Housebuilder concerns grow over build cost hikes and land shortages

Housebuilders are increasingly concerned about the cost of building new homes and the shortage of land to build them on.

2 minutes to read

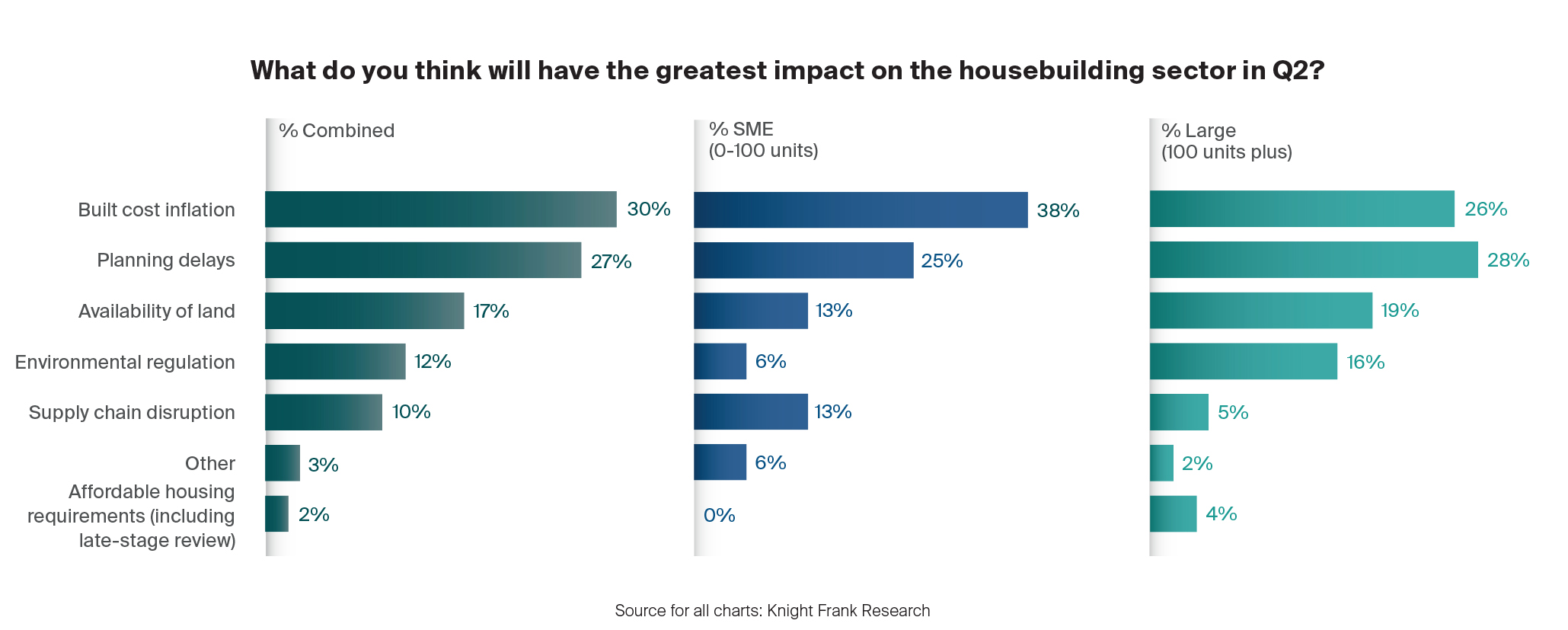

In our fifth residential development survey of volume and SME housebuilders, 40% of respondents said they believe ‘build cost inflation’ and ‘supply chain disruption’ will have the biggest impact on the sector in Q2, with over a quarter citing planning delays as another key issue.

In total, 85% of respondents said that land availability was either ‘limited’ or ‘very limited’ in the first quarter of 2022, up from 70% in Q4 2021.

Against this backdrop, the majority expect land prices to either rise (47%) or stay the same (44%) next quarter.

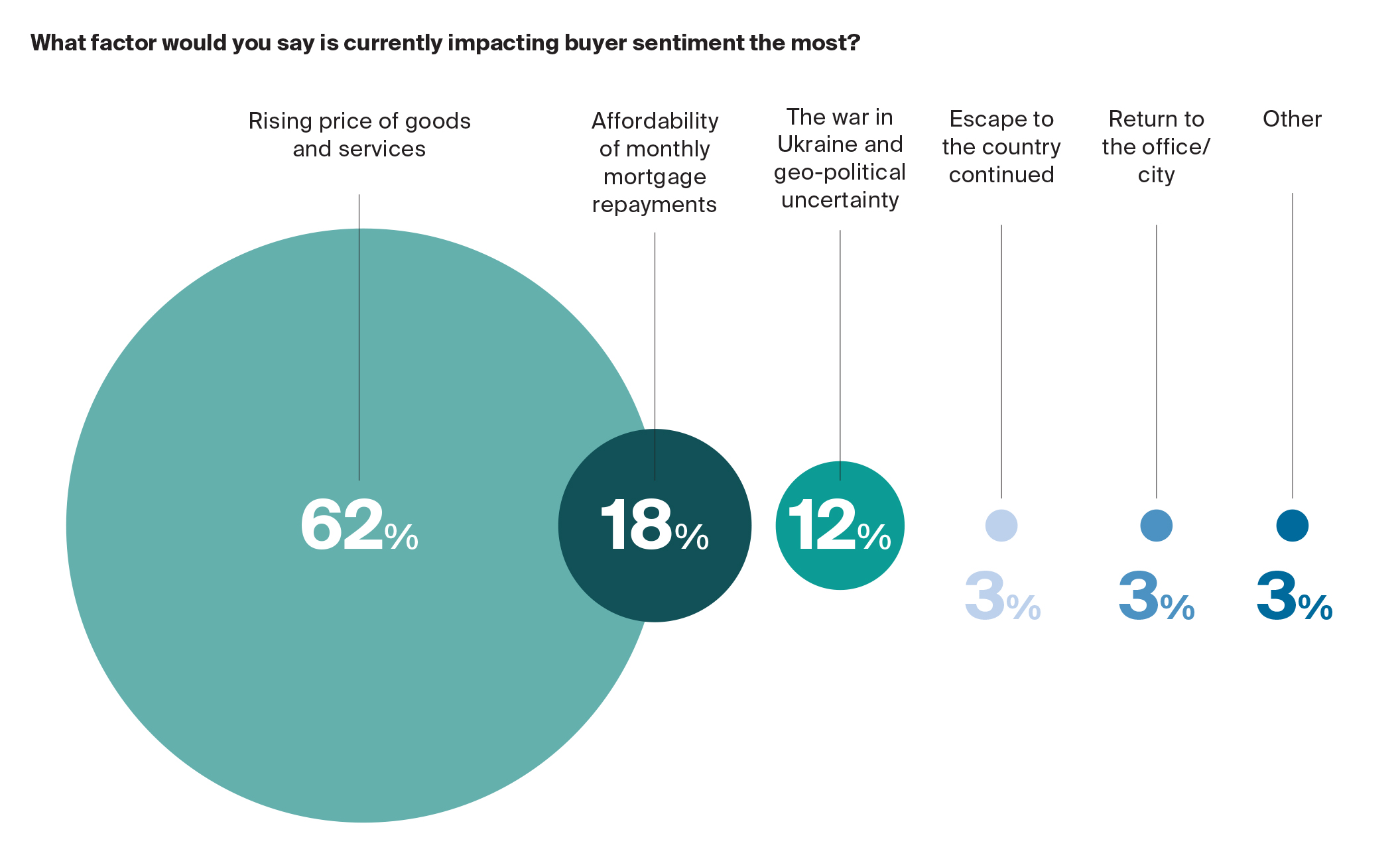

Going forwards, land prices should come under further pressure from ongoing build cost hikes at a time of cooling housing demand. Higher mortgage rates and a cost-of living squeeze mean we expect UK house price growth to slow later this year. Our survey found that 62% think the rising prices of goods and services is weighing on house buyer sentiment the most.

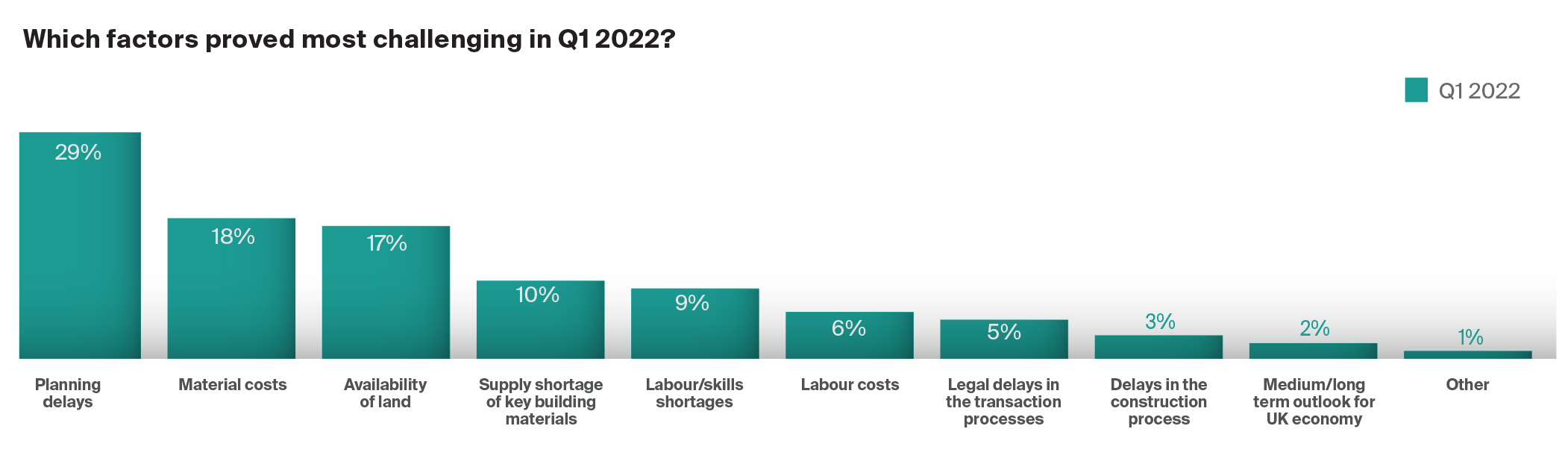

Supply side challenges

Increased construction costs and supply chain disruption are key issues around the country but particularly in areas where house price growth has been less strong, such as in London. Our survey found that build costs had had a ‘significant’ impact on 44% of respondents’ businesses in Q1, with nearly half reporting a ‘moderate’ impact.

In this environment, signs are already emerging that housing delivery rates could slow moving forward. A quarter of our survey respondents said they expected new starts to fall in the second quarter. It is the first time since we began the survey a year ago that a greater proportion are expecting new starts to fall rather than rise.

An increase in competition from logistics players is also exacerbating the land supply issue and constraining the build out rates of new homes.

Residential developers are being outbid on several sites, even those with planning permission in place for housing. Overall, our survey found that over half (56%) of respondents are seeing more competition for land from other use classes such as logistics.

Other supply side challenges include a new environmental ruling on nutrient neutrality, impacting delivery in areas including Norfolk, Hampshire, Devon and the northeast. In March Natural England issued guidance instructing local authorities to consider the impact of nutrient neutrality before granting planning permission, causing residential development delays.