Rental value growth reaches new highs as pandemic recovery continues

February 2022 PCL lettings index: 175.8

February 2022 POL lettings index: 180.7

2 minutes to read

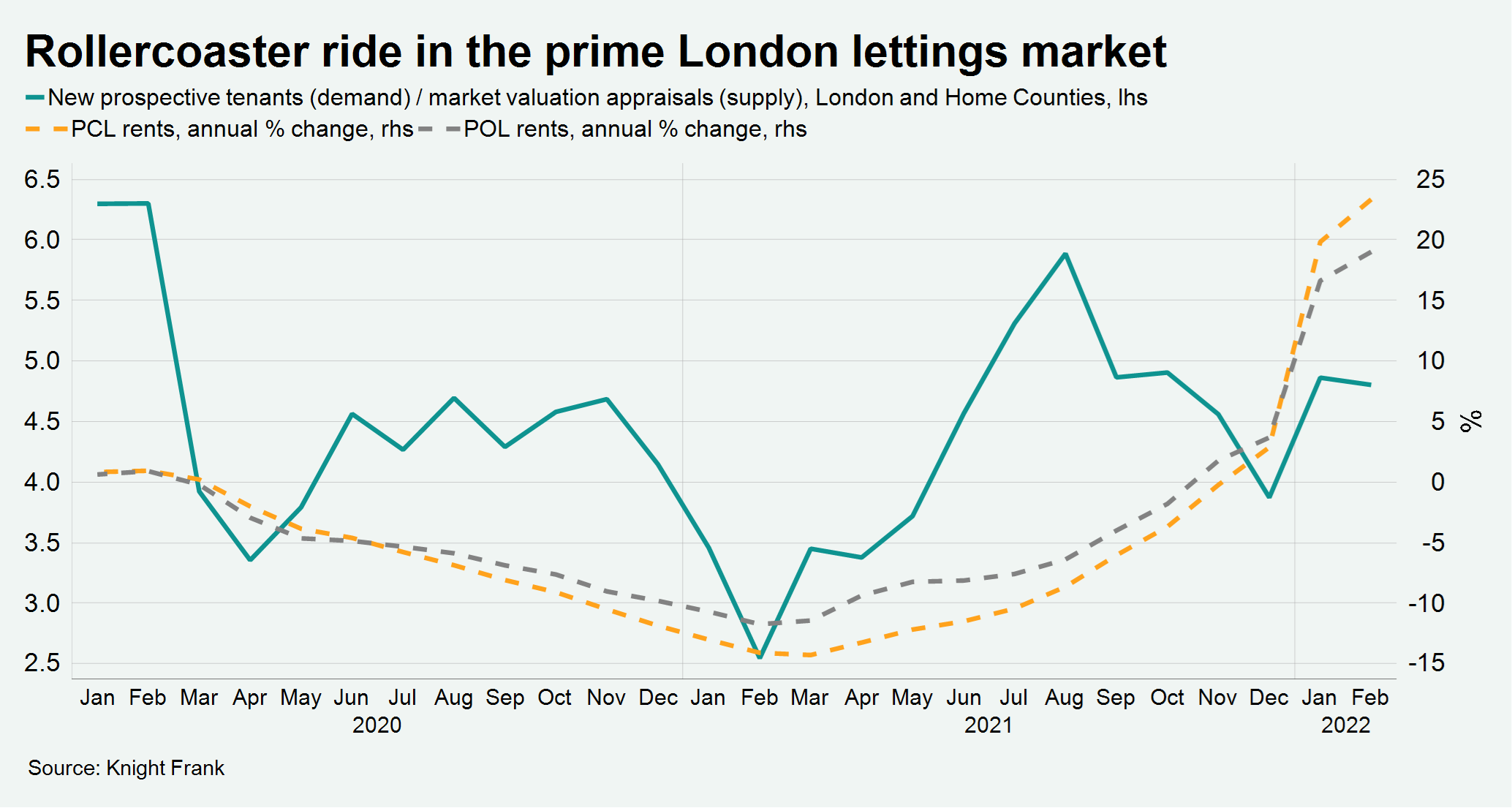

Rental value growth in prime London markets climbed to the highest levels on record in February as the recovery from the depths of the pandemic continued.

Annual growth was 23.3% in prime central London while it reached 19% in prime outer London, underlining the precipitous nature of the drop that bottomed out last April.

As the country locked down early last year, a wave of short-let properties came onto the long-let market while demand remained muted as many offices and universities remained closed in the first quarter of 2021. A number of tenants took advantage of falling rents to move further into central London, a trend we explored at the time.

It means average rental values are 6.8% above the pre-pandemic level in March 2020 in prime central London. The equivalent figure in prime outer London is 6.2%, as the below chart shows.

“The last two years have been a rollercoaster ride in the prime London lettings market,” said Tom Bill, head of UK residential research at Knight Frank. “Demand has been generally strong while supply has ebbed and flowed quite dramatically, although more balance is now returning.”

Quarterly growth was 2% in prime central London in February compared to 13.4% last August, demonstrating how conditions are now calmer.

For now, demand remains exceptionally strong. The number of new prospective tenants registering in February was 49% above the five-year average. Meanwhile, the number of tenancies started was 6% above the five-year average.

“Both of those figures would be even higher if we had more stock,” said Gary Hall, head of lettings at Knight Frank. “There are some localised examples of the balance tipping back in favour of tenants as supply picks up but the general picture is still fairly imbalanced, which should keep upwards pressure on rental values for a while yet.”