Oil at $130 a barrel, crossing the green energy threshold & UK lenders pull 500 mortgages in a month

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Commodities

Brent crude climbed 6% yesterday to surpass $130 a barrel following President Biden's immediate ban on Russian oil imports and the UK's pledge to phase out Russian oil by the end of the year. Wheat prices hit a new record and the London Metal Exchange halted trading in nickel after it spiked 250% in two sessions.

The Centre for Economic and Business Research issued an eye-popping scenario suggesting rising commodity prices could knock 4.8% off disposable incomes this year while the UK's key measure of inflation could hit 8.7% in Q2. The Resolution Foundation said inflation would average 7.6% over the course of the year. We should get detailed outlooks from the European Central Bank when it meets tomorrow and the Bank of England's MPC when it convenes next Thursday.

Sentiment remained resilient through February and consumer card spending increased 13.7% during the month compared with the same period in 2020, according to data from Barclaycard.

Green energy

It's still early days to be drawing firm conclusions as to the long term economic impacts of the conflict, though it's likely the West's relationship with fossil fuels has been altered permanently. Europe will likely become more reliant on coal in the short term, together will employing a greater focus on the need to maximise the exploitation of domestic oil and gas reserves in Europe.

The crisis could lead to much more repaid deployment of green energy this decade, Bloomberg finds. Germany last month committed €200 billion to bring forward its goal of 100% renewable energy by more than a decade.

Last week we touched on a report from the House of Lords lamenting the UK's lack of a "credible" plan to meet its net zero targets, particularly when it comes to addressing carbon emissions from the stock of existing homes. That position is unlikely to hold if energy bills continue to rise to this degree, which is likely to focus the minds of policymakers in the months ahead.

Switching to heat pumps or hydrogen is no silver bullet but it's a key part of the picture. Bloomberg's Justin Fox has done the maths in Europe. The International Energy Agency’s new 10-point plan to cut European gas imports from Russia by more than 50 billion cubic meters over the coming year envisions that speeding up the replacement of gas boilers with heat pumps would eliminate two billion cubic meters.

A lot more heavy investment will be need to really move the dial - and who bears the cost will become ever more politically challenging.

Mortgages

Volatility in the UK mortgage market is picking up ahead of another potential hike to the base rate next Thursday. Lenders pulled more than 500 products off the market in the four weeks to March 7th, according to data from Moneyfacts.

This has been coming. Lenders price fixed-rate mortgages based on how cheaply they can borrow in the swap market. Swap rates are typically lower than mortgage rates to provide lenders with a profit. Swap rates have climbed higher than mortgage rates in recent months, so some repricing was inevitable.

"The pace at which deals are withdrawn is leaving borrowers with little time to react. They might discuss a rate with a lender only to call back a day later and find out it's gone," Hina Bhudia of Knight Frank Finance tells the Telegraph.

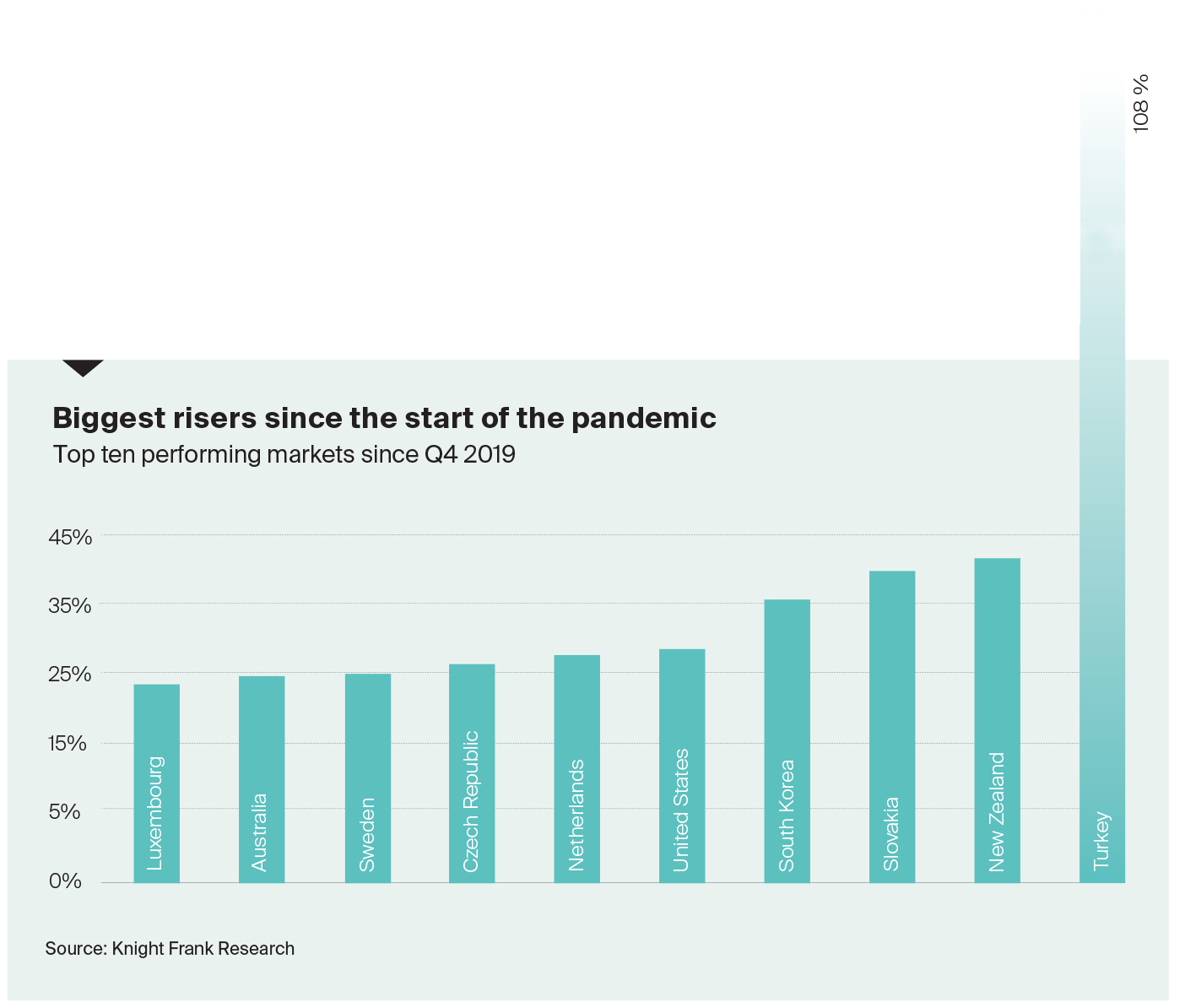

Global house prices

Global house prices increased by 10.3% on average in 2021, according to the latest Knight Frank Global House Price Index, which tracks the movement of average residential prices across 56 countries and territories worldwide. We expect more muted growth in 2022 as risks mount.

The index tracks nominal and real price growth in local currencies. There was a divergence between nominal and real price in the final quarter of 2021 with real price growth moderating from 6.2% in Q3 to 4.7% in Q4. This is the first time we have witnessed a slowing rate of annual growth since the start of the pandemic.

Almost half of the countries and territories tracked by the index registered annual price growth above 10% in nominal terms, including the US and UK. Here, if you were fortunate enough to be on the housing ladder at the start of 2021 the value of your home increased by $64,500 and £26,800 (c.$36,300) respectively.

In other news...

US single family landlords eye wealthy renters with high end homes (Bloomberg), work from home experts are in demand (Bloomberg), AustralianSuper joins British Land for 53-acre London regeneration project (IPE Real Assets), slowing recovery could halt Great Resignation, says Morgan Stanley chief (Times), ECB pursues flexibility as divisions deepen over Ukraine crisis (FT), Rishi Sunak feels the heat as economic effect of Ukraine war hits UK (FT), UK housing secretary threatens industry over tower block safety (FT), and finally, there are no good choices for the west on Ukraine (FT).