Leading Indicators | Rate Hikes | Remote Working | Construction Costs

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Pace of rate hikes to vary

Following last week's data release which pointed to a record 8.6% level of inflation for the Eurozone in June, market commentators have noted that the ECB could hike rates by as much as 50bps at its meeting in July. This will be the central bank's first rate hike in 11 years. Meanwhile, money markets have scaled back rate hike predictions in the US, with expectations that the interest rate will be 3.2% by year end, compared to 3.4% last week. In the UK, markets forecast a 2.4% interest rate by 2023, however, this is higher than consensus forecasts which place it at 1.75%.

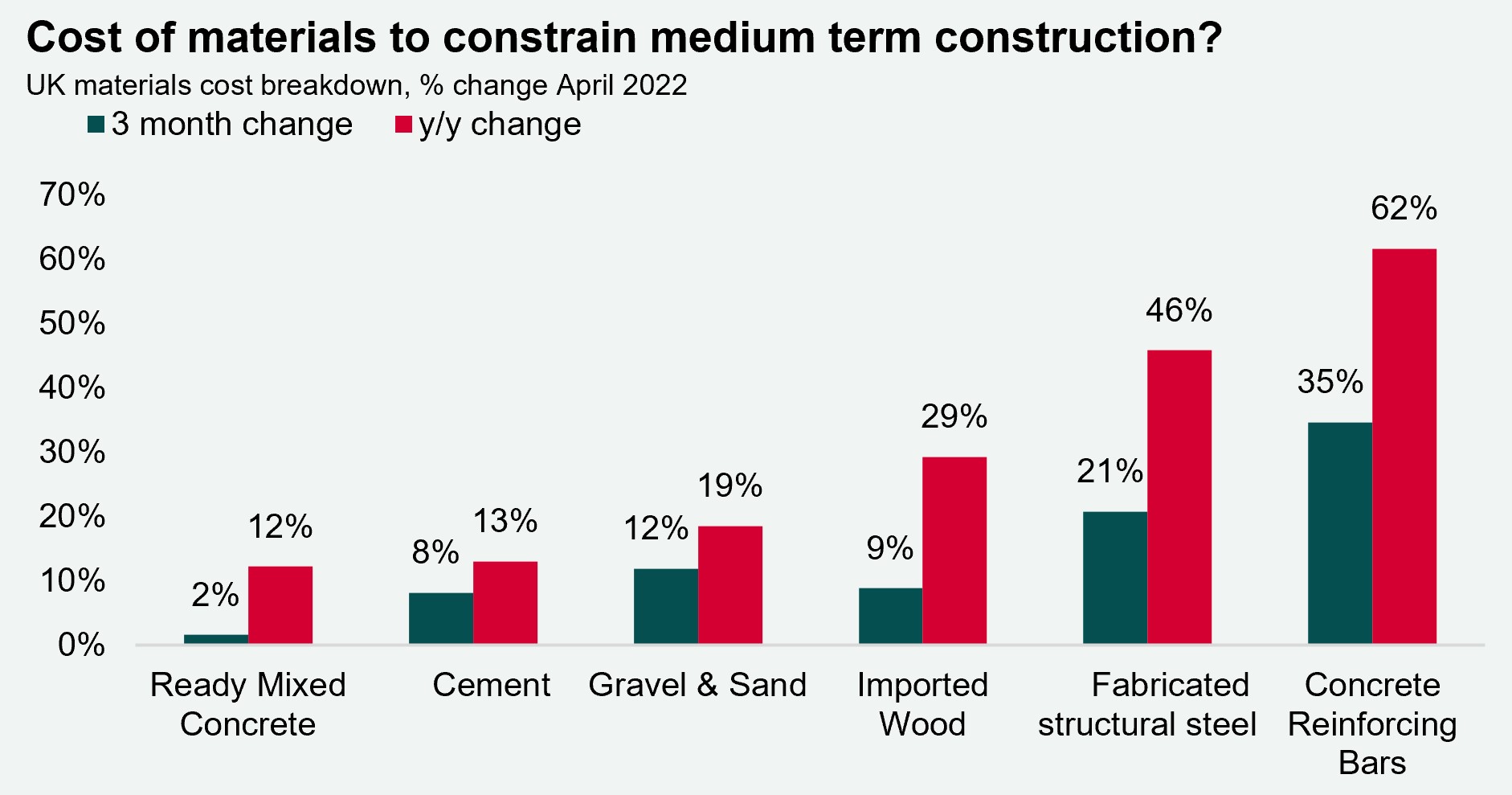

Construction costs likely to impact the supply pipeline

The BCIS All-in Tender Price Index (TPI) increased by an estimated 9.1% y-y in Q2 2022. Meanwhile, the BCIS expect the cost of raw materials in the UK to more than treble in 2022. This could impact the construction pipeline in the short to medium term, which will likely have implications for buyers seeking new stock. In London, despite the 14.4 million sq ft of office space under construction, there will still be a significant shortfall of best-in-class office space. With this in mind, investors could benefit from higher rents, due to occupiers competing for space.

Will worries over economic growth cause an improvement in office occupancy?

In his latest House View article, Lee Elliott explains that the genie has been let out of the remote working bottle by the pandemic and is unlikely to ever return. With employees demanding more flexible working, many employers are adopting hybrid arrangements - typically combining formal office presence with remote working. According to May’s Freespace Index, 67% of the offices they track globally have seen some form of re-occupancy, with the majority being at least one third full. However, with the global economic outlook downgraded and sentiment worsening, we could well see more people return to the office going forward as global labour markets come under pressure and presenteeism becomes an understandable reaction from employees.

Download the latest dashboard