Omicron set to slow the pace of recovery for London’s hotel sector

Whilst October’s trading results yielded continued strong growth, Omicron has thrown off course the strong end to the year the sector was desperately seeking.

2 minutes to read

October’s trading figures were a turning point for London’s hotel market and for the first time since the start of the pandemic, achieved more encouraging results than hotels across the wider regional UK market.

Omicron set to slow London’s hotel recovery – for now

London’s recovery continued throughout October albeit the pace of occupancy growth slowed compared to previous months, rising by just 2.6 percentage points of occupancy, to 48.2%. Strongest growth was recorded in London’s Luxury and Upper-Upscale Hotels.

Growing demand for overnight accommodation from overseas visitors helped London hotels withstand the 7.5% increase in VAT, recording 6.6% growth in the Average Daily Rate (ADR), which helped deliver 12.6% growth in Revenue per Available Room (RevPAR) to £93.10 for the month of October.

London continued to deliver its highest level of profitability since the start of the pandemic, with 13% growth in Gross Operating Profit per Available Room (GOPPAR), with hotel demand boosted by an uplift in overseas visitors.

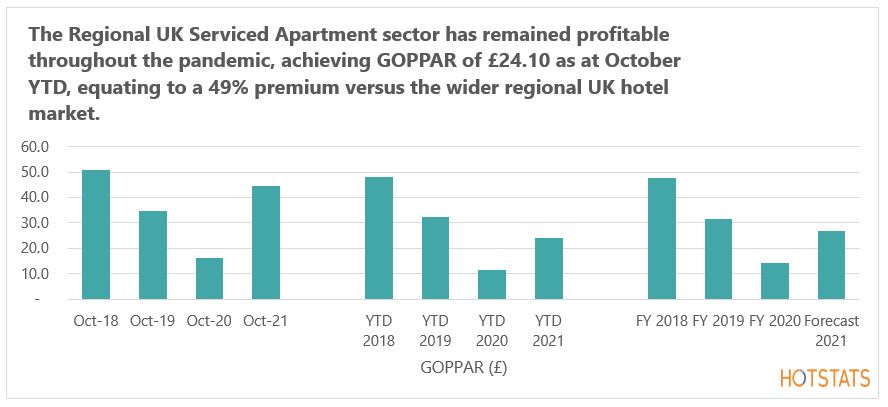

Resilience of Serviced Apartment Sector reigns on

Resilience has stemmed from each operator’s ability to pivot the business model.

As at October year-to-date (YTD), branded serviced apartments outside of London have achieved Occupancy of 61.7%. Over the past three months, occupancy has averaged 88%, some 21 percentage points of occupancy higher than the wider Regional UK hotel market.

With the benefit of the reduced VAT rate, ADR is 34% ahead of 2019 levels. Meanwhile, RevPAR equates to £52.60, some 48% ahead of RevPAR for the same October YTD period in 2020 and a premium of 36.5% over the regional UK hotel market. Yet, whilst October’s trading results yielded continued strong growth, Omicron has thrown off course the strong end to the year the sector was desperately seeking.

Download the latest Hotel Dashboard for Knight Frank’s latest sector outlook.

Using the latest HotStats benchmark data, we provide an overview of performance for both London and Regional UK hotel markets. This month with spotlight on both London’s Upper Upscale Hotels and Regional UK’s Serviced Apartment / Apart-hotel sector.