A future space strategy: Just enough. Just in case.

The turmoil brought about by Covid-19 has been all-consuming, with leasing activity hitting a “hard brake” almost overnight. Understandably, occupiers have bought time by engaging with regearing and renewal as the focus shifted to dealing with the operational challenges brought about by the virus. Most managed to avoid knee-jerk strategic responses and now, as we enter the third – and hopefully less tumultuous – year of the pandemic, the implications for south east offices are beginning to become clearer.

4 minutes to read

The impact of post-Covid working practices on office demand

Our bespoke analysis of Knight Frank market data shows 4.8 million sq ft of active occupier demand over 10,000 sq ft remains unfulfilled as of March 2022. This figure has gradually risen from a low of 3.5 million sq ft at the depths of the pandemic, and provides a clear sign that, even though the appetite of businesses to enact space moves is still below pre-pandemic levels of greater than 5 million sq ft, confidence is solidifying and engagement with the market is increasing as a result.

Are active organisations requiring the same quantum of space?

Analysis of active named demand over 20,000 sq ft concludes that39% of occupiers active in the market are requiring less space. The scale of this reduction ranges from 5% to as high as 50%, although the results are skewed by the inclusion of several larger corporates all with current accommodation over 100,000 sq ft. A number of these companies had already embarked on significant downsizing plans pre-Covid, but these were accelerated by the pandemic as well as, in some cases, by a lease event.

Indeed, a wider review of historic patterns indicates that space utilisation was changing ahead of Covid-19. The average deal size in the south east between 2000 and 2010 was 19,000 sq ft. By the following decade (2011–2020), this had decreased by 18% to 15,600 sq ft, with a low of 12,500 sq ft recorded in 2017. Cushioning the impact of this though was a rise in deal numbers, which increased on average by 5% between these two timeframes.

What happens next?

The remaining 61% of future space requirements analysed in our study were either space neutral or upsizing, although “rightsizing” will clearly be a consideration for the market moving forward. One possible product of a strategy focused on the acquisition of “just enough” space might be the need to secure “just in case” space. This could mean that as business operating models increasingly accommodate a flexible option to avoid holding dead space, preference is given to locations where third-party flexible space providers are strongly represented.

How well serviced are the south east markets?

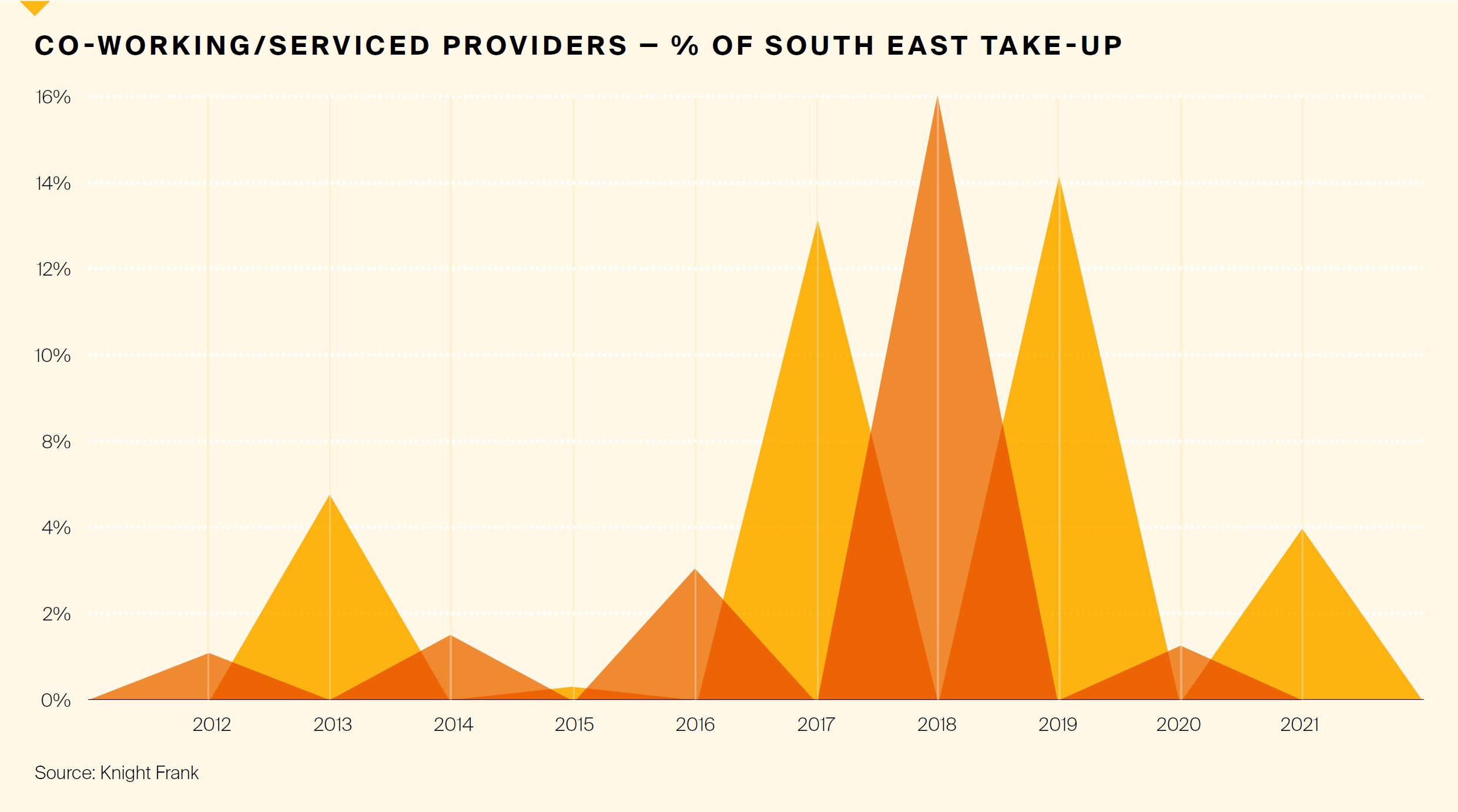

Prior to 2017, the principal market for flexible office operators was largely limited to central London, with providers typically only representing 1%–2% of leasing activity in the wider south east markets. From 2017 to 2019 though, operators acquired some 1.4 million sq ft of flexible space, more than in the previous 10 years combined. All leases taken during this period were to support business growth as opposed to satisfying an end user pre-commitment, with only the onset of Covid-19 stemming onward ambitions. Analysis of current space leased or managed by thirdparty providers shows that serviced or flexible office stock in the south east and greater London markets was 3.8 million sq ft.

"One possible product of a strategy focused on the acquisition of ‘just enough’ space might be the need to secure ‘just in case’ space"

Click to enlarge image

Of this, 73.7%, or 2.8 million sq ft is located in our identified 18 key south east markets. For context, this is similar to the amount of space operated by WeWork in central London. Unsurprisingly, the highest concentration is found in west London, with 35% (1 million sq ft) identified as operational. Interestingly, west London also has the highest ratio of serviced space to total stock of the major markets at 7%.

"A hybrid approach will mean a combination of core, flex and home"

Click to enlarge image

A flexible future

With the constitution of the occupier changing, not surprisingly the demands placed on offices is undergoing transformation. Integrating an element of flexible space is sure to gain traction in real estate strategy moving forward.

Technology, creative and digital firms are good examples where businesses need to be nimble to respond to the changing demands of the marketplace. Demand for flexibility is by no means limited to these sectors though. Indeed, firms across all sectors are increasingly exploring the merits of incorporating an option for flexible space in their occupational strategies.

Fundamentally, the Covid pandemic has raised awareness of different ways of working, prompting businesses to evaluate what their property brings to the company. A hybrid approach that delivers on-demand, customisable and scalable access to space, amenities and services is gaining favour. The physical office must accommodate this change in a forward-thinking, creative way. Increasingly, the “workplace” is becoming more adaptable, elastic and responsive to what individuals and teams are doing. This will mean a combination of core, flex and home, with the office integral to bridging the gap between “in person” and digital experiences.

Download Navigating the property lifecycle PDF