More than two-thirds of homeowners are concerned about increasing borrowing costs

The rising cost of living and mortgages cited by 31% as a reason not to buy.

2 minutes to read

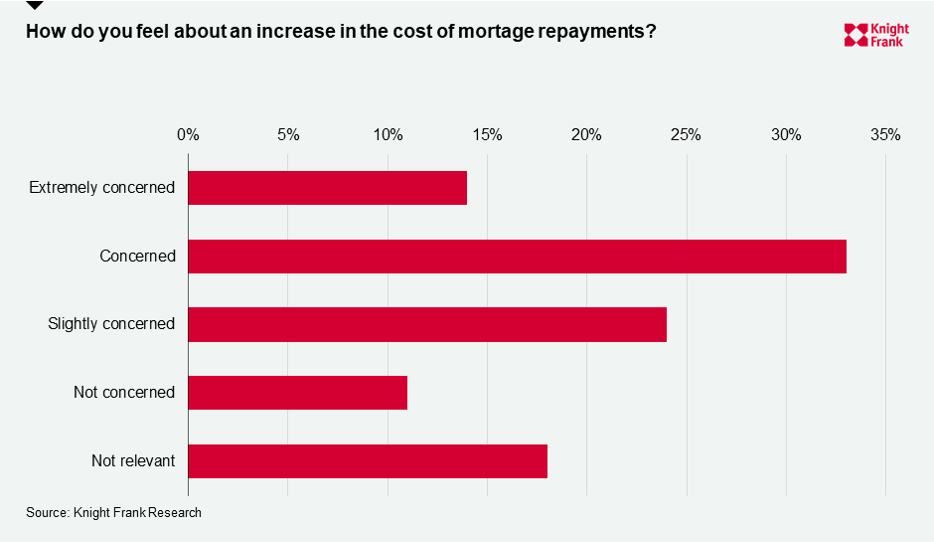

Seven out of ten people are concerned about an increase in mortgage repayments, according to a new housing market survey.

While close to a quarter (24%) were slightly concerned about an increase, approaching half (47%) were ‘concerned’ or ‘extremely concerned’, according to Knight Frank’s latest residential property survey.

Among those not planning to move within the next year, close to a third (31%) cited either the rise in the cost of living or increases in borrowing costs as the reason.

It comes after the Bank of England’s decision to raise the base rate to 1.25% in June.

Although 74% of UK borrowers are on fixed-rate mortgage deals according to UK Finance, those seeking to borrow, renegotiate or remortgage, face the prospect of higher rates as lenders react to expectations that the base rate will reach 3% by 2023 in a bid to tame 40-year high inflation.

“We’re seeing an impact where we have offers or agreed sales that are taking time to progress. Some buyers are finding they cannot get to the level they previously could due to the increase in rates,” said Matthew Hodder-Williams, office head at Knight Frank Sevenoaks.

Arabella Howard-Evans, head of sales at Fulham, agreed. “It’s been one of our busiest spring markets on record, but the cost of borrowing is something that’s definitely coming into play now. We’re seeing more caution on the buyer side, and people doing what they can to avoid rearranging existing mortgages knowing if they go back to their lender it’ll cost more and may no longer work for them,” Arabella said.

Approaching half (46%) of survey respondents said they had experienced a fall in spending power because of a rise in living costs.

Despite the concerns, demand is proving resilient with 58% of respondents looking or deciding to buy within the next year (compared with 43% in December 2021).

House price expectations soften

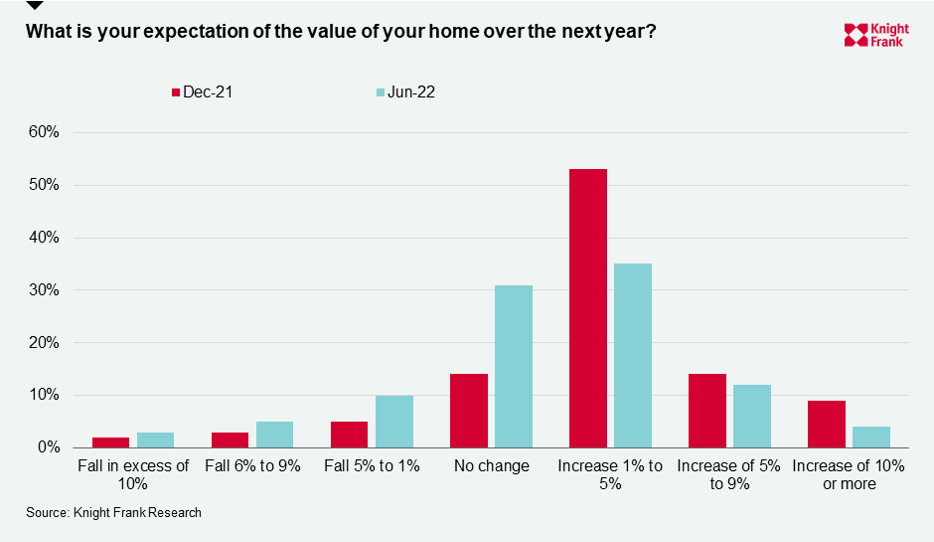

More than half of respondents (51%) said the value of their home would rise in the next 12-months.

An increase in value of between 1% to 5% was the most popular option with 35%. In second place was ‘no change’ in value with 31%.

The result shows a softening in sentiment, with 76% of those surveyed expecting an increase in the value of their homes in December 2021.

We forecast house price growth will moderate this year, from double digit to high single-digit by the year end as buyers’ finances are squeezed and the gap between low supply and high demand in the market reduces.