Friday property news update - 25 June

Working from home moderates, holidays to the Balearics and the growing green homes problem

4 minutes to read

Solving the green homes problem

The government's ambitious pledges to cut carbon emissions have so far proved to be hot air, according to an embarrassing update from the Climate Change Committee (CCC), the PM's own climate advisors. In a revealing interview with Sky News, Chris Stark, the committee's chief executive, said there is a gulf between ambition and a willingness to take tough decisions that affect people's lives.

There remain critical questions unanswered as to who will pay for the decarbonisation of buildings, according to the report. The CCC wants sales of gas boilers to all homes and businesses phased out by 2033 and replaced by green alternatives such as heat pumps, which can cost up to £35,000 each. Failures identified include a lack of progress on ensuring building standards are properly enforced and the fact that the Planning Bill does not ensure that developments are compliant with net zero commitments.

We talked last week about Rishi Sunak's difficult GB News interview as he struggled to articulate who would pay the bill to "green" the nation's housing stock. There is some evidence that officials are trying to unpick this problem - see the February consultation with lenders trying to get Green Mortgages off the ground - but there remains a glaring lack of proper incentives to retrofit homes.

The delayed Heat and Buildings Strategy should appear at some point during the summer and, according to the CCC's recommendations, that needs to include a "long-term policy framework to support sustained energy efficiency and heat pump growth at sufficient scale" - or about 600,000 heat pumps per year in existing homes by 2028. That would have to include a replacement for the Green Homes Grant. Interestingly, the CCC also urges ministers to consider the role tax incentives might play, such as Stamp Duty differentials for greener homes.

Travel

The government announced last night that its green list for travel would be expanded from Wednesday, permitting travel to 16 countries without needing to quarantine on return. Those countries include the Balearic islands, Malta and Madeira.

The reopening of travel corridors is likely to have a big impact on prime European property markets. The European Union lifted restrictions on non-essential travel for US citizens last week and, according to analysis by Kate Everett-Allen, Knight Frank’s website saw a 46% uptick in enquiries logged by US-based web users in the week ending 21 June compared to the previous week, with properties in Lucca, Florence, Vienna and Geneva high on US search lists.

That will build on improving sentiment as the recovery in Europe's largest economies takes hold. French business confidence surged to its highest level in nearly 14 years in June, mirroring a rise in Germany.

Transitory inflation

The Bank of England yesterday opted to hold the base rate at 0.1% and retain current levels of quantitative easing, despite issuing a warning that inflation could surpass 3%. Monetary Policy Committee (MPC) members maintained their stance that rising inflation would right itself naturally once the impacts of the post-lockdown reopening subsided.

Twelve agents from the Bank speak to 700 regional businesses during each reporting period, and the latest round of feedback includes widespread concerns about the cost and availability of materials and components. There are now "severe materials shortages" in construction, including for cement and timber, which may now begin to impact construction output. Some manufacturers say they are beginning to stockpile once again.

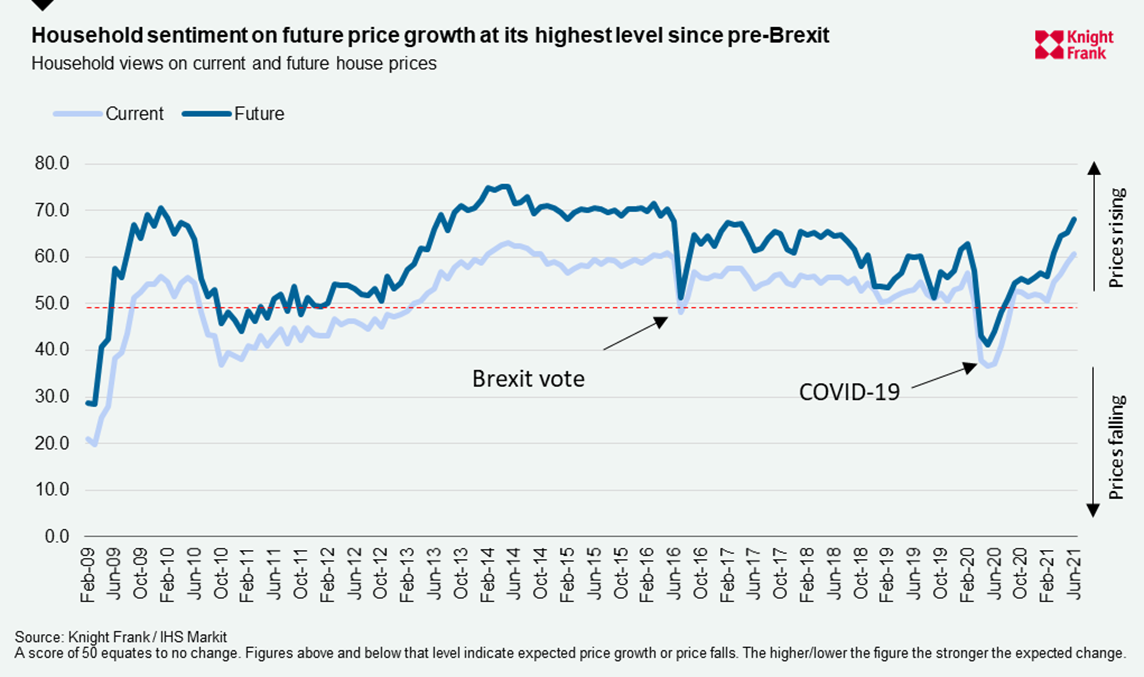

The MPC meeting minutes said housing market activity remains robust and the theme of strong demand running up against limited supply is now being monitored by officials. Separate data released by IHS Market shows households are more confident about future house price growth than at any point since before the vote to leave the EU in 2016.

WFH latest

The Bank of England's Decision Maker Panel consists of the Chief Financial Officers of small, medium and large UK businesses and the latest survey of more than 3,000 participants points to further moderations in the number of employees working from home.

The share of employees working from home fell to 35% in May, from 40% at the start of the year. Over the next few months, businesses expect the proportion of employees working remotely to fall further to 24% in 2021 Q3.

The share of employees working on premises has been increasing in recent months, reaching 58% of the total workforce in the May survey. That proportion was expected to increase further to 64% in June and 73% in 2021 Q3.

In other news...

Chris Naughtin on European investors searching for Australian commercial real estate.

Elsewhere - the CMA's clampdown on leasehold, the number of furloughed staff falls to a record low, the US homes supply crunch, Berkeley on London, The Crown Estate set for windfall from green energy revolution, battles loom as housing developers eye bucolic rural England, new climate reporting rules to be extended by UK financial regulator, Blackstone sweetens deal for St Modwen, and finally, the revival of smaller towns is feeding a crisis of confidence across our cities.

Photo by Science in HD on Unsplash