Forecasting global cross-border capital flows

Our Capital Gravity model forms one of the cornerstones of our Active Capital research. Now in its sixth year, we have used the latest machine learning techniques and unique datasets to predict where real estate capital will flow in 2022 and beyond.

8 minutes to read

In this article, we cover:

- 2022 predictions at a glance: where will capital flow?

- Our interactive Capital Gravity map

- Predictions split by real estate sectors and investor types

- An exploration of the other factors that could influence capital flow

2022 predictions at a glance

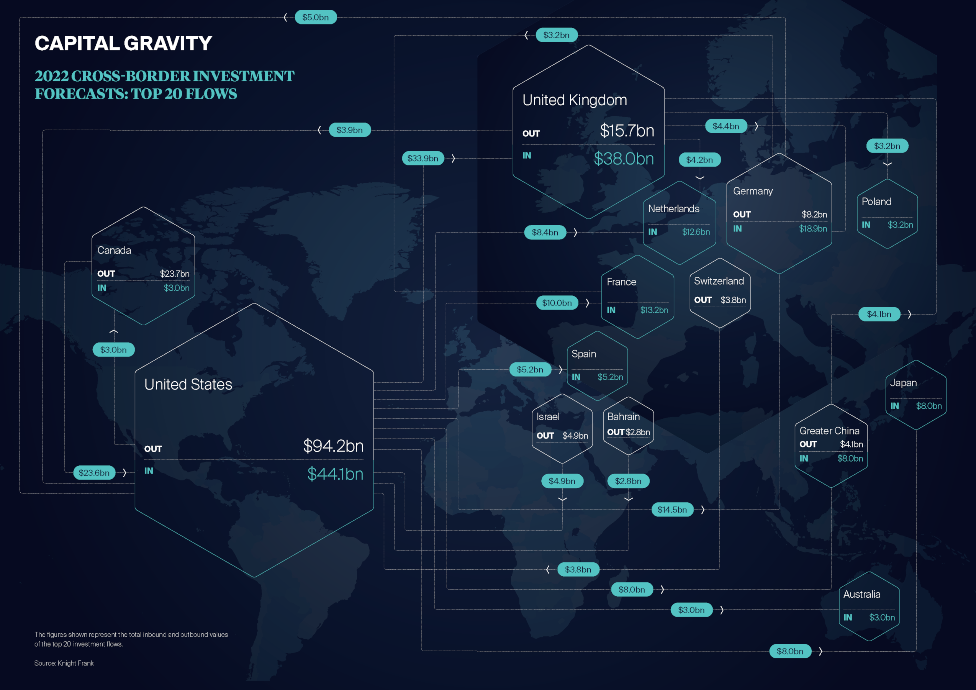

We predict that 2022 will be a record year for capital flows, with the US, the UK, Germany, France, and the Netherlands, are forecast to be the most popular destinations for that capital. We expect a resurgence of interest in the office sector, as well as continued growth in residential and industrial investment.

"We predict that 2022 will be a record year for capital flows."

The US, Canada, the UK, and Germany are forecast to be the largest sources of cross-border capital, dominated by investment managers, institutions, and private equity investors.

Click to enlarge image

Above: The figures shown represent the total inbound and outbound values of the top 20 investment flows.

Source: Knight Frank

Where will capital flow in 2022?

As the world moves into the next phase of living with Covid-19, we could see a period of elevated volumes. Indeed, we forecast that 2022 will be a record year for global cross-border real estate investment.

The largest increases in activity are likely to be seen in EMEA and APAC, with EMEA predicted to be the top region of interest next year. While overall investment into the Americas is expected to moderate, the US is forecast to remain the number one destination for inbound capital over the coming year, as well as the largest global deployer of capital.

"Our forecasts show that UK offices are expected to be a top destination for US capital."

Our forecasts show that UK offices are expected to be a top destination for US capital, driven particularly by private equity as they invest into new markets and ride the recovery. In addition to UK offices, US private equity money is forecast to target the core European markets of Germany, France, and Spain, as well as further afield in Greater China, Japan, and India.

Overall, the office sector globally is expected to account for just over half of all cross-border investment volumes, indicating that interest in this sector remains very much alive, even as we continue to see a rotation of assets by investors, particularly private equity, into the industrial, residential, life sciences and data centres sectors.

"Overall, the office sector globally is expected to account for just over half of all cross-border investment volumes."

Investment managers and institutional investors are expected to lead the demand for office assets, while HNWIs will demonstrate strong interest too, particularly into the UK and US office markets.

On the other hand, while listed/REITs and private equity investors are likely to increase their investment into offices, the two investor types are forecast to account for less than 40% of total cross-border investment volumes into the sector.

This is likely because REITs are becoming more specialised, and private equity investors are investing into sectors which capture structural changes, such as industrial, residential, data centres, and life sciences.

"Private equity, investment managers, and institutions are also expected to have a focus on the industrial sector in EMEA."

Private equity, investment managers, and institutions are also expected to have a focus on the industrial sector in EMEA, which should lead to a bumper year for inbound investment, particularly into the UK, Germany, France, and the Netherlands.

The past year has illustrated the relative resilience of real estate as an asset class, albeit with a bifurcation in performance between those well-located, sustainable, core assets and the rest.

Our Capital Gravity model suggests that while the next few years will see a boost in investment volumes, 2022 is likely to see a sharp rise in activity, providing investors the opportunity to rebalance portfolios, execute business plans and further their strategic goals.

For the first time, we have been able to extend our forecasts beyond geographical destinations and into investor and sector types. The following points highlight some of the trends we predict for 2022 and beyond.

Above: The office investment market is alive.

Sectors

Offices

The office investment market is alive. 2022 is expected to be a bumper year for activity, with the highest demand from income-focused investment managers and institutions targeting the US, the UK, Germany, France, and the Netherlands.

Logistics

Investment managers and private equity funds, particularly from the US and Canada, are forecast to remain major players in the logistics market in 2022, particularly targeting the US, the UK, Germany, France, the Netherlands and Greater China, as well as Spain, Poland, and Australia.

Retail

2022 could see interest from investment managers and listed/ REITs investing into destinations across the globe, notably the US, Germany, and the UK. France, the Netherlands, Italy, Poland, Spain, and Japan could also see inbound investor interest.

Residential

The broader residential sector is an increasing area of interest, right across the investor spectrum. Sources of capital are likely to be broad based, targeting a geographically diverse area, including the US, Germany, the UK, the Netherlands, and Japan.

Above: Rothenburg ob der Tauber, Germany

Hotels

Hotels are likely to see a record year in 2022, with particular interest from private equity investors, who could contribute to almost half of volumes next year, targeting the UK and the US.

Student housing

Interest from investment managers is expected to grow over the next few years, while private equity is likely to make up more than half of investment demand in 2022.

Investor types

Private equity

Our forecasts show that private equity investment will continue to be dominated by US players in 2022, targeting a wide range of sectors in the UK, as well as the office sector across a diverse set of destinations, from India to Germany.

Investment managers

We predict that investment managers will increase their investment into EMEA, while overall global cross-border investment from this group could lift by 50% in 2022 from 2021.

Over half of capital from investment managers is forecast to be from the US and Canada in 2022 (with other top players including the UK, Germany, and Switzerland) targeting the office and residential sectors.

Institutions

Our model suggests that for institutions, the office, residential and industrial sectors will be the top three sectors of interest in 2022, with a globally spread range of sources and destinations of capital across the Americas, EMEA, and APAC.

Above: Rodeo Drive, Los Angeles, USA

Listed/REITs

Listed real estate companies and REITs will have some of the most diverse appetites in 2022, with investors from Canada, the US, Singapore, Greater China, the UK, and Australia targeting sectors across office, retail, industrial, residential and hotels.

HNWI

Half of HNWI (high-net-worth individuals) capital is predicted to come from EMEA in 2022, notably including Spain and Israel. The US is also forecast to be a top source of HNWI investment, targeting largely office and retail assets.

Other investor types

Banks, sovereign wealth funds, and corporates based in Greater China, the UK, Canada, and France, will be important sources of capital, focusing in particular on the office and retail sectors.

Last year, our Capital Gravity model predicted that in 2021, the US would be the top destination for global cross-border real estate capital, followed by the UK, Germany, Australia, and France. Now, as we watch the US and the UK vie for the top spot at the time of writing, followed by Germany, Australia, and France, we can see that our forecasts passed the predictive test.

What other factors could influence capital flows in 2022?

Asset rotation

Assuming a five-year hold, transaction activity in 2017 helps indicate the level of asset rotation we might see in 2022. Global volumes in 2017 were circa 11% above the long-term average.

Given that some assets purchased in 2016 and earlier and are also likely to have been held back from sale through the pandemic, asset rotation could be a significant contributor to assets coming to the market in 2022.

Currency and hedging

Currency hedging benefits for US investors into the UK and Europe remain muted compared to levels seen pre-pandemic, while both the Euro and Sterling have seen moderate strengthening against currencies such as the USD and KOR over the course of the past year or so.

Currently, there are few indications of significant appreciation, but if this were to change, assets across Europe could become relatively more expensive compared to those in the US and Asia-Pacific.

Views on inflation

Debate over the trajectory of global inflation is leading to some degree of oscillation of government bond yields. However, they remain below pre-pandemic levels and are unlikely to put outwards pressure on property yields in the medium term.

"The consensus is that inflation should be transitory, albeit there are questions around the risk of cost-push inflation."

The consensus is that inflation should be transitory, albeit there are questions around the risk of cost-push inflation. Real estate is seen by some investors as an inflation hedge which means an inflationary environment could boost demand.

Recovery from the pandemic

The next phase of the Covid-19 pandemic involves learning to live with it, supported by the ongoing global vaccination programme.

There remains the risk of a ‘vaccine busting’ variant which could introduce new headwinds to recovery, however, at the time of writing, markets are cautiously optimistic and forecasting a post-pandemic bounce in activity in 2022.

Above: The World Inside, Singapore

ESG

Sustainability is an increasingly global focus for real estate investors, and we expect this to spur capital flows towards green-rated buildings and buildings which have the potential to be made ‘green’ over the coming year.

As embodied or lifecycle carbon emissions gain importance for investors, 2022 could also see more interest in asset repurposing and refurbishment opportunities.

Download the Active Capital 2021 Report