Price growth accelerates in prime London markets

February 2022 PCL sales index: 5399.0

February 2022 POL sales index: 269.0

2 minutes to read

Annual price growth in prime areas of the capital climbed to multi-year highs in February as central and outer London followed their own paths to recovery as the pandemic winds down.

Average prices rose 4% in the 12 months to February in prime outer London, which was the highest figure since May 2015. It was the eleventh consecutive month of annual growth and underlines the continued appetite for space and greenery even as offices re-open.

Quarterly growth of 1.7% was the strongest since September 2014 and indicates the current strength of demand versus supply.

Meanwhile, an overdue recovery continues to drive prices higher in prime central London, helped by the tentative return of overseas buyers. However, while air passenger numbers are climbing, international buyers are not yet the force they were before the pandemic for the reasons explored here.

Prime central London prices rose 1.9% in the year to February, which was the strongest rate of growth since July 2015. Prices are recovering after a seven-year period of tax changes and political uncertainty, a process that has been slowed down by the pandemic.

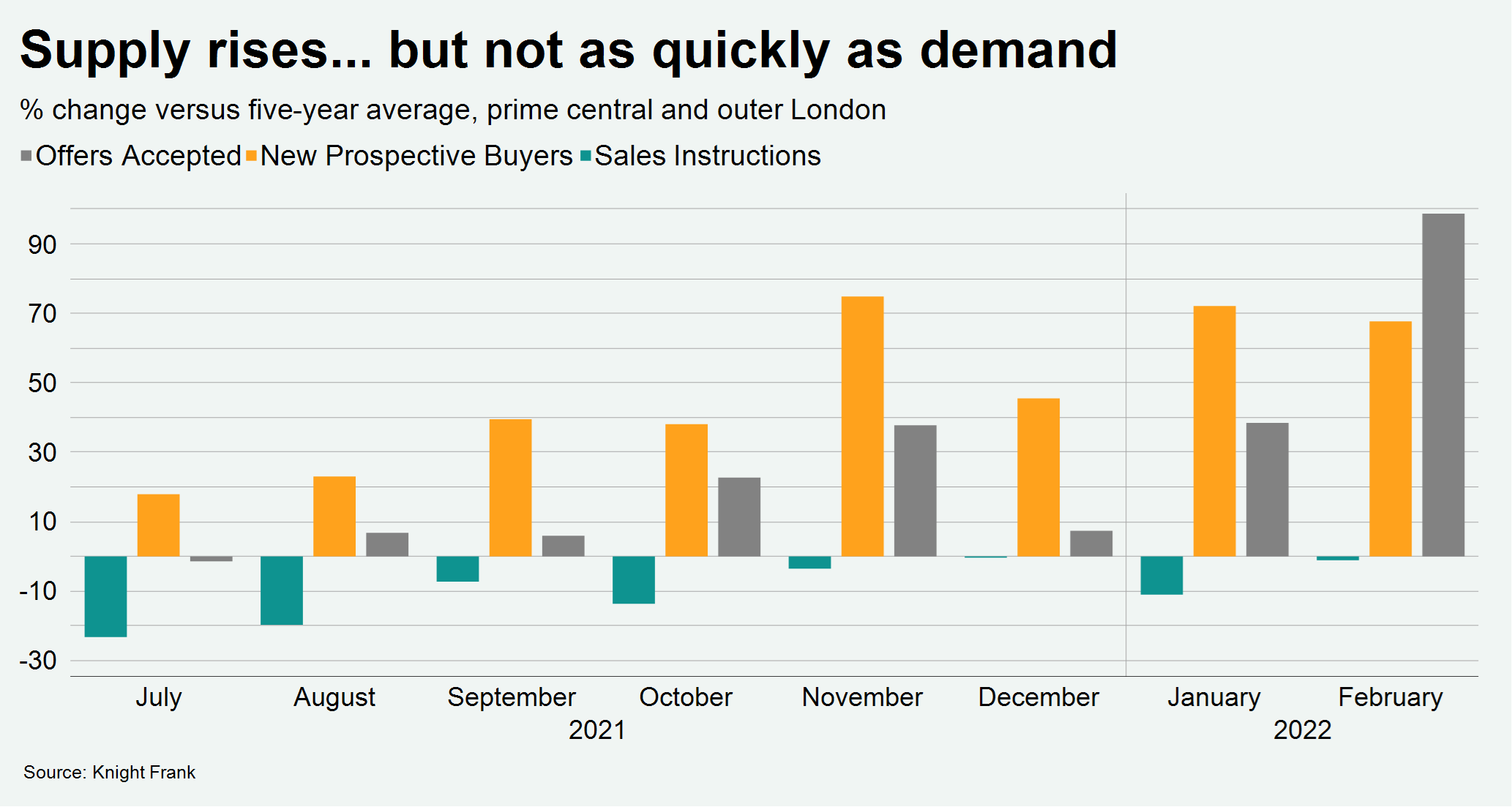

Demand remains unrelenting across the whole of London, as the below chart shows.

The number of new prospective buyers registering in January in London was the highest figure for 20 years. While the figure dipped slightly in February, it was still 68% above the five-year average.

Supply is picking up gradually but struggling to keep pace.

The number of sales instructions was 1.1% below the five-year average in February, as more balance begins to return to the property market ahead of spring.

Meanwhile, the number of offers accepted in February was 99% higher than the five-year average, underlining the strength of the sales pipeline in the capital.

“A shortage of supply and the race for space have led to double-digit growth across the UK,” said Tom Bill, head of UK residential research at Knight Frank. “Prices in prime London markets have lagged the rest of the country due to the huge demand for country living and the erratic return of international buyers, but that gap looks set to close this year.”

The strongest-performing areas of the capital in February included Wandsworth (9%), Wimbledon (8.6%), Richmond (8.3%), Dulwich (6.4%), Islington (5.8%), Bayswater (5.2%).