Midweek property news update - 7 July

Quarantine-free travel, the building boom and the huge challenge of hitting net zero

4 minutes to read

Delta

This morning's papers have a very 2020 feel to them. Sydney is in lockdown, South Korea is on the cusp and new cases of Covid-19 are on the rise across Europe.

The spread of the Delta variant means that as of yesterday daily cases in the UK had ticked back up to about 30,000, though the success of the vaccine roll out, which has largely decoupled infections and hospitalisations, means the reopening of the economy is set to continue. This morning's Times reports that vaccinated travellers from amber listed countries will be exempt from requirements to quarantine as early as July 19th.

Consumers spent less time in shops, bars and restaurants last month due to nervousness over rising infections, though the ultimate economic impact of the so-called third wave is likely to be limited. For more detail see our updated House View, which provides a snapshot of the outlook for a range of real estate sectors, including residential, offices and retail.

The building boom

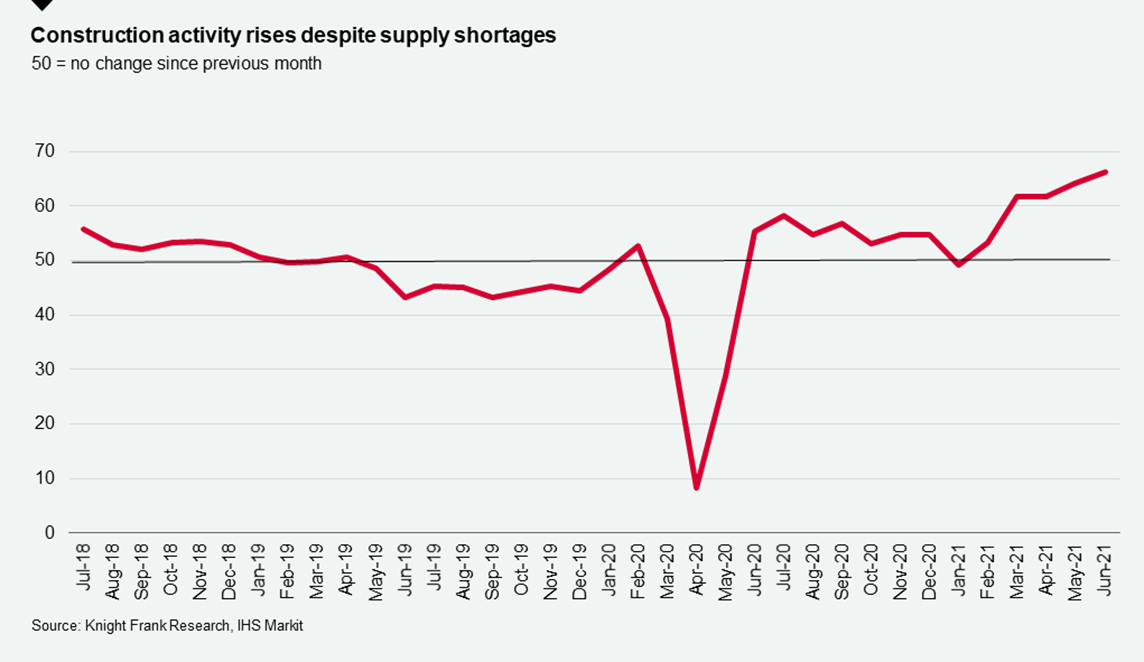

Construction activity in June expanded at the fastest rate since records began back in 1997, according to a new purchasing managers (PMI) index from IHS Markit. The housebuilding sub-sector led those gains, after expanding at the fastest rate since November 2003.

The unprecedented surge in activity pushed both lead times and the cost of products and materials up the most since records began. Construction companies report severe shortages of stock and worsening delays in shipping and haulage, especially for products sourced from the EU. Supplies are contracting across the board, particularly for cement, concrete, plaster, steel, timber and roof tiles.

These trends are now weighing on sentiment. Though construction companies are generally optimistic about growth prospects for the next twelve months, confidence eased back to its lowest reading since January.

Net zero

The transition to net zero by 2050 will cause the public debt to rise by 20%, though it will have a smaller impact on the economy than the pandemic, according to a fiscal risks report from the Office for Budget Responsibility.

Much of the challenge lies in the built environment and the numbers are eye-popping. Between 2020 and 2050, buildings are likely to make up 14% of emissions reductions, according to the government's climate advisor. That, according to the report, will require investment of about £362 billion - or about 28% of the total investment cost of reaching net zero.

Decarbonising domestic heating will, in turn, require most of that investment, and the report makes an interesting comparison to the mass conversion of domestic heating from coal and oil to gas and electric boilers that took place in the 1960s (see p.116). Reaching net zero is more challenging "in almost every respect", covering investment in both heat efficiency and low carbon technologies across a larger number of properties and over a longer period.

Part of the challenge centres on uncertainty over appropriate technology, and the report states "the option value in waiting to see how that is resolved is high" - which may explain the government's current lack of policy direction. Switching to hydrogen would involve less upfront investment and would be delivered through the existing gas network but there are significant technological and cost uncertainties. Heat pumps are familiar in Europe but are more expensive and require more heat efficient buildings to work effectively.

Finally, the report illustrates the huge skills challenge. The government has a target for residential heat pump installations to reach 600,000 by 2028, which is hugely ambitious, however converting the remaining dwellings by 2050 would require 1 million installations a year from 2029. The Construction Industry Training Board estimates that by 2028 an additional 86,000 plumbers will be required, with an extra 350,000 full-time equivalent construction sector jobs needed over the next decade.

South Korea

Earlier this week we talked about surging prices in global urban housing markets, led by Seoul. House prices in the South Korean capital climbed more than 25% in Q1 compared to a year earlier and local media is peppered with stories detailing the scramble for secure housing.

Much like officials in New Zealand, Canada, and China, the government is attempting to curb house price inflation and has proposed various curbs on overseas purchases of Korean homes. Official figures reveal that overseas individuals now own 21.35 million sq meters of real estate, up 78% from 11.99 million sqm in 2016, according to new analysis from Stephen Wong.

Many of those bills are still pending in the National Assembly. We expect prices to continue rising for the foreseeable future, though political desire to reign in speculative purchases is likely to prompt the introduction of new taxes with the aim of cooling activity.

In other news...

Stephen Springham on the decline of GAP and the battle for Morrisons. Plus, Will Matthews has the latest leading indicators covering inflows to equity funds, private equity activity and why the UK’s real estate sector has been growing more rapidly than previously thought.

Elsewhere - ESG outperformance looks set to end, investment industry at ‘tipping point’ as $43tn in funds commit to net zero, Lloyds Bank gets into the rental business, the quest for ‘green’ cement draws big name investors to a $300bn industry, the Pfizer vaccine and the delta variant, and finally, China bans the tallest skyscrapers due to safety concerns.

Photo by Abby Anaday on Unsplash