The rise of branded residences, the flight to quality offices and what constitutes a green building?

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

The flight to quality offices

From London to Hong Kong, a flight to quality, green offices is underway among the world's largest corporate occupiers, widening rental premiums for the best-in-class buildings. Knight Frank's UK Cities Report, out now, reveals the degree to which tightening regulatory standards and new mandatory climate reporting will drive a swelling group of occupiers to a shrinking pool of green buildings.

Firstly, the reporting: more than 1,300 of the largest UK-registered companies and financial institutions must begin disclosing climate-related financial information from April 6th. The UK is the first of the G20 countries to make this commitment and disclosures will further magnify the role of real estate in company carbon footprints. Yet, just 20% of offices occupied by UK listed companies in the UK regional cities currently hold an EPC rating of A or B.

This means that either investment to improve energy efficiency will increase or space moves will be initiated to prevent real estate undermining ESG-focused strategies.

Secondly, the regulations: from April 2023, it will become unlawful to continue letting space with an EPC rating of ‘F’ or ‘G’, even in the middle of lease term. The UK government is considering enforcement of EPC ‘C’ by 2027, with evidence of owner action potentially required as early as 2025. Yet just one in five offices currently available across UK cities would meet the required standard if the ruling were to be applied today, meaning huge numbers of buildings will require refurbishment and/or repurposing.

Together, these factors mean the flight to quality will be the defining theme of leasing activity across UK Cities in 2022. For more, see the full report.

What is a green building?

Of course, EPC's aren't perfect. They measure a building's potential energy efficiency, not real-world energy consumption. A building's actual carbon footprint will to a large extent depend on how an occupier uses it.

That could mean buildings with the highest EPCs consume more energy than lower rated buildings, and in fact, that's exactly what it means. Data handed to Bloomberg by the Better Buildings Partnership, a group of real estate investors and landlords that include some of the biggest names in the industry, reveals that some buildings rated EPC A use more energy than some of their peers rated C, D, E or even F.

The data, which is self-reported from more than 1,100 commercial properties owned by members of the Better Buildings Partnership, also finds that the median energy intensity for all B-rated buildings is higher than for C-rated buildings.

“Energy efficiency isn’t as simple as you think,” David Coley, professor of low carbon design at the University of Bath tells Bloomberg. Quite.

Innovation ecosystems

React News reveals that Goldman Sachs has doubled its Birmingham office requirement to 100,000 sq ft. The new space will be its technology and engineering hub, according to the report.

Birmingham's reputation as an innovation hub is growing. There are already 122 financial technology companies in the wider region with a workforce of more than 7,000 people, according to the West Midlands Growth Company. Europe’s largest asset management fintech innovation hub, The Engine Room, is based in Birmingham. See our focus on the region here.

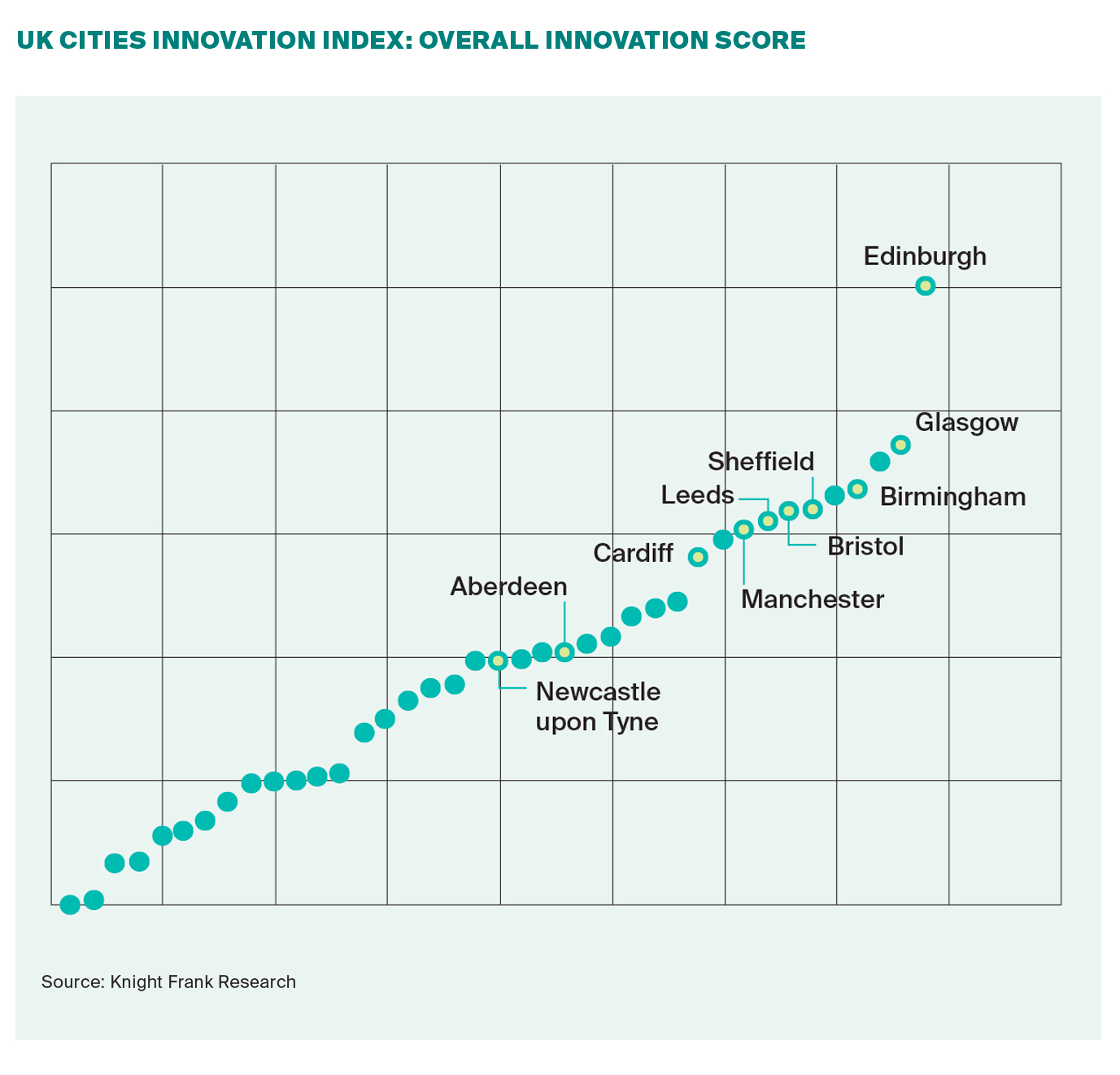

The UK Cities Report unpacks what it takes to build an innovation ecosystem. Education is the backbone, but retention is the goal. On that front, Birmingham scores highly. Some 46% of students in the city say they will stay there post graduation, putting it second only to Edinburgh, according to Knight Frank data.

Birmingham also scores highly on our UK Cities Innovation Index (see below), which combines 32 variables and more than 1,200 data points across 39 major regional UK cities. See this piece for more on that.

London

Britain is more attractive to global financial services businesses as a place to expand than at any time since the Brexit referendum - see write up in the Times here.

We've talked at various points about London's largely undimmed status as Europe's key financial hub - see the squabbling over clearing last week or the various surveys showing less than 10,000 jobs have left the capital since the 2016 vote, compared to the pre-vote forecasts of 100,000.

Earlier this month the FT compared the leakage to a slow puncture, but the data isn't so clear cut. EY's survey of 40 key decision makers found 87% expect to invest in the UK next year, compared to about half in early 2021 and 11% back in 2019. Meanwhile some 90% said the UK offers the right conditions to invest in assets with ESG attributes.

Branded residences

The first true branded residence, the Sherry-Netherland hotel in Manhattan, opened its doors in 1927. Almost a century later, there are more than 400 branded residences across the globe, according to Knight Frank's new Branded Residences report.

Growth has been underpinned by demand for the product. More than one in three prime international buyers (39%) would be willing to pay a premium for a branded residence, according to our survey of more than 900 Knight Frank clients globally. That figure rises to 45% and 43% in Australasia and Asia respectively.

Drivers of demand vary from scheme to scheme. Whilst a brand association and its benefits may result in a premium in any region, the additional value varies substantially. Defining factors and special features, such as historical legacy or park views, can also influence the price that buyers are willing to pay.

Indeed, our research shows that there is great variation on price differentials between global cities, and even within cities. Price premiums can vary from as much as 132% in some cities in Asia, to there being no differential at all. Typically, the premiums are between 25% and 35% comparable to non-branded products - see the full report, linked above, for more.

In other news...

City of London planners put wooden skyscrapers on the horizon (Telegraph), IMF trims UK growth forecast (Reuters), manufacturers plan biggest prices rises since 1977 (Reuters), the winding road to global recovery is through a thicket of risks (FT), and finally, Singapore's surprise rate hike (Bloomberg).

Photo by Elifin Realty on Unsplash