The year of big numbers, the Ski industry's eastern hope and do homebuyers care about green homes?

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Green homes

Revelations laying out the scale of the residential market's net zero challenge was among the most important property stories of 2021.

Hitting the Climate Change Committee's (CCC) recommendation that all properties hit EPC rating C over the next ten to 15 years will require £55bn of investment by 2050. That would encompass the insulation of some 3.1 million cavity walls, 11 million lofts and 3.4 million solid walls, to name a few. For all 19 million homes, the government estimates costs will be somewhere between £1800 and £3400 per property, and that excludes any investment in heat pumps.

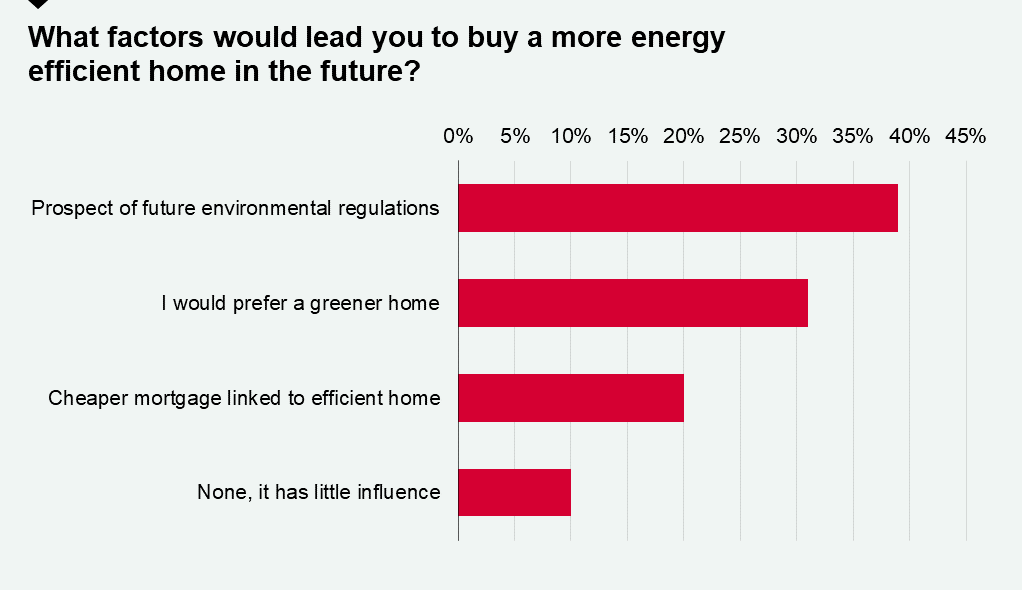

The issue is starting to sink in with homeowners. Some 86% of respondents to Knight Frank's latest sentiment survey, published yesterday, said the energy efficiency of a home was either very important or important to them. Two in five buyers said the prospect of regulatory invention impacting the value of their property would influence their decision to buy a more efficient home. See this piece for more.

Big numbers

It has been a year of big numbers for the housing market. From the massive swings in activity fuelled by the stamp duty holiday to the redrawing of the commuter belt and the big move to the countryside - Chris Druce compiles a few of the best numbers that describe another extraordinary year.

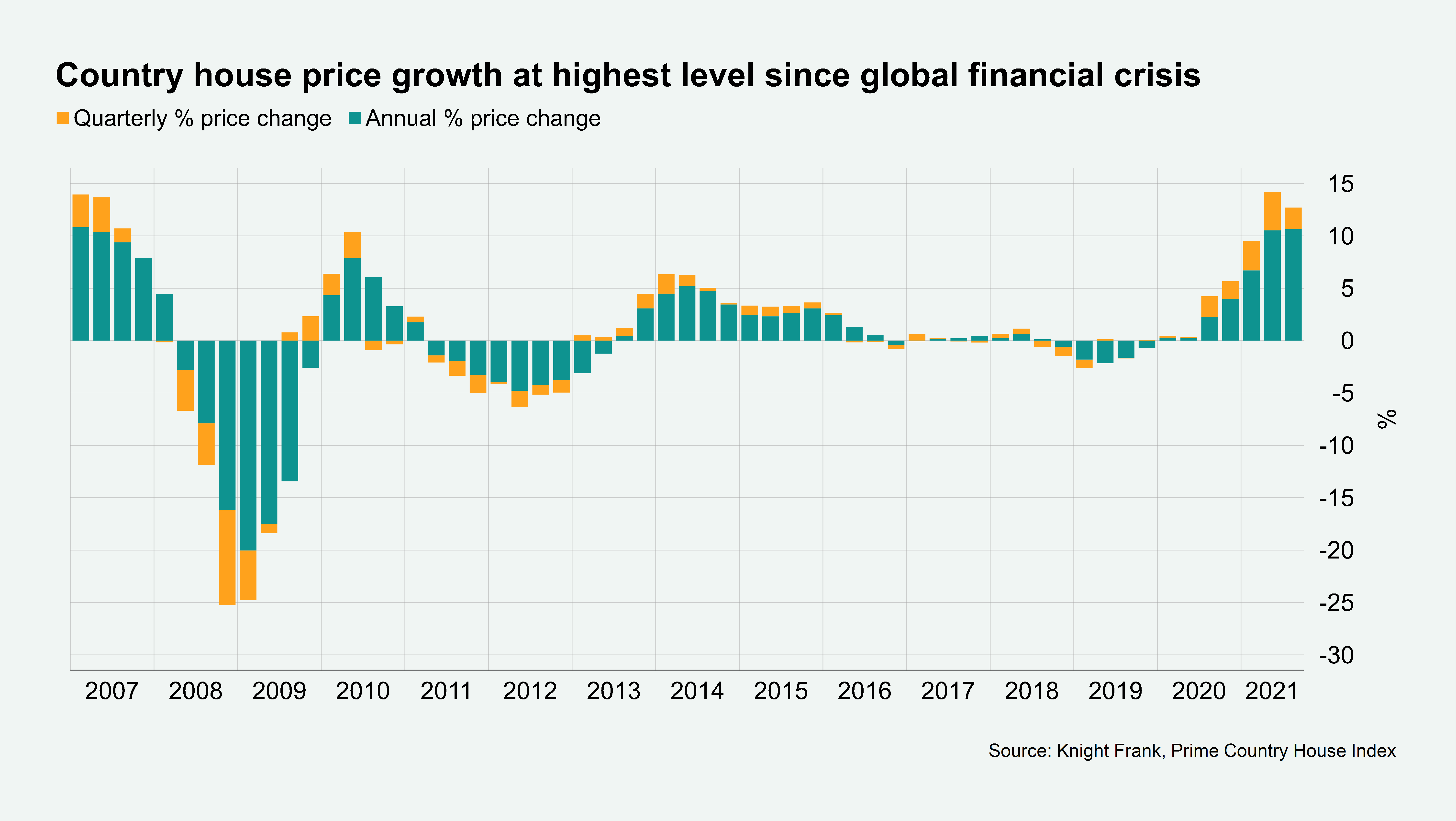

The annual rate of growth in the Prime Country House Index reached 10.6% in September, its best performance since before the global financial crisis.

That said, the resurgence of towns and cities will be one of the big themes of 2022. The number of offers accepted in London reached a ten-year high in November as the capital moved firmly back onto the radar of buyers. New demand is rising faster in the capital than elsewhere in the UK.

The tax haul

For the chancellor, any fall in tax receipts from the stamp duty holiday has been more than offset by the booming second homes market.

HMRC has taken £11.44 billion in receipts from the property tax so far this year, the most collected in the first eleven months of the year since 2017. The government estimates that in the financial year 2021-22 there will be 974,310 residential property sales, making it the busiest year in a decade.

Separate ONS data revealed public borrowing dropped by almost 50% in the first eight months of the 2021/22 financial year compared with a year earlier. That followed a year of colossal pandemic-induced spending - the £136bn figure is still three times higher than the level of borrowing two years earlier.

Skiing

President Xi Jinping’s decision to bid for the 2022 Winter Olympics could prove a boon for the ski industry globally, writes Kate Everett-Allen.

Despite the Chinese mainland being home to around 13 million skiers, that number equates to just 1% of the population according to the 2021 International Report on Snow & Mountain Tourism, suggesting there is plenty of room for growth. President Jinping’s goal is to use the Beijing Olympics to convert 300 million Chinese residents to winter sports. The industry already generates around RMB 3 trillion per annum (US$465 billion) but to date most wealthy Chinese mainlanders head to Japan for their skiing fix.

The likelihood is that some of this growing demand will find its way to the European Alps. Firstly, due to the scale of wealth creation taking place. In the five years to 2025, the Chinese mainland will be home to an additional 3.3 million high-net-worth individuals (US$1m+). Combine this with a greater propensity for travel (covid willing) and an increased focus on health and wellbeing and we expect more interest in The Alps in the coming years.

In other news...

Rajani Sinha on the top five trends in India's property market for 2022.

Alex Ogario on why January will be a unique opportunity for borrowers in the UK mortgage market.

Elsewhere - the Great Resignation is about to get greater (Times), Atom Bank sees a rush of job applications after switch to four-day week (Times), Chinese investors pick luxury watches over houses (FT), and finally, the green debt market is growing faster than its impact (Bloomberg).