A record year for corporate activity and the return of the UK's productivity puzzle

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

UK economy to expand by 5%+ in 2022

The most recent treasury consensus forecasts highlight a strong outlook for the UK, with output predicted to grow by 5%+ next year. Consumer spending will play a significant role in this leg of the recovery, with forecasters envisaging a very significant +6.4% uplift next year. This comes as GfK’s latest UK consumer confidence index improved in November, despite the UK ‘s current decade-high inflation of 4.2% and questions over the timing of future base rate rises.

Global corporate activity reached record levels in 2021

What comes next? Approximately 2,850 businesses have raised a combined c.$600bn via IPOs so far this year, beating the previous historic record set in 2007 by over 40%, while 2021 will also go down as a record year for M&A transactions. Current indications are that the focus for 2022 will shift to more traditional capital expenditure in existing businesses, with multiple surveys highlighting strong corporate appetite for expansion.

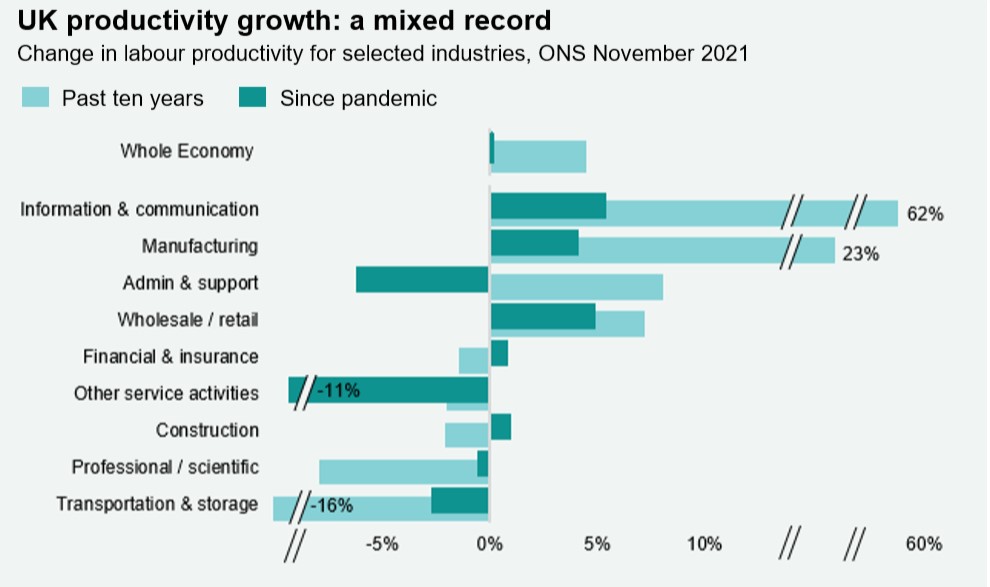

Will a capex rally kickstart productivity growth in 2022?

Labour (wages) is becoming more expensive, while capital (borrowing) remains historically cheap. Consequently, optimistic businesses seeking to expand might reasonably invest in new machinery, technologies and automation, ahead of additional hiring. Most forecasters agree: while unemployment will still edge lower next year, the OBR predicts an almost 10% increase in capital spending – a positive for construction, demand for sites/facilities, and local economic growth. One big question, however, is the extent to which this investment will boost the UK’s decade-long slump in labour productivity growth.

DOWNLOAD THE LATEST DASHBOARD HERE