Price growth remains stubbornly high, but demand is softening in the UK housing market

New buyer enquires fall, but the capital bucks the trend

4 minutes to read

The UK property market put in another resilient performance in June, with house price growth remaining in the double digits despite consumer confidence falling to a record low in the face of 40-year high inflation.

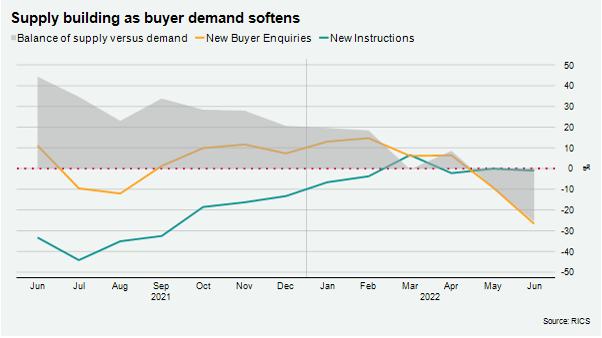

However, June’s RICS UK Residential Survey pointed to a softening in demand. New buyer enquiries moved further into negative territory, with a net balance of -27% of respondents seeing a fall, down from -9% in May.

Bucking the national trend, London buyer enquiries showed resilience with +7% of respondents seeing an increase.

The volume of sales dipped, with a reading of -13% in June compared with -5% a month ago.

With new instructions broadly flat, the amount of property for sale remains tight even with demand softening and this continues to exert upwards pressure on pricing, with +65% of survey respondents reporting an increase in prices.

In the lettings market, the reverse is true, with tenant demand (+36%) outstripping supply (new landlord instructions -11%) and a net balance of +52% of respondents expecting rents to continue climbing in the short-term.

House price growth remains strong, with Nationwide data showing average prices increased 2.4% in the three months to June, down from 3.1% in the three months to May. It put the annual change in prices at 10.7% in June.

Halifax said the average property was 13% more expensive in June than it was 12 months ago, which was the highest rate of growth since 2004 and an increase from 10.7% in May.

The lender said that property prices appeared to have been largely insulated from the cost of living squeeze, which was currently being felt most by those on lower incomes who are typically less active in the housing market.

However, the housing market will not defy economic gravity forever- the rising cost of borrowing is a concern to more than two-thirds of people Knight Frank surveyed – and we forecast that annual house price growth will finish 2022 at 8% before slipping to 1% in 2023 as the economic situation deteriorates.

Mortgage approvals for house purchase remained steady in May at 66,163 (compared with 66,064 in April) due to buyers seeing more purchasing options as supply and demand rebalances, and an added urgency to get a deal done as lenders continue to pull their cheapest products in anticipation of further rate rises by the Bank of England.

Prime London Sales

Last quarter was an undeniably strong period for the prime London property market - the question is how long it will last. Rising mortgage rates will eventually begin to curb demand, which will happen to a greater extent in lower price brackets and domestic-driven markets.

Higher levels of affluence, housing equity and a broader base of international buyers will support demand in prime central London (PCL) even as the cost-of-living squeeze gets tighter.

Average prices in PCL increased 2.5% in the year to June as they continued their gradual recovery. In prime outer London, annual growth reached 5.1% after quarterly growth slowed for the fourth month in a row, underlining how the race for space is calming down.

Prime London Sales Report

Prime London Lettings

Steep increases in rents in the prime London property market are calming down. However, the slowdown is a mathematical inevitability rather than the start of a major shift in the supply/demand balance.

Rental values hit their low point in the first half of last year as the market was flooded with short-let properties due to staycation restrictions.

After reaching a peak in April, annual increases in June narrowed to 26.8% in prime central London (PCL) and 21% in prime outer London (POL). Over the first six months of the year, rents rose 8.4% in PCL and 7.4% in POL, underlining how a large part of this annual increase took place in the second half of 2021.

Supply is picking up modestly in pockets of London but not to the extent that it is anything other than a landlord’s market.

Prime London Lettings Report

The Country Market

Price growth slowed in the UK country house market in the three months to June, as buyers become more circumspect against the backdrop of rising living costs and supply continued to normalise.

Average prices rose by 0.7% in the second quarter, compared with 3.5% in the three months to March.

It was the weakest quarterly growth since the market reopened in May 2020 after its enforced closure. It meant the annual change fell from 11.3% in March to 8.2%.

Price growth peaks in country markets due to improving supply and buyer caution