Aspen sees prime prices jump 19% as supply shrinks

Slim pickings for buyers late to the party in Aspen, leading to more off-market sales.

3 minutes to read

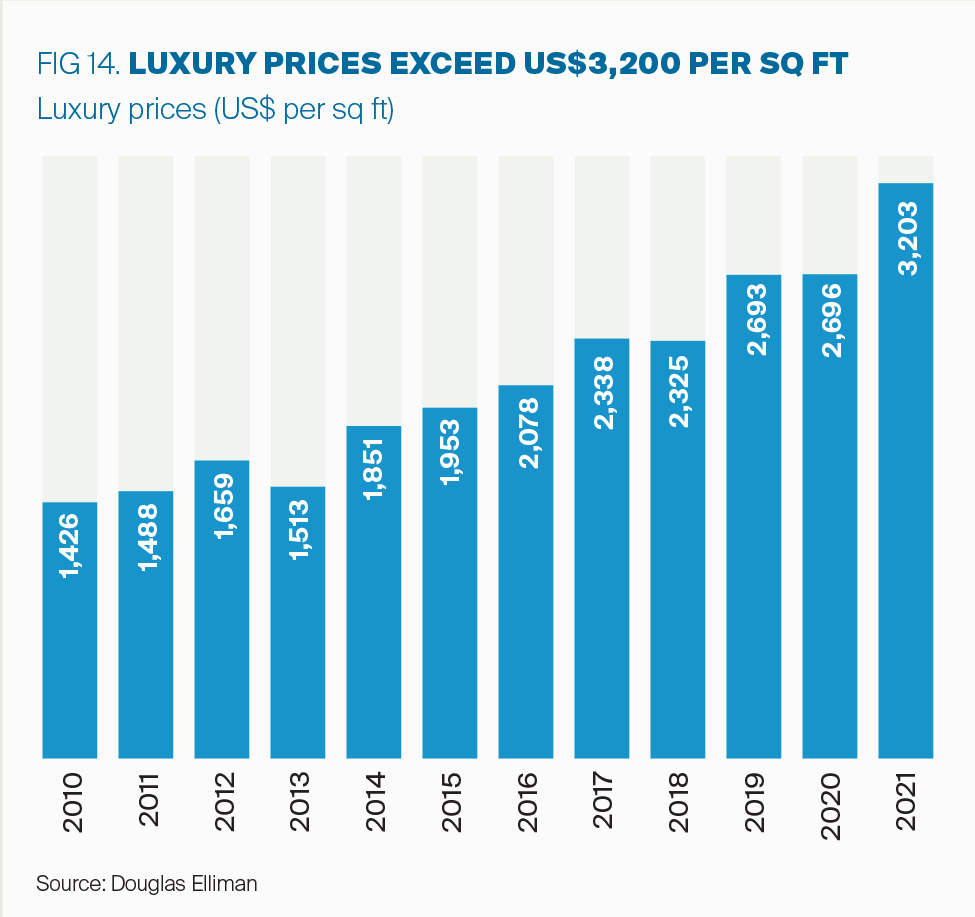

Following a 51% surge in transactions in 2020, the Aspen market paused for breath in 2021, sales slowed but not due to a lack of demand rather a shortage of stock, which continued to have an inflationary effect on prices.

The influx of co-primary residents from New York, Miami, Los Angeles and San Francisco has continued, with more high-net-worth individuals opting to call Aspen home and enrolling their children at Aspen Country Day or Aspen Public School District. The birth of co-primary homes was a key trend that shaped prime residential prices across the globe in 2020.

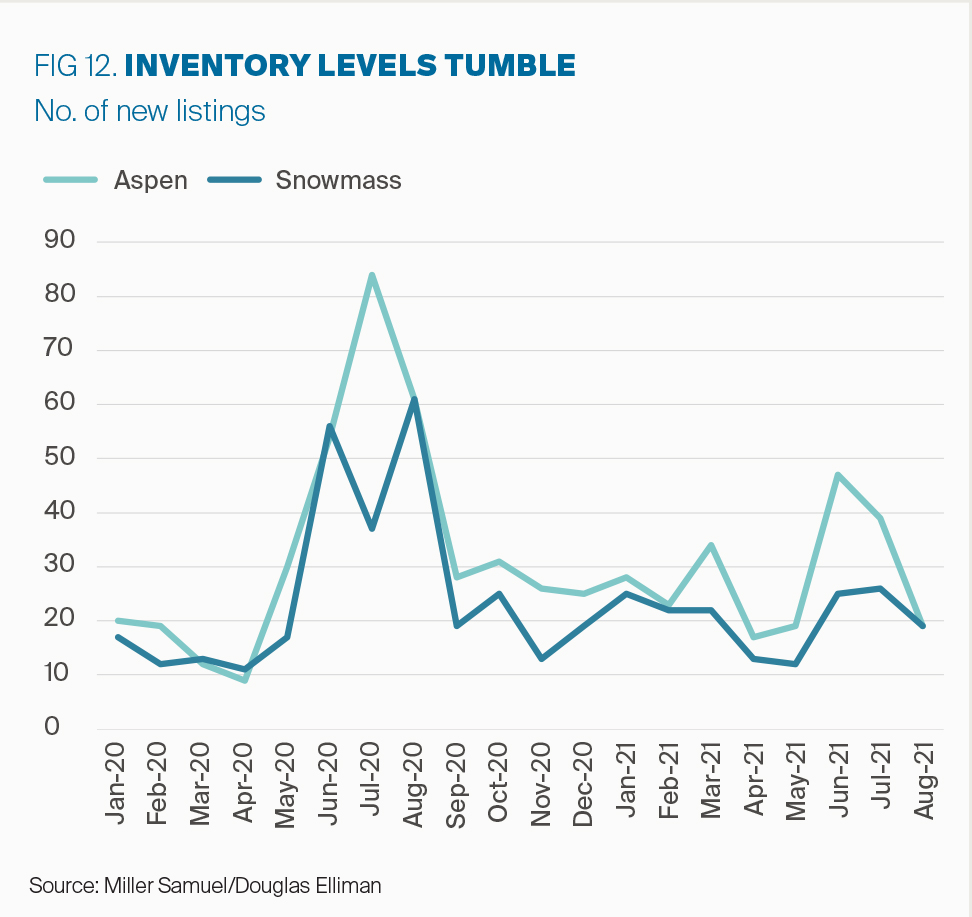

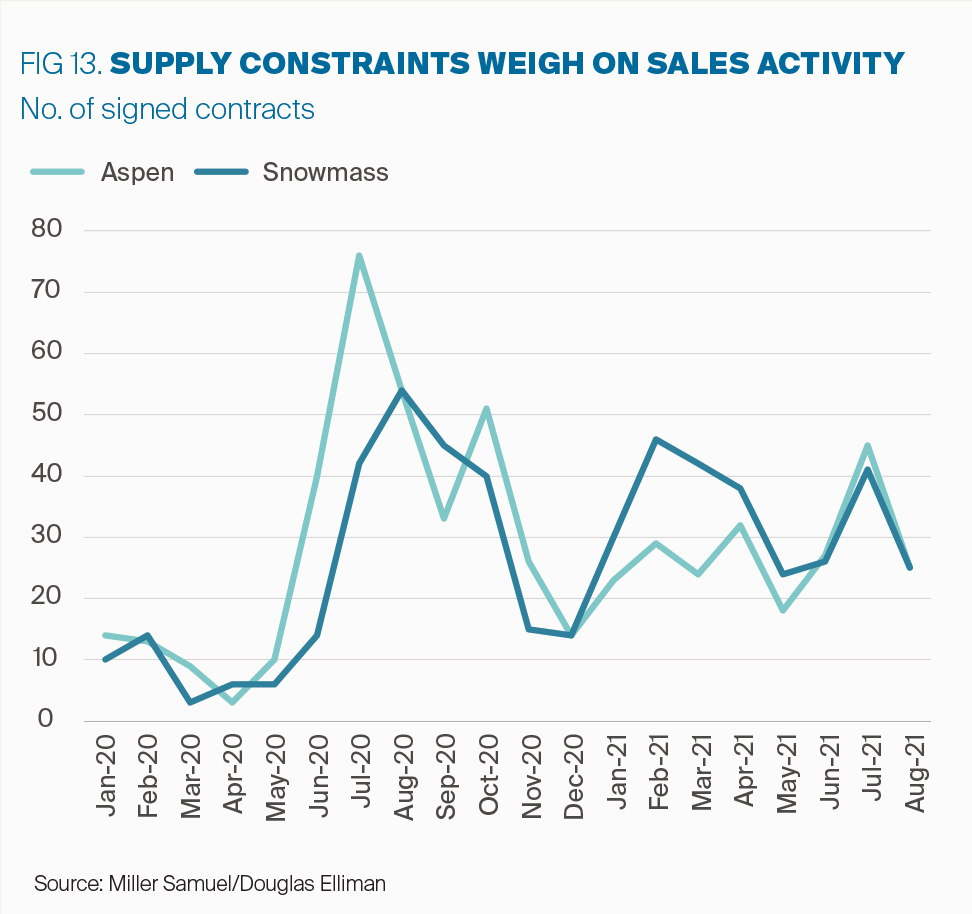

In short supply according to Miller Samuel, Aspen saw 19 new listings in August 2021 (condos and single-family homes), down from 61 a year earlier. This fall in inventory has seen sales dip, 25 contracts were signed in August 2021, down from 54 in August 2020.

Riley Warwick at Douglas Elliman, Knight Frank’s residential partner in the US, points to one particular sale to show the extent to which Aspen has become a seller’s market, “one property I’m familiar with sold for US$6.65 million in 2019 and was resold in 2020 for US$9.3 million despite no significant refurbishment, almost a 40% increase.”

With Aspen Central Core, Red Mountain and West End achieving high prices, some buyers are venturing into up-and-coming neighbourhoods such as Meadowood, Five Trees and Mountain Valley.

There is little prospect of new developments boosting stock levels significantly in the medium term with only a small number of schemes in the pipeline, Lift 1A and Aspen Club amongst them. Neighbouring Snowmass offers buyers more choice in terms of available stock as well as the joy of ski in/ski out homes. But sales volumes are robust there too; Electric Pass Lodge sold out pre-completion, whilst nearby Havens Snowmass sold out in four weeks.

Off-market sales increase

With inventory levels constrained an increasing number of sales are being agreed off-market as agents resort to cold calling, such is the imbalance between demand and supply.

One such property not publicly listed was 421 Willoughby Way on Red Mountain which sold to a Douglas Elliman buyer for a record-breaking US$72.5 million in June 2021. A 21,477 sq ft home with nine bedrooms, the property last sold for US$43 million in 2009.

According to Douglas Elliman, of the 77 single-family homes currently listed in Aspen, 21 have an asking price of US$20 million or above.

Opening up

With borders largely closed since Spring 2020, US buyers have been the driving force behind the Aspen market. According to the National Ski Areas Association, US ski areas saw their fifth highest visitor numbers on record in 2020 with 59 million visits registered. However, with vaccinated travellers from the UK and Europe permitted from November 2021, and with significant wealth amassed globally during lockdowns, we expect a broader buyer mix this winter.

If you are seeking a 'home from home' in the Alps, or have an alpine property that you are thinking to sell, why not speak with our Alpine specialists for further advice on where, why, and how to buy and sell in the mountains.