Omicron, the return of market volatility, and the latest forecasts for commercial property

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Assessing the Omicron impact

While the World Health Organization (WHO) has suggested the virus could pose a ‘very high global risk’, it will be a number of days before its severity is more fully understood. Initial economic impacts will be focused on the fallout from travel restrictions: countries including the US, Japan, EU states and the UK have placed restrictions on travel to South Africa and neighbouring countries. At present, the recent experience of adapting to such disruptions means that most forecasters do not envisage a significant knock to what are typically bullish economic growth projections for 2022.

Volatility returns to global markets

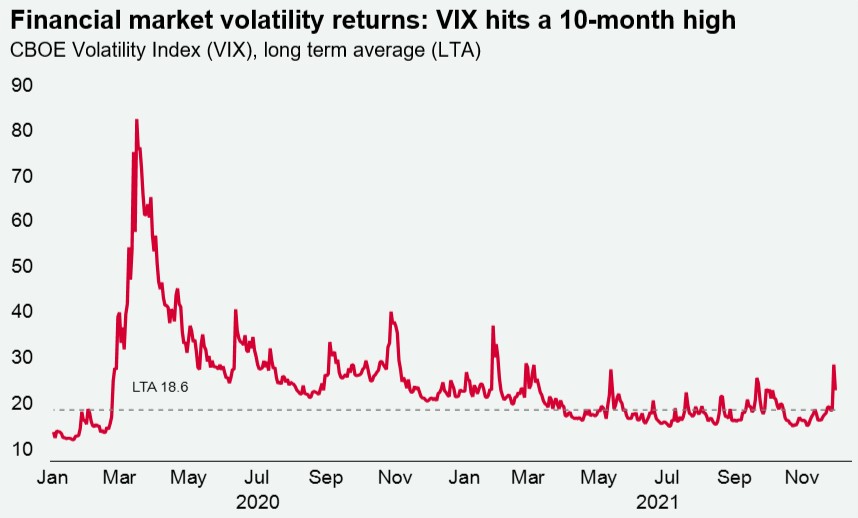

News of the Omicron virus coincided with a sell-off in riskier assets on Friday, with equities losing about -2.5% globally, bond yields compressing, and crude oil prices dropping by -13%. The CBOE Volatility Index (VIX), a real-time measure of market uncertainty, jumped by 54% last week and is likely to remain elevated in the short term. Periods of rising market volatility can incentivise investors to target perceived safe-havens, such as government bonds, as well as assets that are not ‘marked to market’, such as real estate.

UK commercial property is set to return 11% this year

The latest IPF Consensus Survey shows UK All Property total returns for 2021 were revised upward to 11.0% from 6.9% in August. The sector’s outlook was strengthened also for the years ahead, as total returns for 2022 and 2023 were revised upward to 7.4% and 6.4% respectively.

DOWNLOAD THE LATEST DASHBOARD HERE