UK healthcare market shows resilience as sector recovers from the pandemic

“Whilst the stronger than expected margins in 2021 showcase the sector’s resilience, they also highlight the combined efforts of operators, their teams, and the UK government in supporting the sector.”

4 minutes to read

In the latest edition of our 2021/22 Healthcare Market Overview, we take a look at market trends over the past year and present a forward view. 2021 presented a number of standout factors that we believe will continue to trend over the coming year.

Covid-19

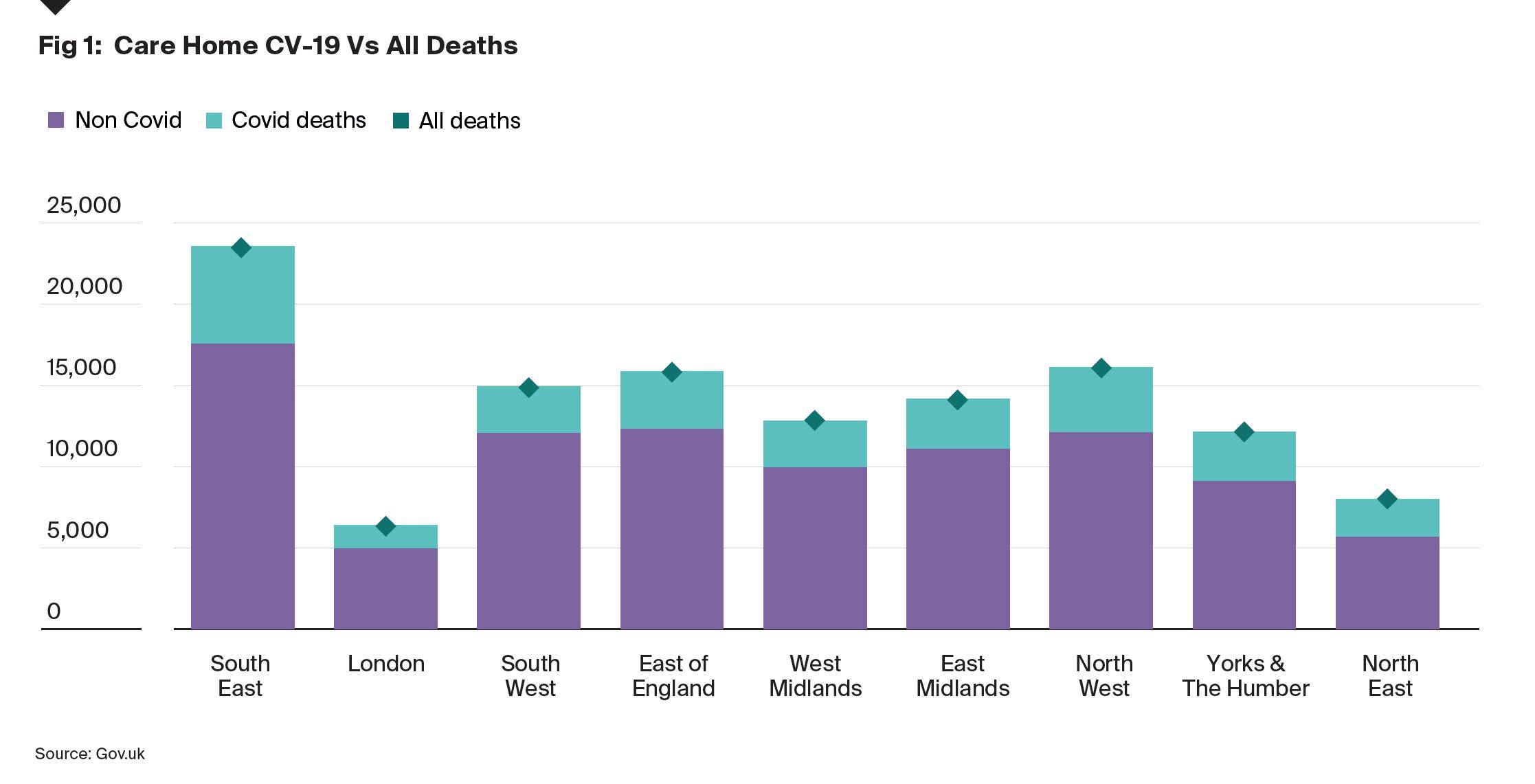

The outbreak of Covid-19 and the UK healthcare sector’s response to such unprecedented circumstances have highlighted the sector’s continued resilience and robustness. As per Figure 1, we can see the consistency in the management of care home deaths that occurred because of Covid-19 cases. This suggests that whilst occupancy was impacted by the virus, the significant fall is likely to result from the restrictions to admissions imposed during lockdown periods.

Considering the pandemic’s impact on occupancy, all care EBITDARM as a percentage of income fell by less than initially expected in 2021. The average of 26.2% still suggests strong trading given the circumstances faced by homes. Operators will now have greater insight into their abilities to withstand future headwinds and be better prepared for any future shocks.

Whilst the stronger than expected margins in 2021 showcase the sector’s resilience, they also highlight the combined efforts of operators, their teams, and the UK government in supporting the sector. However, the timing of reduced government intervention will be an important factor during the sector’s return to normal levels.

Covid-19 may indeed act to accelerate the closure of outdated homes and replace them with high-quality, future-proofed assets. This further validates the argument for en-suite rooms with the viewpoint that these benefits extend to improvements in home virus control. No doubt, the pandemic will have prompted a change in the way care homes are not only run but also configured moving forward, with particular emphasis placed on internal circulation, air quality and ventilation. Emphasis will also be on transitional space to support social distancing.

Occupancy

Average occupancies across the sector will certainly be a matter of interest. Whilst 2021 saw a substantial dip in care home occupancies following the outbreak of Covid-19, operators began to report recovering levels in the mid to latter part of the year. While this recovery is slow, many operators are experiencing pre-pandemic occupancy levels once more.

Bed supply

Bed supply remains a topic of concern. Despite new beds being developed, the rate at which they are built, and the level of home closures means that supply is not keeping pace with demand. This, in line with the UK’s ageing demographic, means that the elderly care market is now at risk of reaching capacity by the end of the decade.

"Bed supply remains a topic of concern. Despite new beds being developed, the rate at which they are built, and the level of home closures means that supply is not keeping pace with demand."

_Julian Evans, FRICS, Partner, Head of Healthcare,

Much of the market also needs an upgrade due to being made up of older converted stock that lacks essential en-suite facilities that are becoming increasingly unfit for purpose.

Build costs

A combination of the global pandemic’s effect on factory supply, ports and rising shipping costs has seen the cost of raw materials such as aggregates, timber, and steel with increased labour costs slow new build delivery over the past year.

Although this is a clear issue alongside the increasing cost of finance, the appetite for UK healthcare is strong due to its underlying demand drivers. Therefore, we can expect new care home development to remain active in 2022 whilst sale & leaseback / forward funding, challenger banks and conventional banks re-entering the market aid the unlocking of funding.

Staff costs

The 2021 Knight Frank Trading Performance survey has highlighted growth in nurse and carer wages. Average nurse wages per hour sat at £17.38, up 2.9% from last year, whilst average career wages per hour were up 5.4% at £9.23.

Despite both growing at a higher rate than the National Living Wage per hour, which currently sits at £8.91, government announcements regarding the new National Living Wage of £9.50 from April 2022 is likely to impose further upward pressure on these averages, especially in the hourly rate of carers. With labour shortages and Brexit also contributing factors, this cost inflation may filter through into weekly fees.

ESG

The 2021 Knight Frank Active Capital report highlighted the importance of sustainability as a fundamental of modern-day real estate strategies. The report suggests an 8-18% sales price premium for green-rated buildings. Global investor and occupier demand for sustainable buildings continues to rise, as does the proposition of sustainable/green finance from lenders, whilst the case for placing institutional money into ESG strategies grows.

This, in tandem, opens the discussion of the importance of ESG within the market for care related assets. Unlocking sustainable development of new homes will become more important whilst the social aspect of ESG will direct attention to how operators and investors align their investment and operational activity with the UN Sustainable Development Goals.