What happened to global house prices in 2021?

The Global House Price Index tracks the movement of average residential prices across 56 countries and territories worldwide. The index tracks nominal and real price growth in local currencies.

2 minutes to read

Globally, house prices increased by 10.3% on average in 2021. We expect more muted growth in 2022 as risks mount.

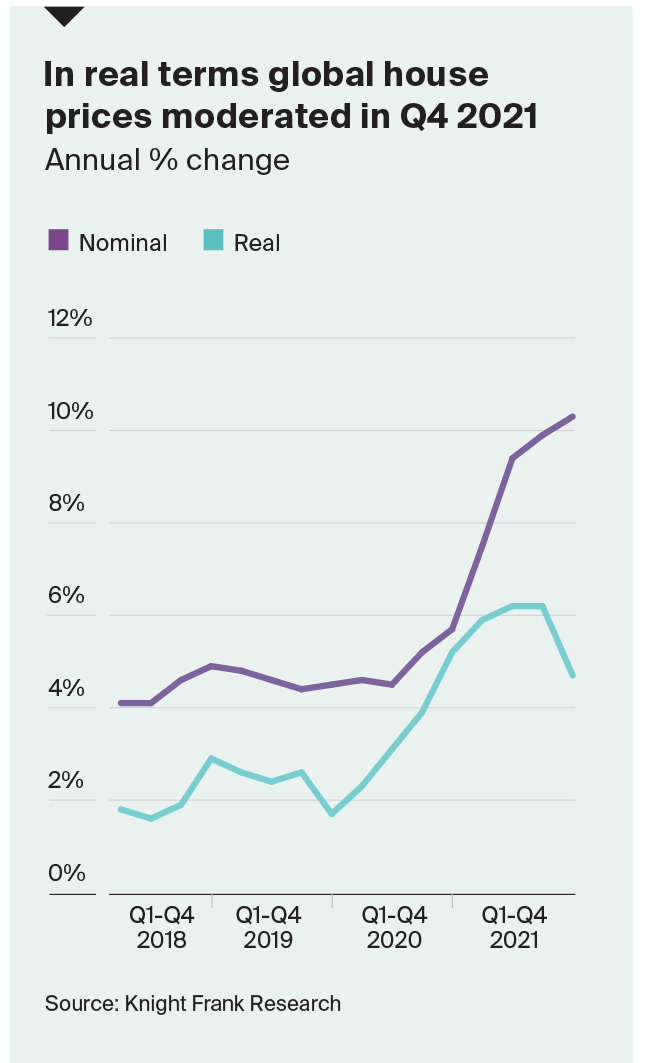

There was a divergence between nominal and real price in the final quarter of 2021 with real price growth moderating from 6.2% in Q3 to 4.7% in Q4. This is the first time we have witnessed a slowing rate of annual growth since the start of the pandemic (Fig 1 below).

Almost half of the countries and territories tracked by the index registered annual price growth above 10% in nominal terms, including the US and UK. Here, if you were fortunate enough to be on the housing ladder at the start of 2021 the value of your home increased by $64,500 and £26,800 (c.$36,300) respectively.

The crisis in Ukraine will lead to weaker global economic growth, tempering our outlook for international house prices. On the other hand, it may also reduce the number and speed of interest rate hikes that some central banks were pricing in only a few weeks ago.

Turkey leads the house price index in nominal terms with prices up 59% in 2021. However, deduct Turkish inflation of 36% at the end of 2021 (54% by the end of February 2022) and Australia edges ahead in real terms with price growth of 17.5%.

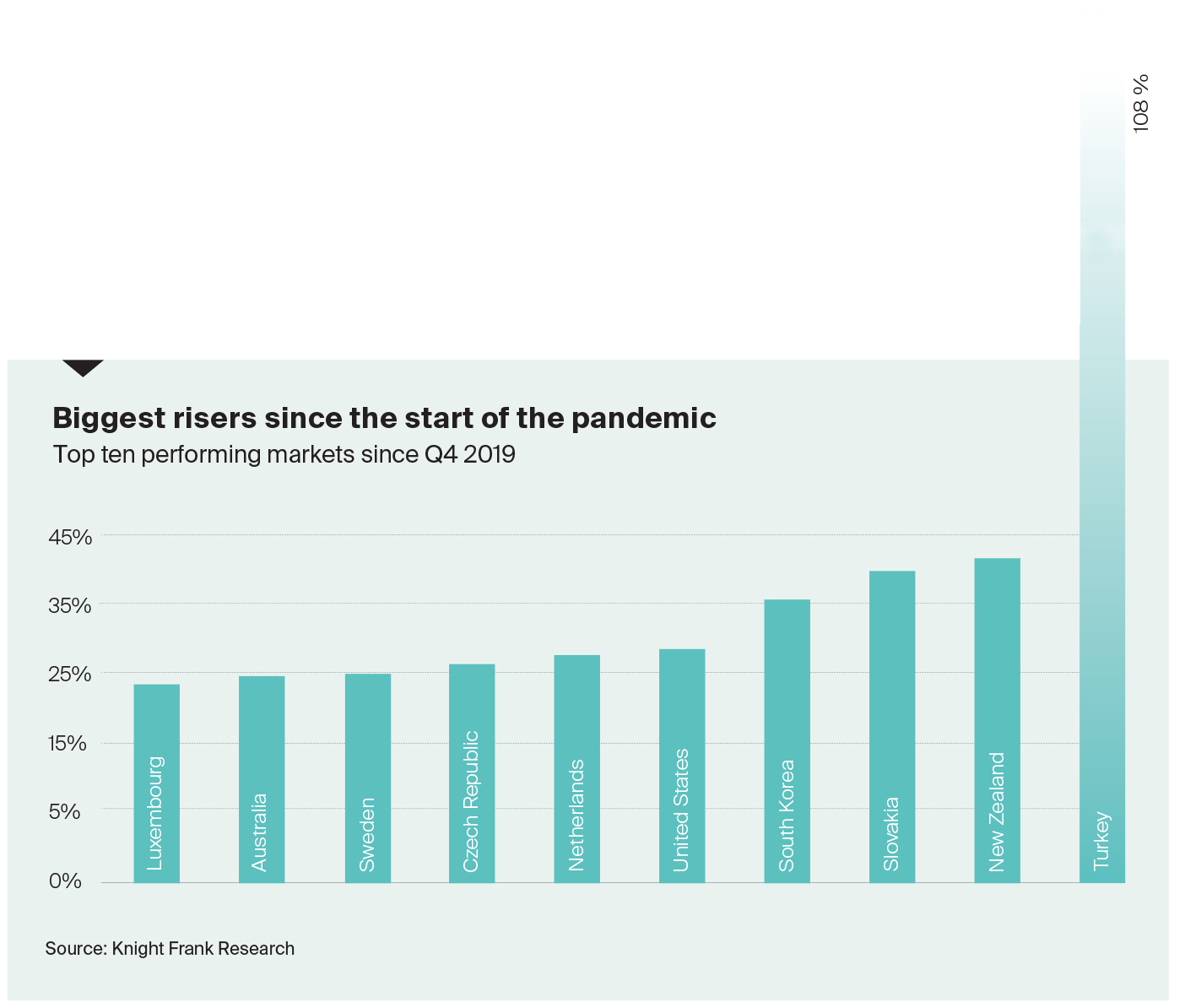

Whether tracking nominal or real prices the top five performers remain the same, their order simply shifts, these include Turkey, New Zealand, Czech Republic, Slovakia and Australia.

Only three markets saw prices decline in 2021 – Malaysia, Malta and Morocco.

The ten markets that have witnessed the strongest increase in house prices since the start of the pandemic are largely developed markets where governments stepped in to support economies, and in some cases, housing markets via mortgage holidays or subsidy programmes (Fig 2 above).