February saw record house price growth as buyers pushed ahead

High demand and limited supply continued to drive prices in the UK.

3 minutes to read

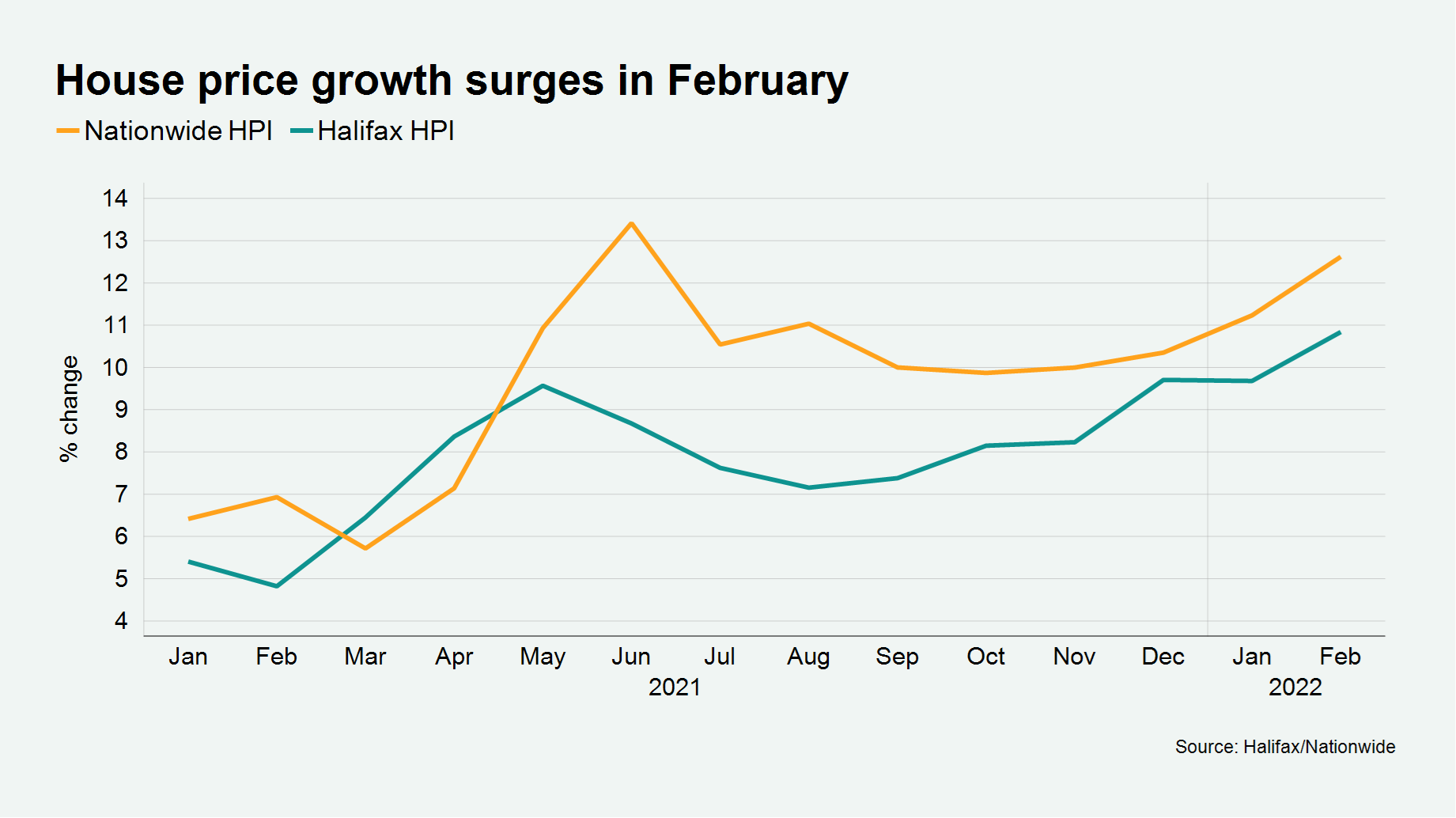

House prices rose at their fastest annual pace since 2007 last month according to Halifax, with the pandemic inspired momentum in the property market showing no signs of slowing.

The lender recorded an annual change of 10.8% in February, the strongest level since June 2007 (+11.9%) and eighth consecutive month of growth.

In the past 12 months house prices have gained on average £27,215, which is the biggest one-year cash rise recorded in over 39 years of the Halifax index.

It was a similar story from Nationwide, which said annual house price growth had accelerated to 12.6% last month, up from 11.2% in January. This was the strongest pace since June last year.

Both lenders forecast an end to this record-breaking growth as the cost-of-living bites and borrowing becomes more expensive.

But for now, the established pattern of high demand and limited supply that has been with us since the tail-end of the stamp duty holiday prevails.

If anything, market momentum strengthened during February, with RICS reporting an increase in agreed sales off the back of a rise in new buyer enquiries. New buyer enquiries showed a net balance of +17 in its latest sentiment survey, which was the sixth consecutive positive monthly reading.

The volume of new sales instructions moved to -4 in February. It has only been positive once during the past year, which has left supply at a historic low, said RICS.

Homeowners appear to be pressing ahead with plans to move-house even though stamp duty is now fully reinstated. There were close to 107,000 UK residential property transactions in January compared with an average of 98,000 per month in 2019.

Capital Economics suggested the adjustment to remote working was likely boosting transactions. It pointed out that while the share of mortgaged households that moved home rose to its highest since 2007 last year, at 7% it is still a minority, and far fewer than have had their working patterns altered by the pandemic. This suggests activity will remain high.

Mortgage approvals for house purchase were 73,992 in January, according to the Bank of England. This seasonally adjusted figure was the highest since July last year.

Prime London Sales

Annual price growth in prime areas of the capital climbed to multi-year highs in February as central and outer London followed their own paths to recovery as the pandemic winds down.

Average prices rose 4% in the 12 months to February in prime outer London, which was the highest figure since May 2015. It was the eleventh consecutive month of annual growth and underlines the continued appetite for space and greenery even as offices re-open.

Meanwhile, an overdue recovery continues to drive prices higher in prime central London, helped by the tentative return of overseas buyers. Prime central London prices rose 1.9% in the year to February, which was the strongest rate of growth since July 2015

Prime London Sales Report: February

Prime London Lettings

Rental value growth in prime London markets climbed to the highest levels on record in February as the recovery from the depths of the pandemic continued.

Annual growth was 23.3% in prime central London while it reached 19% in prime outer London, underlining the precipitous nature of the drop that bottomed out last April.

It means average rental values are 6.8% above the pre-pandemic level in March 2020 in prime central London. The equivalent figure in prime outer London is 6.2%

Prime London Lettings Report: February

Country Market

The UK housing market is proving resilient with high demand and low supply, however with supply outside London depleted after a record 2021, some sellers remain reticent to list their properties due to a perceived lack of purchase options.

Market valuation appraisals were up 6% in February versus the five-year average outside of London. However, new sales instructions continue to lag and were 9% below the five-year average in February.

New prospective buyers were up 39.5% versus the five-year average in February outside of London and offers accepted were up 42.9% on the same basis, which was the strongest reading since April.

Country Market Update