Where are the UK’s next £1,000psf markets?

New data shows how the UK property market continues to level up after the pandemic.

2 minutes to read

The UK property market was experiencing its own levelling-up process long before the government decided to re-name one of its ministerial departments last September.

Property prices in London have been under-performing the rest of the UK for several years due to the affordability squeeze in the capital. As a growing number of people have moved out of London, more blue-chip companies are opening regional offices.

It is a trend we explored here, highlighting how the UK house price map is being re-drawn, an effect turbo-charged by the pandemic-fuelled race for space.

The emergence of more £1 million property markets outside of London is one consequence of higher price growth in the regions, as we analysed here.

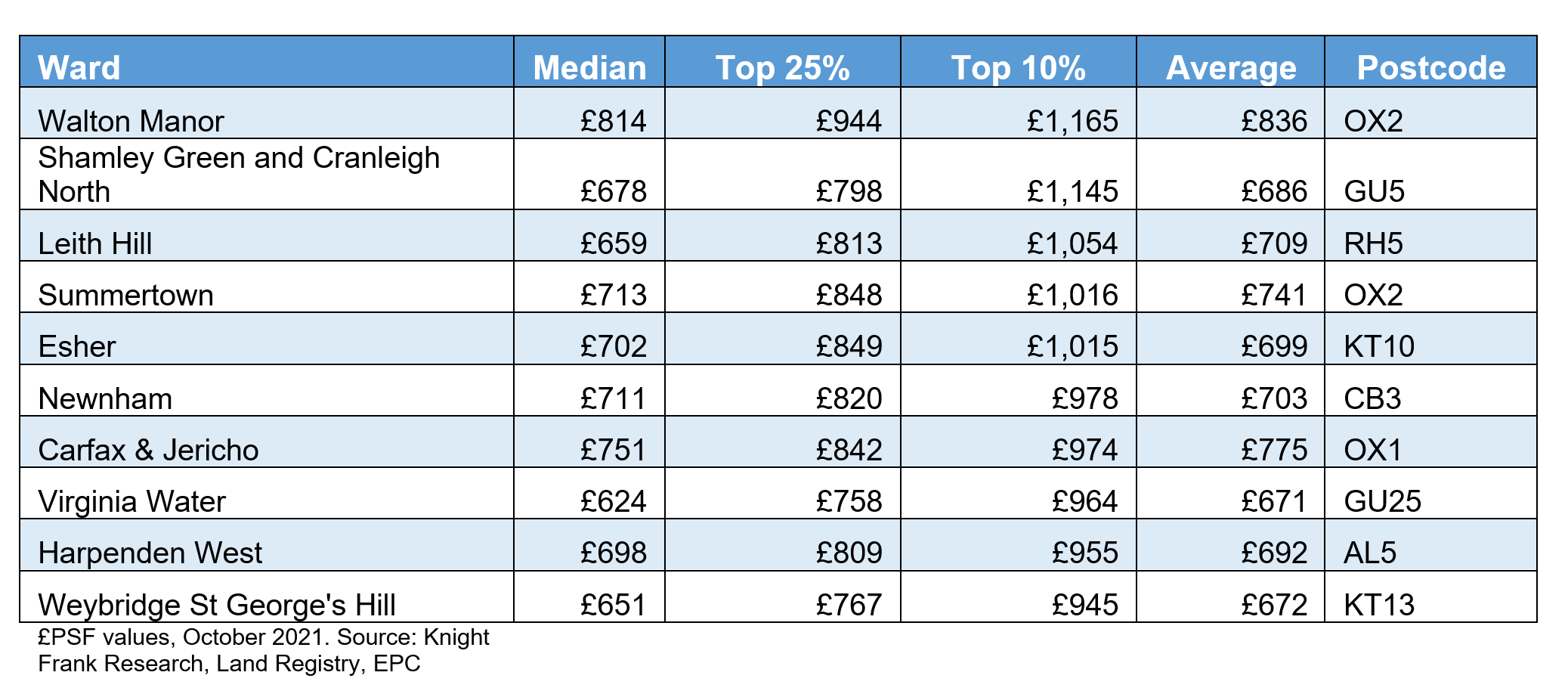

A more accurate yardstick would be the number of £1,000 per square foot property markets, which is also increasing outside the capital.

“Pounds per square foot is a better way of gauging the popularity of a location rather than how large its properties are. Size, as they say, isn’t everything,” said Tom Bill, head of UK residential research at Knight Frank.

Unsurprisingly, all wards in England and Wales with a median price of more than £1,000 per square foot are in London. The wards of Knightsbridge and Belgravia (£2,237) and Brompton and Hans (£2,022) head the list and are the only two areas in the country where the figure exceeds £2,000.

However, outside the capital, there are five wards where the top 10% of sales exceed £1,000 per square foot, suggesting the median in these locations will soon exceed the threshold. They include two parts of OX2 in Oxford and three areas to the south-west of London.

“The market in north Oxford has the classic drivers of great properties, shopping and schools,” said William Kirkland, head of Knight Frank’s Oxford office. “From Summertown you can walk to some very good state and independent schools, which is why people are still choosing to come here from London.”

“Outside of London, it’s no surprise to see Oxford and parts of the south-east near the top of the list,” said Tom. “More areas will join them as property prices across the UK continue to re-balance in coming years, a trend that has been accelerated by the pandemic.”