Green building value: do green-rated buildings add a premium to sales price?

The importance of ESG in real estate has been widely publicised. But the precise influence of green credentials on a building’s sales price is less well understood.

7 minutes to read

Our research shows that in both hemispheres of the world, green building ratings are already having a positive impact on building values, and we have quantified it.

We combined proprietary Knight Frank data with green ratings and other geographical evidence for prime office buildings in London, Sydney and Melbourne.

"We found an 8-18% sales price premium for green-rated buildings compared to equivalent buildings without a BREEAM or NABERS rating across these markets, depending on the level of green rating."

This supports our Sustainability Series research which finds a 3%-13% rental premium, depending on rating for prime Central London office buildings compared to equivalent unrated buildings.

Methodology

We estimated the green premia for office buildings using hedonic price modelling, a popular methodology used in the residential sector to estimate house prices, and in academic eco-certification research.

This method of analysis enables the price of an asset to be represented as the sum of its attributes, including features of the building, as well as where it is and what surrounds it.

Using in-house expertise and academic literature to identify possible factors that contribute to sales price, we then used statistical tests to help us build the most representative models for London, Sydney and Melbourne.

Including a large number of explanatory variables in the models helps to ensure that the estimated impact of the green rating is robust and accurate. However, to do this, a significant amount of transactional evidence is needed.

This is why Knight Frank, as far as we are aware, is the first commercial firm to apply this type of methodology to investment transactions, due to the strength of our proprietary data, which helped us carry out the analysis.

While there are some location-specific differences, there are common contributors to price, which suggests these factors might also be expected to apply to building sales prices in other locations around the world.

The added benefit of this type of modelling is that while we have been able to use the results to identify the contribution of green ratings to sales price, we have also been able to identify the degree to which locational, lease term and building related factors contribute to a building’s sale price.

As a consequence, we can be confident that the premia identified relate directly to buildings’ green certifications, as influences from other factors are also captured and quantified.

What is BREEAM?

The first building assessment was undertaken by Watford-based Building Research Establishment in 1990, which has since morphed into BREEAM, one of the most recognised international sustainability assessment methods for master-planning projects, infrastructure, and buildings.

It recognises and reflects the value in higher performing assets across the built environment lifecycle, from new construction to in-use and refurbishments.

What is NABERS?

The National Australian Built Environment Rating Scheme (NABERS) measures the energy efficiency of a building by comparing its energy consumption to averages across the sector.

The view from London

Prime Central London office buildings with a BREEAM Excellent rating enjoy a 10.5% premium on sales price compared to equivalent unrated buildings, while those with a BREEAM Very Good rating enjoy a 10.1% premium.

London is an ideal petri dish for this type of research, having large and active investor and occupier markets. The UK’s capital also has one of the biggest pools of green buildings, with the longest history of green ratings of any city globally.

We collaborated with BRE, who provided us with BREEAM green rating information which we combined with Knight Frank’s proprietary building data to develop our hedonic price model.

This led us to a sample of almost 1,500 green-rated and unrated building sales across 17 Central London submarkets between Q1 2010 and Q1 2021. In addition to green ratings, the model also reflects building attributes such as size, height, age, whether the building was leasehold or freehold, its grade, and its lease term.

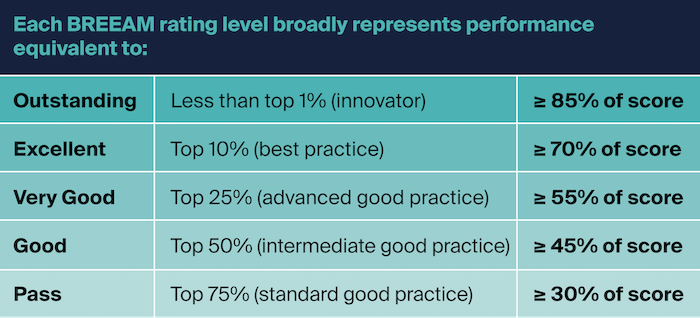

Location and distance to railway stations were also included, as well as year of sale, to capture cyclical and other time-specific impacts on sales price. BREEAM ratings range from Pass to Outstanding.

Due to a lack of transactional evidence, we excluded buildings with Pass, Good and Outstanding ratings, and compared unrated buildings with BREEAM Very Good and BREEAM Excellent to determine our results.

"Our findings show that green ratings on prime offices on average are having a significant impact on sales prices."

The view from Sydney & Melbourne

Prime office buildings in Melbourne and Sydney with a NABERS rating of 5+ enjoy a 17.9% premium on sales price compared to equivalent unrated buildings, while even those with a lower NABERS rating enjoy an 8.3% premium.

NABERS is the dominant green rating used across Australia and we undertook the hedonic price analysis by combining this rating information with Knight Frank proprietary data. This led us to a sample of almost 330 green-rated and unrated asset sales across Sydney and Melbourne between Q1 2010 and Q1 2021.

In addition to green ratings, the model also reflected building attributes such as size, height, age, building grade, and lease term. Locational factors such as market – and in the case of Sydney, submarket – were captured, as well as distance from the waterfront.

Year of sale was also included to capture cyclical and other time-specific impacts on sales price. NABERS ratings range from 1 to 6 and we split the model into buildings without a NABERS rating; those with a rating of less than 5; and those with a rating of more than 5.

What these results mean for investors around the world

Ultimately, our findings show that green ratings on prime offices on average are having a significant impact on sales prices (and even rents in London, as shown by our Sustainability Series), with higher ratings typically resulting in higher monetary benefits.

These results are important for two key reasons. Firstly, they indicate that the highest sales prices are achieved by those investors who aim for the best level of green credentials, rather than satisficing to meet a minimum threshold.

Secondly, the results for sales prices are found at opposite ends of the globe and in different sized markets – suggesting a strong, global pattern between sustainability and value.

The sales price premia from green ratings appear to be driven by both rental and yield effects, both of which influence price.

The drivers behind the income effect on price

On the rental side, our research finds that the most ESG-driven occupiers are willing to pay a rental premium for a building that matches their ethos.

While overall occupier demand for green buildings is still somewhat nascent, occupier interest is expected to expand further due to the built environment’s contribution to global carbon emissions.

For example, our latest (Y)OUR SPACE survey found that only 8% of almost 400 global occupiers currently believe that real estate supports their ESG strategy while 40% have a stated net carbon emissions target. The type of buildings that occupiers choose to locate is a vital factor in achieving these targets.

Green-rated buildings should also increasingly support income, through increased occupier demand and reduced vacancy rates.

"As more and more investors use ESG criteria as a screening tool, demand and therefore liquidity of buildings with green ratings is likely to increase."

The drivers behind yield effect on price

Green-rated buildings may reduce risk premiums due to improved liquidity and lower legislation and obsolescence risks, supporting downwards pressure on yields. As more and more investors use ESG criteria as a screening tool, demand and therefore liquidity of buildings with green ratings is likely to increase.

Green-rated buildings also enjoy a greater degree of futureproofing against potential legislative changes, as governments embed carbon targets into law. This reduces the risk of assets becoming ‘stranded’ due to obsolescence.

Finally, with the increase in benchmarking requirements of financial and non-financial institutions, against different climate change outcomes for example, bank and non-bank lenders are increasingly incentivised to weight their lending towards both green assets and firms that wish to pursue sustainable goals.

All these effects serve to lower the risk premium of such assets, which also reduces the cap rate, or yield.

Against this backdrop, many real estate investors are positioning to rotate towards green buildings, or redevelop existing buildings into green assets in their search for outperformance.

Download Active Capital 2021

_____

Sources:

Chegut, Eichholz & Kok (2013), Supply, Demand and the Value of Green Buildings, Urban

Studies (51,1)

Das & Wiley (2013) Determinants of premia for energy-efficient design in the office market,

Journal of Property Research (31,1)

Eichholtz, Kok & Quigley (2010), Doing Well by Doing Good? Green Office Buildings, American

Economic Review (100)

Fuerst & McAllister (2011) Eco-labeling in commercial office markets: Do LEED and Energy Star

offices obtain multiple premiums, Ecological Economics (70)

Newell, MacFarlane & Walker (2014) Assessing energy rating premiums in the performance of

green office buildings in Australia, Journal of Property Investment & Finance (32,4)

Ott & Hahn (2017) Green pay off in commercial real estate in Germany: assessing the role of

Super Trophy status, Journal of Property Investment & Finance (36,1)