Why the global ski industry is looking to the east

Globally, skier numbers are largely static, but Asia may hold the key to future demand.

2 minutes to read

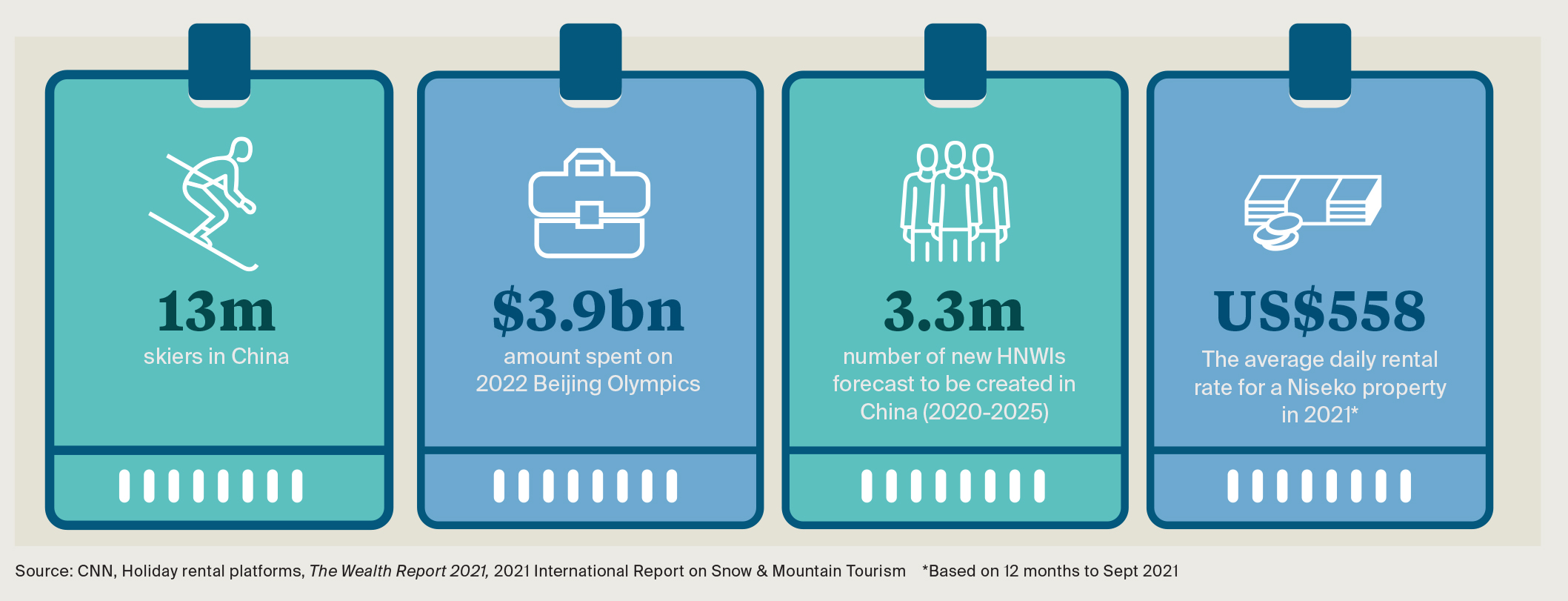

President Xi Jinping’s decision to bid for the 2022 Winter Olympics could prove a boon for the ski industry globally.

Following South Korea’s games in Pyeongchang in 2018, Beijing is set to host over 3,000 athletes in February 2022 reaching a potential global audience of up to 2 billion.

Despite the Chinese mainland being home to around 13 million skiers, it equates to just 1% of the population according to the 2021 International Report on Snow & Mountain Tourism, suggesting there is room for growth. President Jinping’s goal is to use the Beijing Olympics to convert 300 million Chinese residents to winter sports. The industry already generates around RMB 3 trillion per annum (US$465 billion) but to date most wealthy Chinese mainlanders head to Japan for their skiing fix.

The Chinese mainland's resorts are largely dominated by red or blue runs but that is set to change. From Xinjiang province to Heilongjiang significant funds are being ploughed into the infrastructure of China’s 700+ ski resorts according to the China Ski Industry White Book.

Europe-bound?

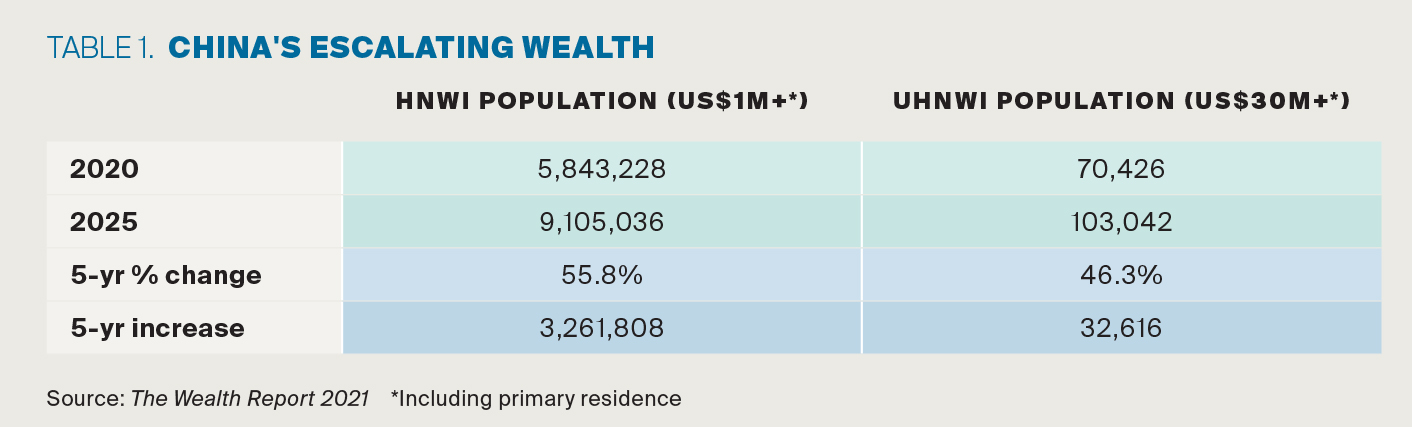

The likelihood is that some of this demand will find its way to the European Alps. Firstly, due to the scale of wealth creation taking place. In the five years to 2025, the Chinese mainland will be home to an additional 3.3 million high-net-worth individuals (US$1m+). Combine this with a greater propensity for travel, an appetite for luxury brands and more of a focus on health and wellbeing and we expect more interest in The Alps in the coming years.

Warren Smith, who opened the first British ski school in the Chinese mainland resort of Wanlong in 2016 said: “We're already seeing demand from Asian students based at UK and northern European universities heading to the Alps to get a European ski experience.”

Photo by Jeremy Cai on Unsplash