How will Boris Johnson's departure impact UK property?

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

UK politics

How will Boris Johnson's departure impact the UK residential market?

A slowdown is coming in the second half of the year as higher mortgage rates bite and supply builds, and that would be compounded if any leadership vote leads to a general election.

However, that prospect feels unlikely in the short term, notes Tom Bill. Waiting until after inflation has peaked at the end of this year would be a lower risk strategy for any incoming prime minister. Indeed, by next spring, even with inflation falling, the calculation may be that waiting 12 months until the next scheduled election in 2024 is the best option. Whenever the next election does take place, it will have the time-honoured impact of slowing the housing market in the run up.

Johnson has told his senior ministers that any “major fiscal decisions” should be left to his successor, according to Bloomberg. Whoever that is faces some difficult choices. The OBR, the government's spending watchdog, warned yesterday that the UK's ageing population leaves future government's with few choices but to raise taxes or face a debt pile of 320% of GDP in 50 years' time.

House prices

House prices increased 1.8% in June, the twelfth consecutive monthly rise, according to the latest Halifax index. That caps annual growth of 13%, the highest since 2004.

You can find our take in Tom Bill's piece linked above. Frustrated demand that arose from a period of low supply has combined with concerns over rising mortgage rates to trigger a very active UK housing market - one that appears oblivious to external events.

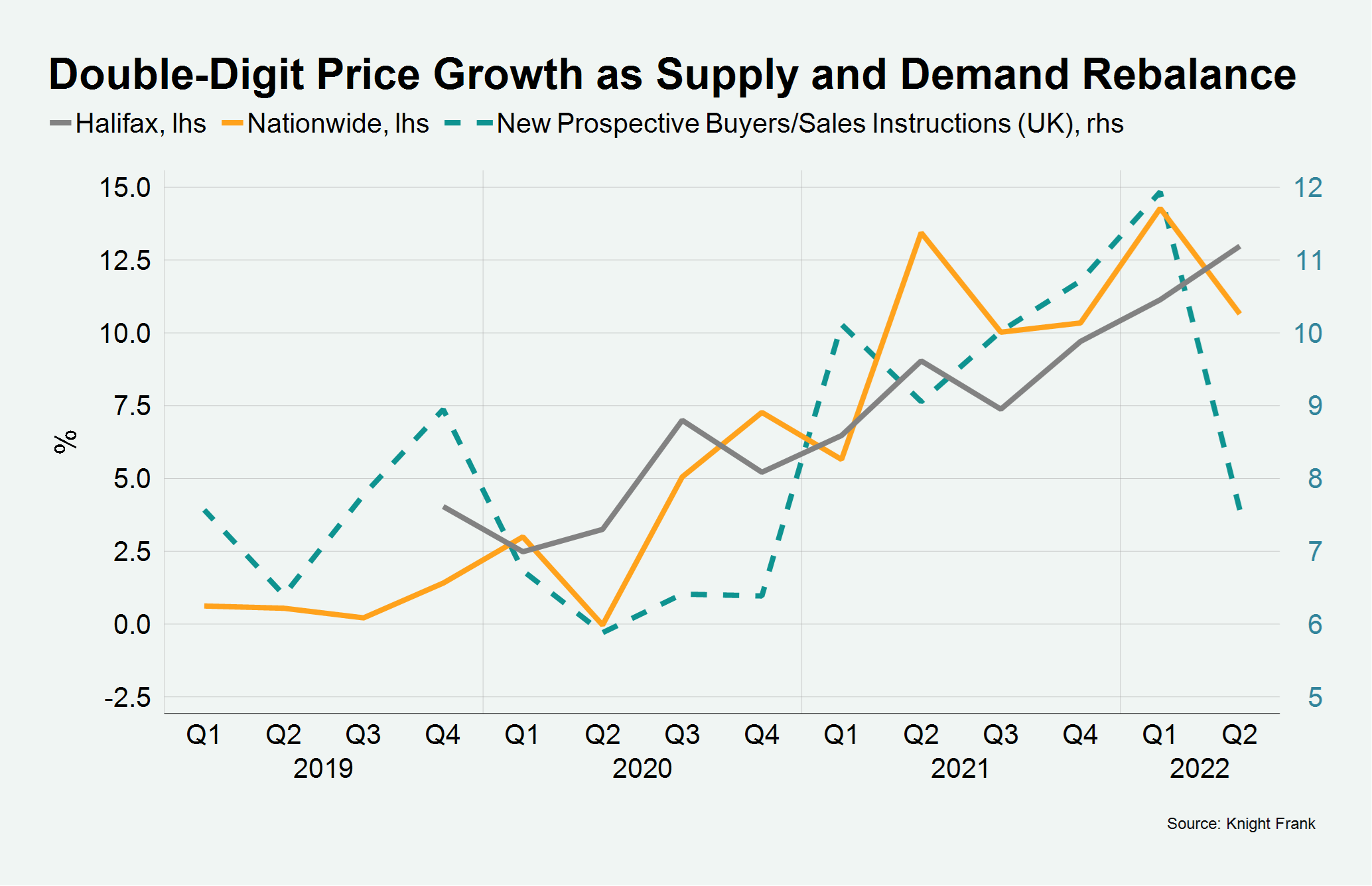

Supply and demand is already beginning to moderate, which will show in the various house price indexes soon. The ratio between the number of new prospective buyers (demand) and sales instructions (supply) was 7.6 in the second quarter, down from 11.9 in Q1 (see chart).

The Bank of England will publish its next interest rate decision on August 4th and Monetary Policy Committee members have been making some fairly hawkish speeches, see Catherine Mann on her preference to "front-load" policy under current circumstances and a slightly more measured Huw Pill on the Bank's willingness to speed up tightening should inflation look entrenched.

Prime London

We're seeing similar patterns in prime London, where supply is catching up with demand. That's leading to strong trading volumes - the number of offers accepted in the second quarter was the highest since 2012.

Rising mortgage rates will eventually begin to curb demand, though higher levels of affluence, housing equity and a broader base of international buyers will support demand in prime central London (PCL) even as the cost-of-living squeeze gets tighter.

Meanwhile, steep increases in rents in prime London are calming down, though the slowdown is a mathematical inevitability rather than the start of a major shift in the supply/demand balance.

Construction

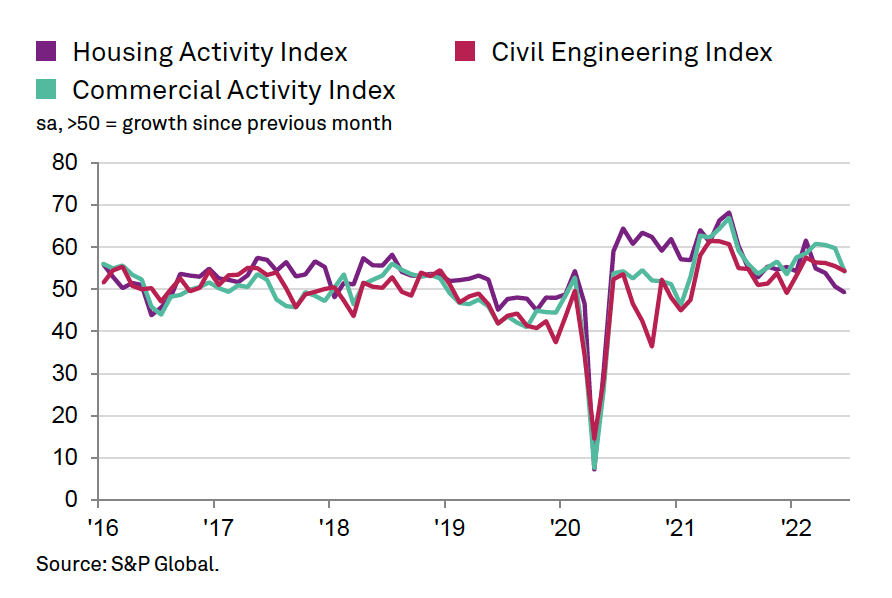

UK construction companies signalled another loss of momentum in June, according to the latest S&P Global/CIPS UK Construction PMI. Business activity expanded at the weakest pace for nine months (though it did expand). New orders increased the smallest amount since last October.

House building was the weakest performer for the fourth consecutive month (see chart).

Spikes in energy costs and commodity prices continue to feed into the price of construction materials. Materials prices rose 27.2% in May 2022 compared to a year earlier, according to official figures. See more from Noble Francis, Economics Director at the Construction Products Association.

Prime France

The French lifestyle is resonating strongly with pandemic-weary overseas buyers. Prime prices in France rose 6% on average in 2021 and residential sales volumes sit 31% above their ten-year average according to our new Prime France Report. Stock levels in key second-home destinations such as Provence, the French Alps and South of France are at their lowest level for decades.

Although there are signs that the exuberance of the last few years is starting to ebb as macroeconomic headwinds mount, the evolving landscape presents opportunities for some international buyers, not least US or dollar-pegged purchasers who currently enjoy a 16% discount compared to a year ago.

In other news...

UK jobs market lost a bit more steam in June (Reuters), China developers face $13bn wall of dollar bond payments in second half (FT), China property debt crisis is just the beginning (Bloomberg), Greystar raises fresh funds as residential rental investment surges past €30bn (FT), Persimmon blames planning delay for lack of new homes (Times), and finally, inside Luxembourg's experiment with free public transit (Bloomberg).