Prime France proves resilient with sales up 5% nationally

Despite a challenging backdrop France’s prime residential markets were resilient in 2020 as the pandemic sparked a reassessment of housing need amongst French buyers

3 minutes to read

Green shoots

Following three national lockdowns, a delayed vaccine programme, closed borders, and with its ski resorts shuttered, France’s property market has operated against a challenging backdrop over the last year.

But by June 2021, 40% of French citizens had received a Covid-19 shot and the EU had unveiled proposals to end restrictions on non-essential travel and welcome back vaccinated visitors, a critical move for the world’s most visited country that usually attracts some 90 million tourists a year.

Since March 2020, France has spent almost 190 days in national lockdown, but the economic impact of successive lockdowns has lessened each time, according to the French Statistics Office. This trend was replicated in the country’s housing market.

Recovery mode

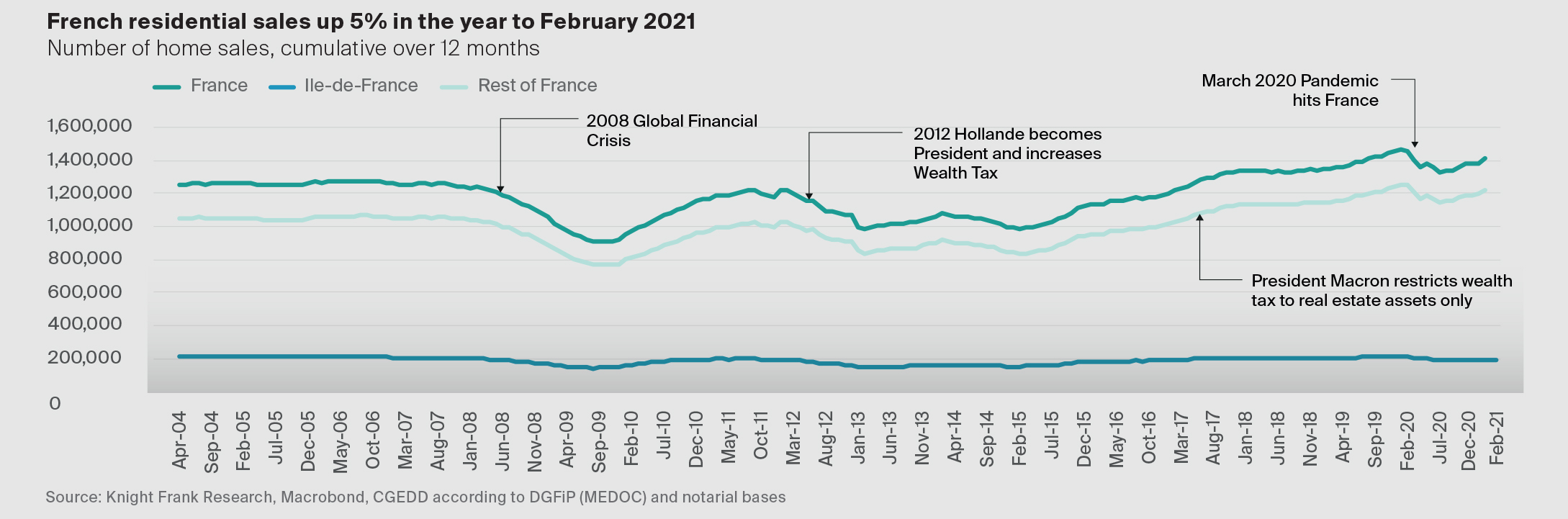

Residential sales largely halted in Q2 2020 as the housing market shut down, but subsequent lockdowns have seen momentum maintained with annual sales volumes up 5% between August 2020 and February 2021. Rural departments such as Aude, the Dordogne and the Pyrénées have seen some of the largest increases in sales year-on-year.

Cheap finance & stimulus support

The French Government has deployed €604 billion in additional spending and liquidity support, including a furlough scheme that covers 84% of net wages for residents earning up to €6,927 per month. At 1.11% mortgage rates are at a 50-year low according to the Bank of France, down from 5.35% in 2008, meaning homeowners looking to relocate or purchase a second home during the pandemic found it a relatively affordable option. Further assistance was provided by France’s Financial Stability Board which eased lending rules in 2020 allowing banks to raise the household debt threshold from 33% to 35%.

The return of the French

Paris was arguably hit hardest by the pandemic but analysis by our Paris research team shows only a small increase in households relocating from central Paris to the suburbs. In the second half of 2020, some 34% of those Parisians that left the city centre moved to the inner suburbs, up from a ten-year average of 30% and 11% moved to the outer suburbs, up only marginally from a ten-year average of 8%. French buyers dominated sales in 2020 as international travel bans curbed overseas demand. In 2020, 60% of prime sales agreed in France by Knight Frank were to French buyers or overseas nationals based in France, the highest on record.

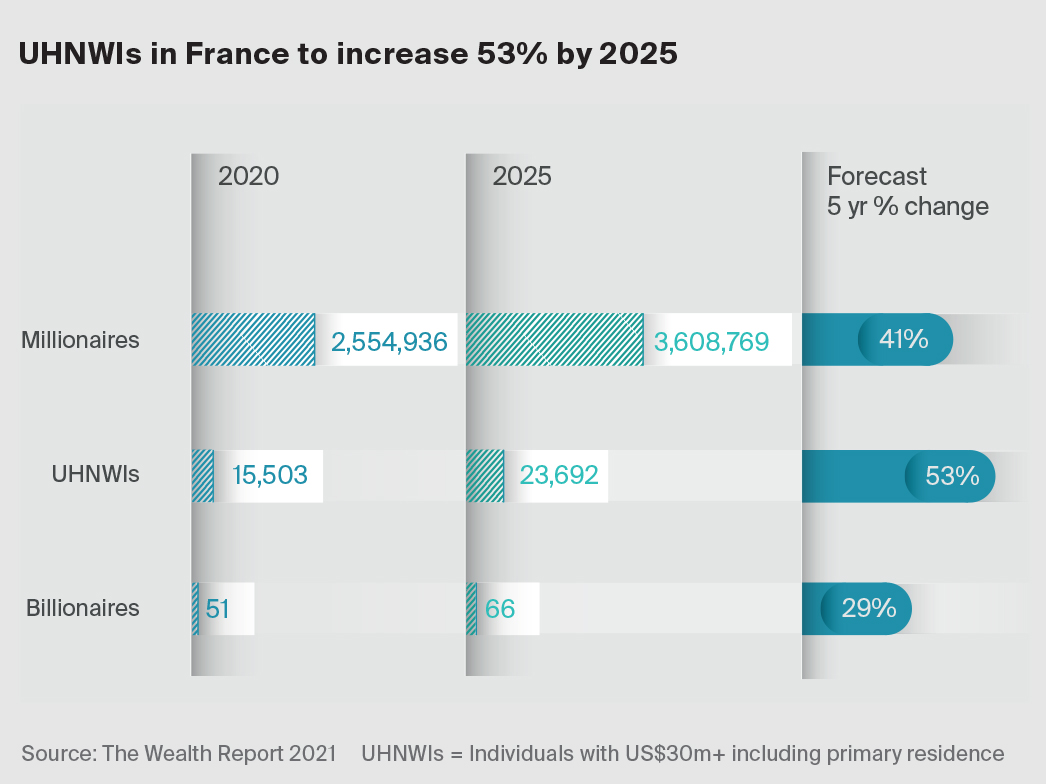

Pent-up demand released in 2021 A surge in overseas demand is likely once borders reopen. France is home to over 15,500 ultra-high-net-worth individuals (UHNWIs), each with more than US$30 million in assets, a figure that is forecast to rise by 53% to almost 23,700 by 2025 according to The Wealth Report 2021.

France’s lifestyle, accessibility and climate are major draws with Monaco and the Côte d’Azur arguably home to one of the largest concentrations of wealth globally. President Macron’s decision in 2017 to remove the wealth tax on everything except property assets, helped cement the view that France was probusiness, reversing the outflow of wealth evident during Hollande's presidency.

7th & 16th arrondissements

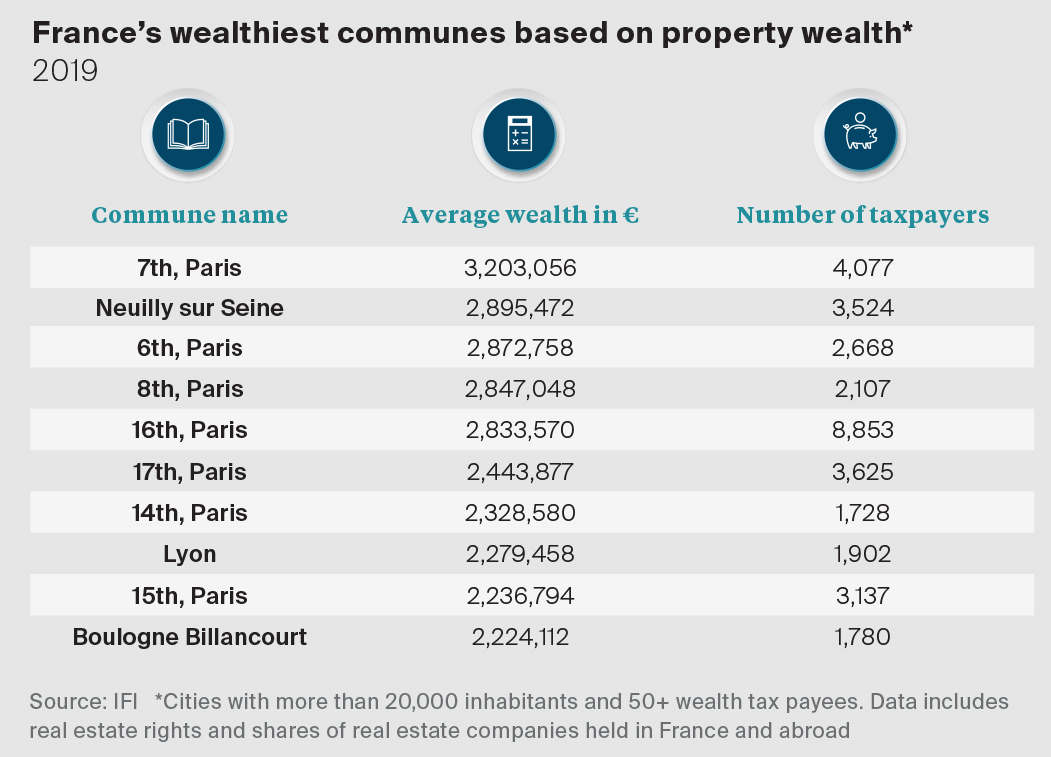

France’s top wealth enclaves Data from the French tax authorities reveals where in France the wealthy reside. In 2019 (latest available data), average wealth (based on property wealth only) was highest in Paris’ 7th arrondissement, whilst the 16th was home to the largest number of taxpayers (8,853).

Photo by Pedro Lastra on Unsplash