Euro (capital) vision – Australia on the radar for European investors

Over the past year, offshore investors have played a lead role in driving commercial property investment in Australia during a period when many domestic asset managers were less active. While overseas investment has traditionally been dominated by buyers from within the region – particularly Singapore and Hong Kong SAR – and also from the United States, European investors have recently become far more active. The increase in European investment into Australia reflects the relatively rapid rebound in economic activity in Australia, the narrowing interest rate differential in recent years (and consequently reduced hedging costs) and a widespread desire among investors for greater geographic diversification.

5 minutes to read

Total commercial property investment volume (excluding development sites) in Australia fell by 34% over the year to March 2021 as elevated uncertainty around the outlook due to the pandemic weighed on investor activity.

Cross-border investment has been more resilient to pandemic-induced downturn compared to domestic investment. Cross-border investors accounted for 40% of total investment over the year to Q1 2021, compared with 34% a year ealier, and 54% of investment for deals with a value greater than $100m compared to 42% 12 months ago.

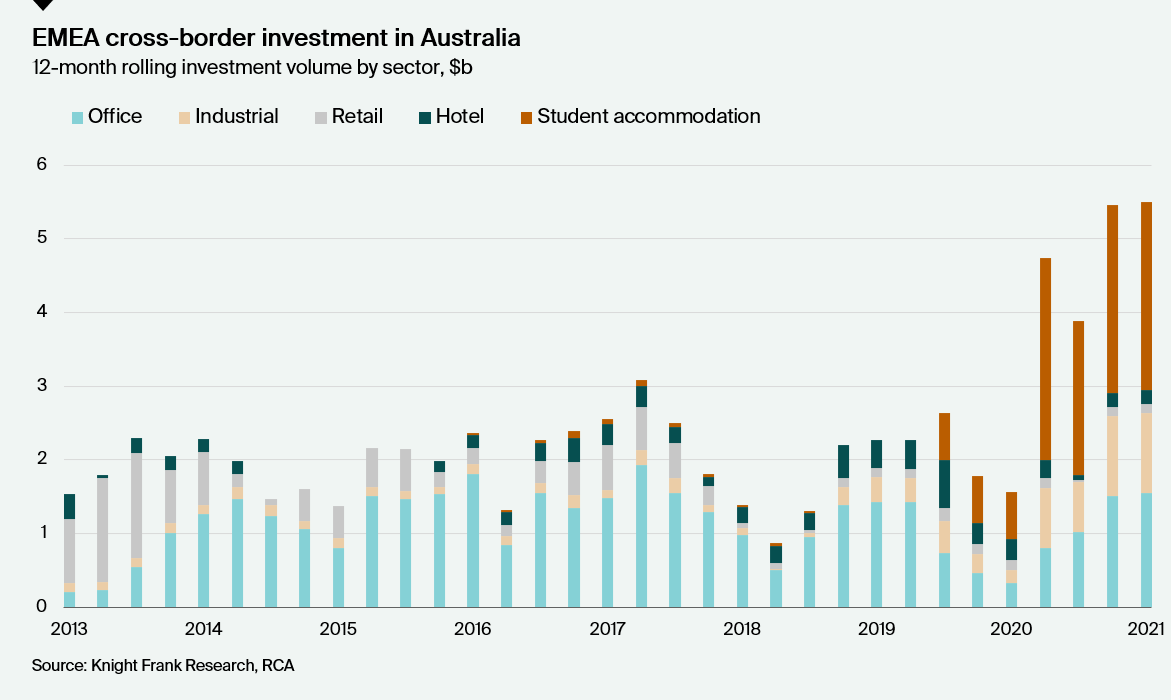

The resilience of cross-border investment reflects the perennial interest from Singaporean investors in the Australian market but also a significant increase in European investment activity. Investment from Europe, the Middle East, and Africa (EMEA) accounted for a record 42% of total cross-border investment in the year to Q1 2021, compared with only 9% a year earlier.

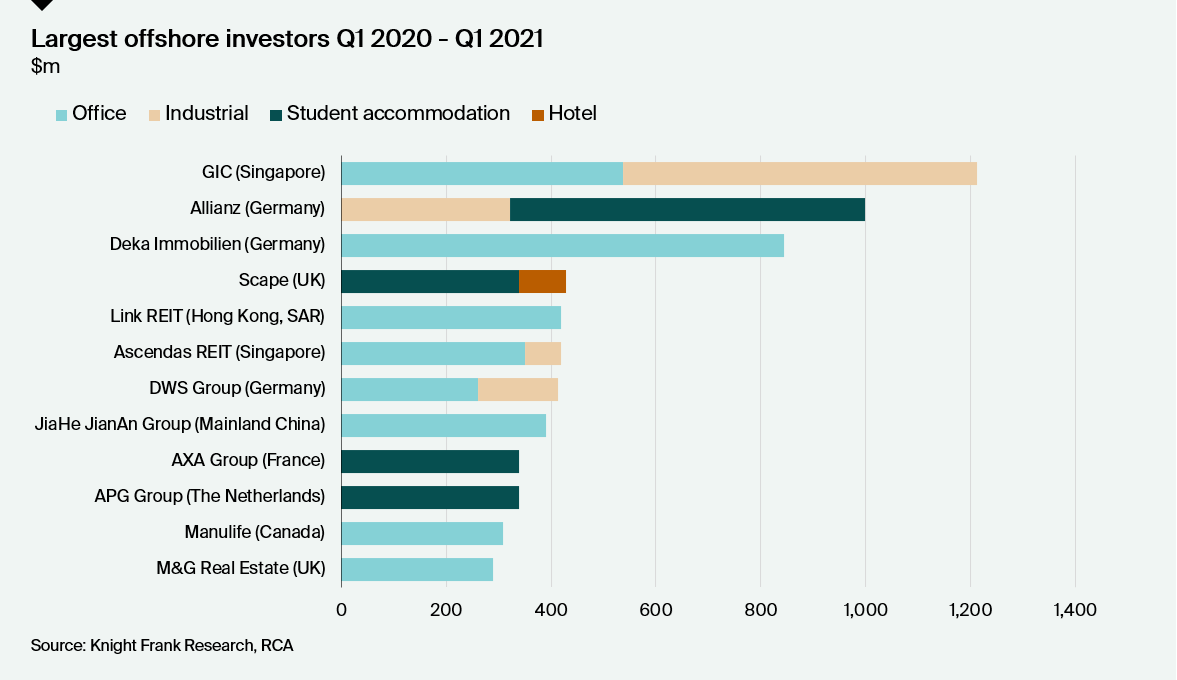

The increase in EMEA investment over the year has been driven by major global asset managers domiciled in the largest European economies – Germany, France, the UK, and the Netherlands. Their investment has underpinned a number of large deals including:

- Scape’s acquisition of the Urbanest student housing portfolio for $2.1 billion with Allianz, AXA, and APG.

- Allianz’s joint acquisition with Charter Hall of four Aldi distribution centres in June 2020 for $648 million followed by the purchase of an additional two Aldi facilities in December for $281.5 million.

- Allianz’s purchase of the Redefine student housing porfolio for $459 million.

- Deka Immobilien’s acquisition of 452 Flinders Street in Melbourne and 66 Eagle Street in Brisbane in separate transactions with a combined value of $844.9 million.

- DWS Group’s purchase of 895 Ann Street in Brisbane for $260 million and the remaining 50% stake in a Coles cold storage and disbribution facility at 99 Sandstone Place in Brisbane for $152.5 million.

- M&G Real Estate’s acquisition of a 25% stake in 400 George Street in Sydney for $260 million.

Reflecting the size of the Urbanest and Redefine student housing portfolios, student accommodation accounted for nearly half (47%) of EMEA investment in Australia over the year to Q1 2021, but office and industrial assets were also highly sought after making up 28% and 20% of volume respectively.

Rise of European capital signals the attractiveness of Australian property

The relatively limited spread of Covid-19 in Australia and the stronger than expected recovery have given offshore investors confidence in the outlook for the domestic economy and commercial property leasing and capital markets.

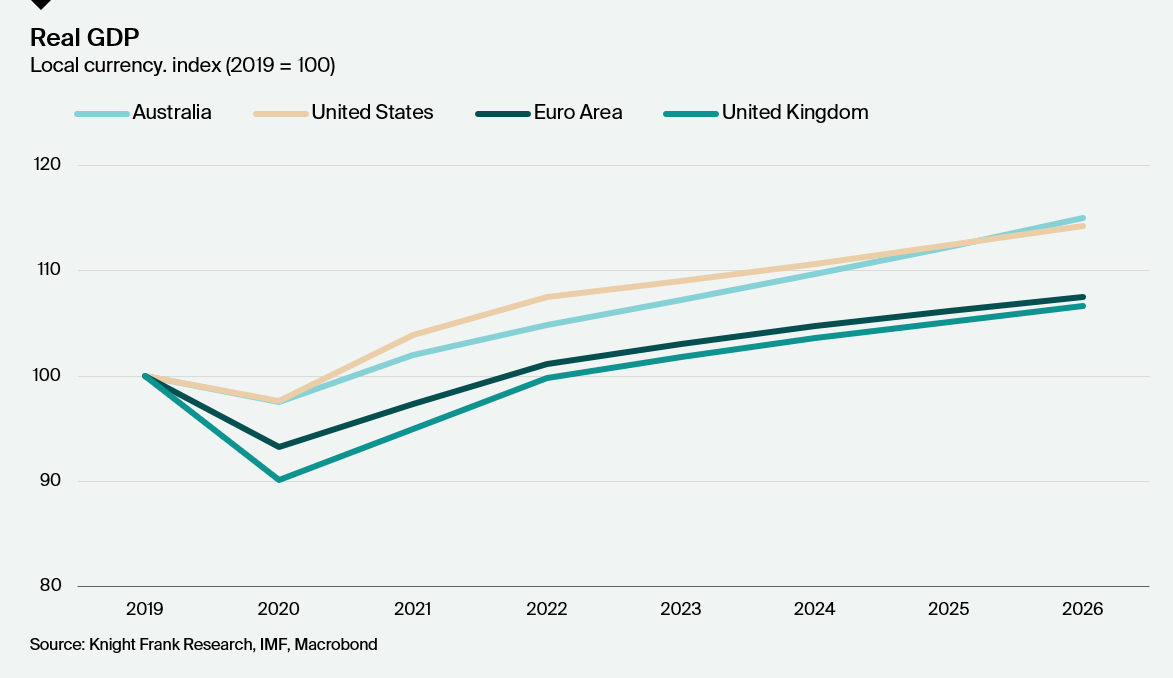

Growth in Australia has been relatively resilient compared to many other advanced economies, particularly in Europe. In year-average terms, output contracted by 2.4% in both Australia and the US in 2020, compared to a much worse -6.7% and -9.8% for the Euro Area and UK respectively. A broad-based global recovery is expected in 2021 and beyond as governments continue to ease Covid-19 restrictions and the rollout of vaccinations progresses. However, growth in Europe will continue to lag behind other advanced economies with output not expected to reach pre-pandemic levels until at least 2022.

This is resulting in European investors looking further afield for sources of growth and stable long-term investment returns, and the relatively strong recovery and growth outlook in Australia will increase the appeal of the domestic market. Furthermore, given the inherent uncertainty surrounding the outlook for global economy and commercial property markets in light of the pandemic, investors will continue to seek more geographically diversified portfolios.

Narrower interest rate differential has reduced hedging costs

The shift to further easing in monetary policy by the RBA in recent years, and the adoption of quantative easing and yield curve control policies following the onset of the pandemic has led to a significant narrowing of the interest rate differential between Australia and major advanced economies. While this narrowing has partially unwound (particularly for US Treasuries) during the recent bond market selloff, Australian government bond spreads to major advanced economy government bonds remain very low by historical standards. Furthermore, the RBA has signalled that interest rates will remain very low in coming years and this is leading many to conclude that lower spreads will persist.

This narrowing is the interest rate differential reduces hedging costs for offshore investors looking to deploy capital in Australia. The interest rate differential between Australia and the capital source country is one of the main factors determining currency hedging costs. Historically, interest rates have tended to be signficantly higher in Australia than in the domicile of major cross border investors in the US, Europe, and Asia-Pacific, but the move to lower interest rates in Australia has changed this dynamic, and lowered hedging costs.

This is particularly true for major European investors who often seek to hedge their currency exposures. The spread between 3-year Australian government bonds and 3-year German Bunds has declined by 190 basis points over the past three years, while the spread to 3-year UK Gilts has fallen by 145 basis points.

Enduring low rate environment will continue to attract European and global capital, adding to market depth and liquidity

With interest rates having been considerably lower in many major economies since the global financial crisis, major European and global funds have become accustomed to the shift-down in IRRs and income returns that lower rates imply, as these forces have impacted their home markets for some time.

In Australia, however, returns have been much higher over the past decade and while long term interest rates have been on a persistent downward trajectory, the pandemic has exacerbated this dynamic and prompted a further shift down in IRRs and target returns. Some domestic investors will continue to seek higher return targets which may be harder to obtain in the current market, whereas European funds are more accustomed to lower return hurdles.

For these reasons, European and offshore investors will likely continue to play a key role in driving investment while domestic investors continue adjust to the new interest rate dynamic.

We expect offshore investors will continue to account for a higher than average share of commercial property investment in Australia in the more challenging environment brought about by the pandemic, with higher risks to income and more uncertainty around capital growth in some sectors.

The increase in European investment activity in Australia over the past year is testament to the relative appeal of the domestic market in an uncertain investment environment, and in adding an additional source of capital to the market it will bolster market depth and liquidity.

For further information please contact:

Chris Naughtin

Director, Research & Consulting

+61 2 9036 6794

Chris.Naughtin@au.knightfrank.com

Ben Burston

Partner, Chief Economist

+61 2 9036 6756

Ben.Burston@au.knightfrank.com