Clearest mortgage hike signal in twenty years

Lenders will raise mortgage rates due to climbing borrowing costs, swap markets indicate.

2 minutes to read

The signs that mortgage rates will rise have become unambiguous.

Following a decision by the Bank of England to increase the base rate to 0.5% earlier this month, further increases are likely this year.

However, while lenders haven’t fully priced in this expectation, swap markets have and it’s only a matter of time before mortgages follow suit.

Swaps are financial instruments used by investors to hedge against fluctuating interest rates, enabling them to swap one income stream with a floating interest rate for another with a fixed rate.

Lenders price fixed-rate mortgages based on how cheaply they can borrow in the swap market. Swap rates are typically lower than mortgage rates to provide lenders with a profit.

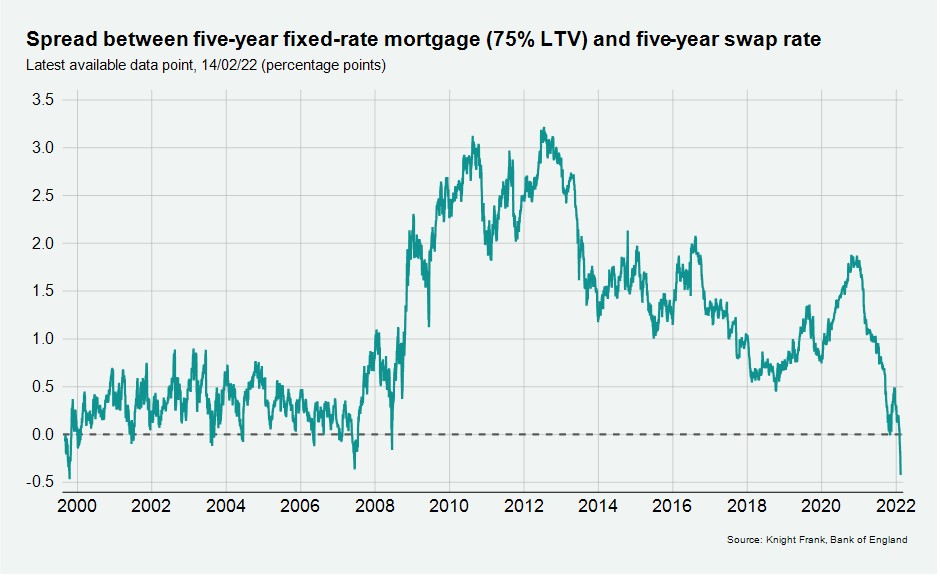

Unusually, swap rates have climbed higher than mortgage rates in recent months, as the below chart shows.

While the five-year swap rate was 2.064% on 15 February, the average five-year fixed-rate mortgage at a loan-to-value of 75% was 1.64% at the end of January, Bank of England data shows.

This negative spread between the two rates is as wide as it has been since October 1999.

"Lenders begin the new year with fresh targets and they want to do as much business as possible during the early weeks of the year. That's likely to explain why swap rates are running so far ahead of mortgage rates at the moment,” said Simon Gammon, managing partner of Knight Frank Finance.

"For borrowers, this is likely to be a temporary reprieve. Mortgage rates will inevitably follow swaps over the coming weeks, so we recommend borrowers lock in a deal as soon as possible. Most offers are valid for six months, so it makes sense to secure a good deal now, then revisit if you need to."

“Financial markets are sending the clearest message in 20 years that mortgage rates are going to rise,” said Tom Bill, Head of UK Residential Research at Knight Frank. “Combined with a cost-of-living squeeze, household finances will increasingly come under pressure this year, which will take the edge off extremely high levels of demand. Gravity-defying price growth will begin to cool, helped by steadily rising supply.”