The UK is the global 'WFH' hotspot

Making sense of the latest trends in property and economics from around the globe

6 minutes to read

WFH

Working from home has become so embedded in the UK that it is now an outlier among advanced economies, according an FT's analysis that draws on Google Mobility Data and research from the universities of Stanford and Southampton. Commuter numbers here were still more than 20% below pre-pandemic levels on Thursday compared to, say, Germany, which was back to within 7%.

Experts and academics quoted in the piece put that down to a mixture of the UK's oversized services sector, its flexible labour market, plus higher commuting costs. Nations like Germany and Italy, for example, have much more industrialised economies with fewer computer based jobs that are in turn, much more tightly regulated.

There is clearly a cultural aspect to working from home that is likely to embed a divide in working habits between nations, at least until we see more data on the effect of mass hybrid work on productivity. Last month we touched on research from Christine Li that suggests we're unlikely to see hybrid working adopted in the Asia Pacific region on any serious scale. Large parts of North Asia, including Greater China, South Korea and Japan, have little or no intention of embracing hybrid working due to an entrenched 'office-first' work culture.

The data suggests that the UK will be the petri-dish in which new ideas are tested, at least for the time being. The exact impact this will have on office space will be determined as leases expire, which will take months and years, not weeks. The London office market, for example, has more than 24.5 million square feet of lease expiries pending between 2022 and the end of 2025, according to Knight Frank's The London Report 2022.

Office demand

That's not to say we can't already draw some conclusions. Knight Frank's M25 and South East Office Market report, published last week, revealed that 4.8 million sq ft of active occupier demand over 10,000 sq ft remains unfulfilled as of March 2022. That's risen from a low of 3.5 million sq ft at the depths of the pandemic and is closing in on the long run average of more than 5 million sq ft.

About four in every ten occupiers active in the market require less space. The scale of this reduction ranges from 5% to as high as 50%, although the results are skewed by the inclusion of several larger businesses that currently occupy more than 100,000 sq ft. A number of these companies had already embarked on significant downsizing plans pre-Covid, but these were accelerated by the pandemic as well as, in some cases, by a lease event.

The remaining 61% of future space requirements analysed in our study were either space neutral or upsizing. Strategies focussed on acquiring "just enough" space may also give rise to "just in case" space as occupiers seek to accommodate a flexible option to avoid holding any dead space. In that case we believe companies will look favourably on locations in which flexible space providers are strongly represented.

Lee Elliott expands on this growing push for flexibility. Occupiers are taking flight to office space that is underpinned with flexible lease structures that also allows for flexible configuration so occupiers can “rightsize” in sync with the business cycle. Until recently that was the purview of serviced office and co-working operators but increasingly we are seeing conventional landlords presenting more flexible products, either directly through self-operation or through informal partnership with operators. See the report for more.

Mortgages

During the most active periods of the pandemic-induced housing boom we saw lenders pulling products off the market and raising rates in order to control business levels by ensuring they weren't the cheapest on the high street. Well, it's happening again as borrowers seek to beat rising interest rates, according to the FT.

Knight Frank Finance Managing Partner Simon Gammon tells the paper that the time taken between agreeing a rate and drawing down the money has “ballooned” in the past fortnight, and that lenders are "repricing or withdrawing chunks of their product ranges at a time in an attempt to maintain service levels.”

The average shelf life of a mortgage deal fell to a record low last month of 21 days, according to data from Moneyfacts. Tom Bill has more from Simon in his weekly update this morning:

“Too much lending can lead to issues around maintaining service standards and bottlenecks. The other reason is that in an environment where rates are rising, the concern of lenders will be focussed on managing their loan book rather than growing it.”

For more of the most important housing market data, see the latest round up from Chris Druce.

Supply chains

We talked last week about the new round of supply chain disruption hitting the UK construction industry as a result of Russia's invasion of Ukraine. Four in ten housebuilders responding to our latest survey said they believe ‘build cost inflation’ and ‘supply chain disruption’ will have the biggest impact on the sector in Q2.

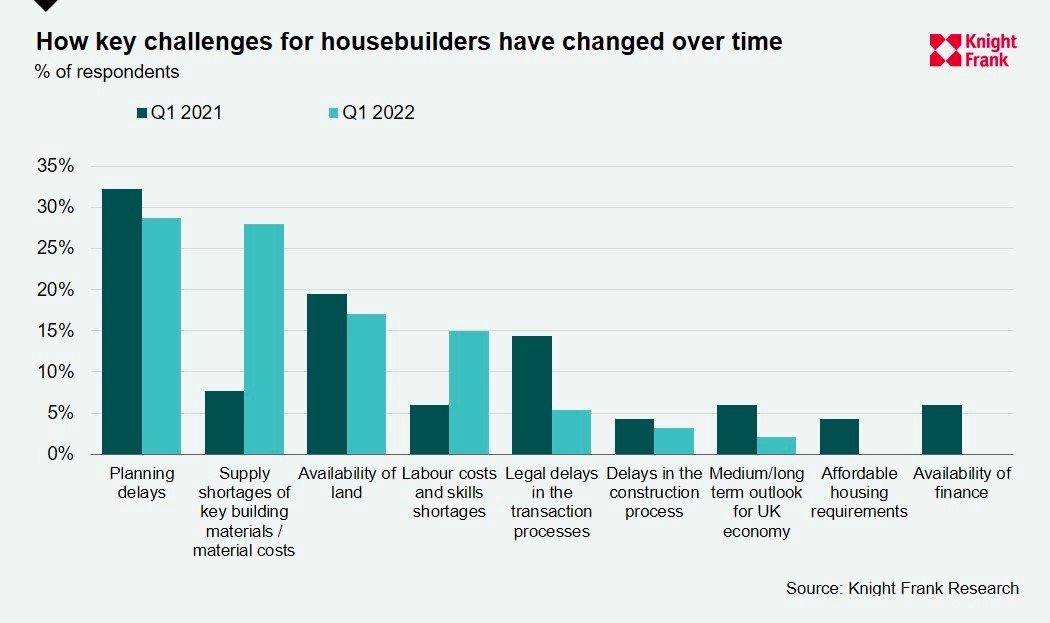

Anna Ward tracks how those concerns have changed over time (see chart). Concerns over labour have risen from 6% in Q1 2021 to 15% this quarter, while concerns over key building materials have grown from 8% in Q1 2021 to 28% this quarter.

House price inflation has enabled housebuilders to offset at least some of the increase in build costs but land values are going to come under pressure as house price growth slows and build costs inevitably keep rising. Greenfield development land values rose 5% in Q1, with urban brownfield land values up 0.4%, according to our latest Residential Development Land Index.

The return of the renters (and landlords)

Rental values in prime areas of London are now 9% higher than they were before the pandemic as low supply and high demand produce an imbalanced market, according to our latest figures.

The number of market valuation appraisals (a leading indicator of supply) was 40% below the five-year average in April, while the number of new prospective tenants registering was 57% higher over the same period.

There was a spike in activity in the buy-to-let sector ahead of the introduction of a 3% stamp duty surcharge for landlords in April 2016. Since then, demand has been in decline due to higher costs and fewer tax breaks as the government introduced measures to tackle housing affordability. Agents tell us that rising rents are tempting landlords back: -

“The extent of the recent rent rises has started to compensate for some of the regulatory changes of the last few years,” says Andrew Groocock, regional head of sales for Knight Frank’s City, East and North region in London. “It’s increasingly driving activity in London’s apartment market.”

You can find our rental forecasts here.

In other news...

Jennifer Townsend on the next hotspots for life sciences.

Elsewhere - economists sound the alarm over UK's post-Brexit finance plans (Reuters), outlooks for EU growth and inflation worsen (FT), Goldman’s Lloyd Blankfein warns of ‘very, very high risk’ of US recession (Bloomberg), UK manufacturers "reshore" supply chains (FT), Shaftesbury investor fires warning shot over £3.5bn Capco deal (Times), investors dive into ‘cheap’ leisure sector (Times), and finally, Adam Tooze on the African "Youthquake" (Substack).