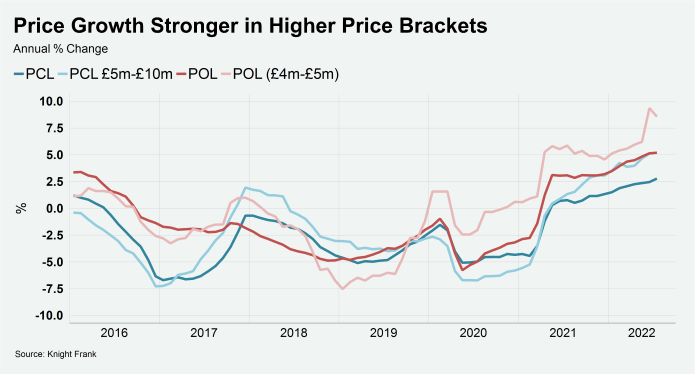

Underlining this fact is the current strength of higher-value markets, as we explored in more detail here. While average price growth in PCL was 2.8% in the year to July and 5.2% in prime outer London, the performance was stronger in higher price brackets, as the chart shows.

The other unknown is the identity of the new Prime Minister in September, although a new UK government that will effectively be in pre-election mode is unlikely to represent much of a short-term risk to the market.