Seniors housing: More supply and flexible tenure options leading to more choice

More supply and more choice will help fuel awareness and exposure to the benefits of specialist seniors housing, driving delivery

2 minutes to read

The seniors housing sector is evolving, with a rapidly growing mix of for sale and rental options. In part, this choice is being underpinned by increasing institutional investment. Last year some 25% of the £1.4 billion invested in the market was for rental product. Two thirds of private operators currently offer rental as a tenure option, either through flexible tenure options on new and existing schemes, or through fully BTR platforms.

For tenants, the benefits are clear. Targeted at independent seniors, such schemes offer the flexibility of rental accommodation in a community setting. The nature of rental also gives customers a chance to move quickly, without necessarily selling a family home first.

From an investor perspective, offering mixed tenure schemes can help accelerate absorption rates, as well as widening the accessible market.

It is a view supported by our research. Some 67% of respondents to our survey of leading investors across residential investment sectors (encompassing student housing, co-living, multifamily and single-family rental and seniors housing) said they expect to be invested in the seniors housing rental market within the next five years, up from 31% who said they were currently investing.

This supports our expectation that the number of private seniors rental properties in the UK will increase by 114% over the next five years, from almost 5,000 currently to more than 10,500.

Even accounting for such rapid growth, seniors housing rental stock will only account for 1.3% of the total number of specialist senior housing options. In the more mature US market, seniors rental housing is well established, accounting for 90% of total stock, with 80% of tenants selling a former family home before moving and becoming a tenant. The homes provided are often part of larger ‘Continuing Care Retirement Communities’ (CCRCs) that allows residents to move into more specialised accommodation as their needs change over time.

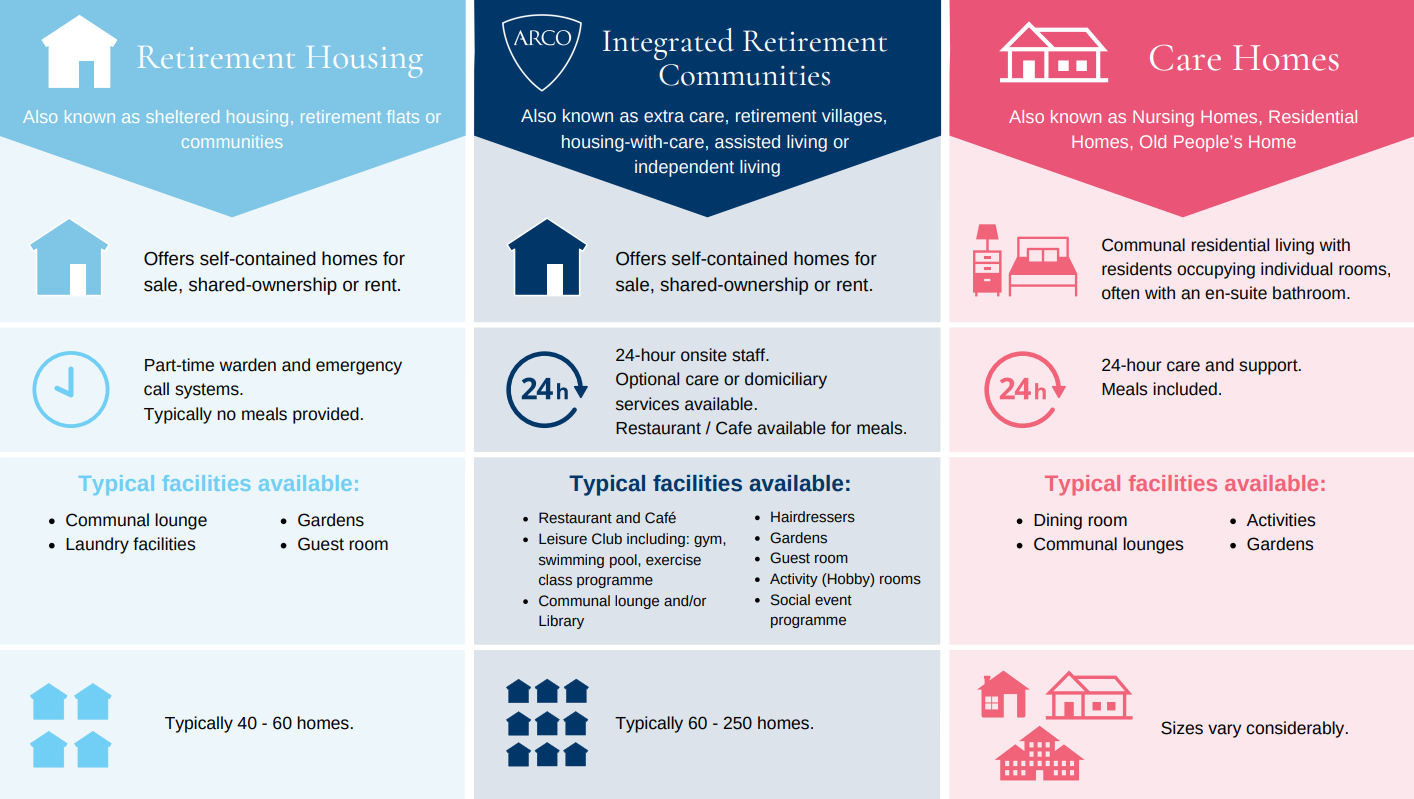

Market segmentation

Urban shift

With increasing institutional investment accessing long term income profiles from rental and event fee income as wells as services, we are also seeing operator’s schemes growing in size, and there is increasing development activity in peri-urban, suburban and urban locations.

Highlighting this shift, some 30% of seniors housing IRC schemes built in the last two years have been delivered in the most urban settlements, according to analysis of the pipeline, up from 9% for schemes built before 1980s.

The size of developments has also risen steadily, with an increasing number of developments of 100 to 150 units and 150+ units being delivered. The planning pipeline suggests this trend is set to continue. That is partly a reflection of a desire for scale and brand-building from new entrants to the sector as they look to create management platforms with operational efficiencies at pace. For these schemes, phasing is important to manage sales rates.