Consumer-Driven Demand: Changing Lifestyles

Where we live, how much we earn, how we shop, what we spend our money on and how we spend our leisure time are all driving changes in our requirements of the industrial and logistics sector.

11 minutes to read

The rise of online retail

Technology and digitalisation have changed how households shop. Online penetration rates have increased from 9.3% to 26.6% over the past ten years (2012-2022) and are forecast to rise further to reach 29.1% by 2028 (Mintel). Growth in online retail sales and the associated demand for business to consumer (B2C) deliveries has driven strong growth in demand for distribution and fulfilment facilities. This type of distribution requires more logistics space compared with traditional retail, with order fulfilment taking place in the warehouse rather than the store.

"Online penetration rates have increased from 9.3% to 26.6% over the past ten years (2012-2022) and are forecast to rise further to reach 29.1% by 2028 (Mintel)"

With e-commerce and B2C operations expanding their footprints, there has been a need for the development of distribution and fulfilment facilities, particularly in the Midlands Golden Triangle, along key transport routes and close to urban centres. Knight Frank analysis of online distribution networks found that every £1 billion in online sales requires 1.36 million sq ft of logistics space.

Servicing the growth in online sales over the past ten years has resulted in rising demand for warehousing space. The pandemic accelerated the growth in e-commerce, with non-essential shops ordered to close during lockdown periods and many shoppers looking to online alternatives due to concerns about the virus. Online penetration rates reached 30.7% in 2021 (ONS), although they have since declined (to 26.6% in 2022). The spike in online sales prompted some instances of online retailers over expanding and this has led to some space coming back to the market recently. However, the long-term trajectory is one of growth.

Download Future Gazing 2024

Though growth in e-commerce has not been the only source of additional demand, stiff competition amongst occupiers has pushed rents up and vacancy rates down. At the end of 2013, the UK industrial vacancy rate (units over 50,000 sq ft) was 9.2%, compared with 5.2% currently (Q3 2023). Prime rents across the UK (units over 50,000 sq ft) have risen 92% over the same period.

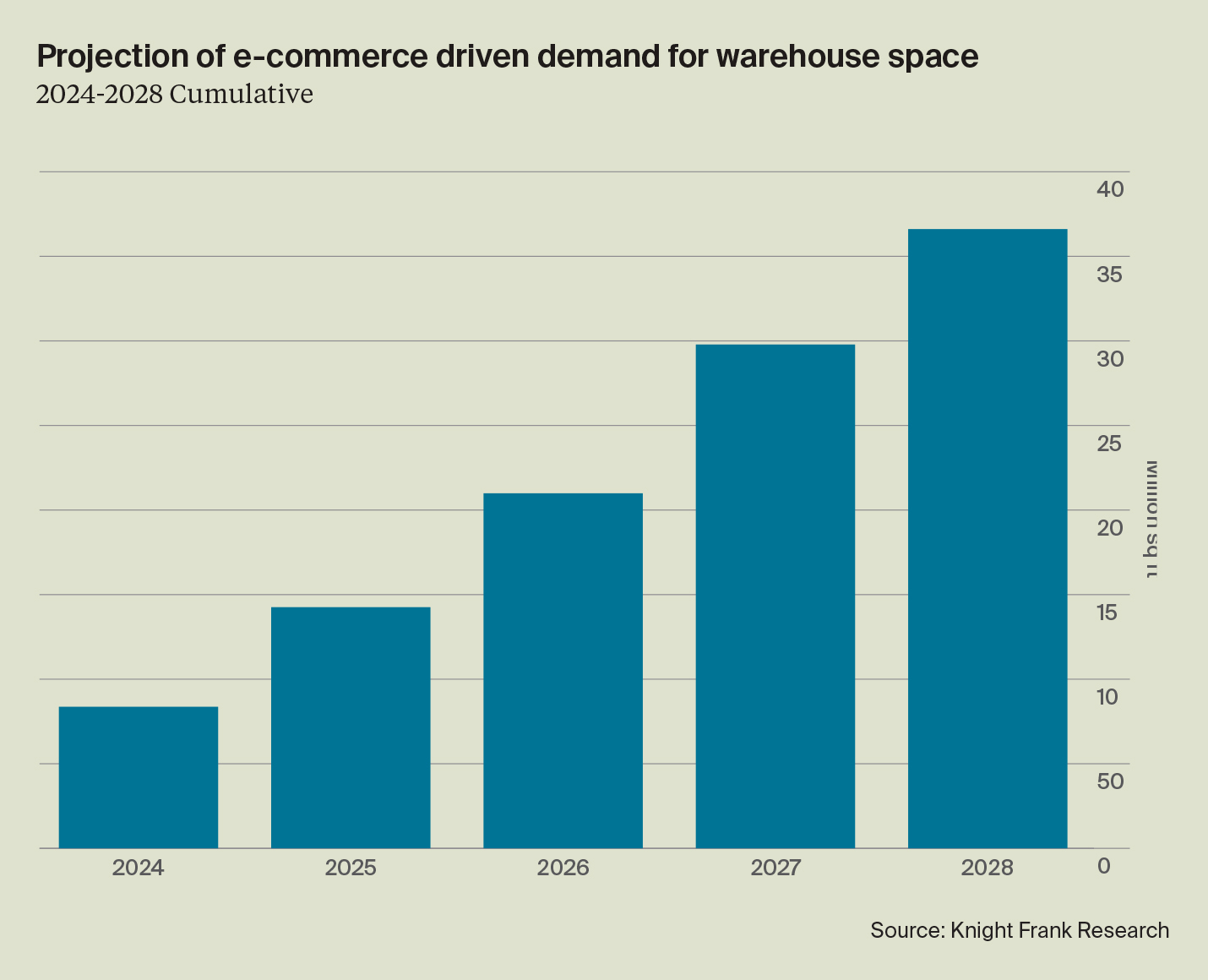

"Based on retail sales forecasts from Oxford Economics and Mintel, we have calculated that the growth in online retail will require an additional 37 million sq ft of space over the next five years"

Households are spending more and more online, and the amount of fulfilment and distribution space needed to service this demand is rising. Online sales totalled an estimated £3,961 per dwelling on average in 2023, requiring approximately 5.4 sq ft of industrial and logistics floorspace (per dwelling). Based on forecast online penetration rates from Mintel, and retail sales and dwellings forecasts from Oxford Economics, this is expected to rise to £4,699 per dwelling by 2028 (2023 prices). This rise will mean that the anticipated growth in e-commerce by 2028 will raise requirements per dwelling to 6.4 sq ft. To put this another way, for each additional dwelling forecast over the next five years an additional 38.2 sq ft of industrial and logistics stock will be needed to accommodate the increasing online retail demand.

"For each additional dwelling forecast over the next five years an additional 38.2 sq ft of industrial and logistics stock will be needed to accommodate the increasing online retail demand"

This figure assumes that the utilisation of space per quantity of throughput remains the same. However, retailers are increasingly outsourcing both their e-commerce fulfilment and deliveries to their store networks to specialist third-party logistics firms. This may result in greater efficiencies, through better utilisation of floorspace, with taller buildings and more mezzanine usage, and greater automation.

Our analysis of online distribution networks found that 20-25% of space is typically needed in ‘last-mile’ facilities as part of hub and spoke distribution models. The growth in online retail over the next five years is likely to require an additional 7-9 million sq ft of last mile logistics floorspace, with a greater proportion of this space needed in and around Greater London and the South East and East of England regions.

Store-based retail set for growth

It’s not only the growth of online retailing, however. While online retail has been a significant source of growth in the sector, it still accounts for just over a quarter of all retail expenditure in the UK.

Download Future Gazing 2024

Delivering to a store network requires much less warehousing space compared with fulfilling individual customer orders. Store stock tends to be delivered in bulk, often in roll-cages, with minimal packaging. This makes storage and packaging much more efficient in terms of space. Furthermore, store-based retail does not require last-mile distribution.

“E-commerce requires three times the amount of distribution space as store-based retail” is an often-quoted figure and our analysis supports this. In our assessment of the top eight retailers in the UK, with predominantly store-based sales, we find that each £1 billion of in-store retail sales utilises 449,000 sq ft of industrial and logistics space.

"For store-based sales, we find that each £1 billion of in-store retail sales utilises 449,000 sq ft of industrial and logistics space"

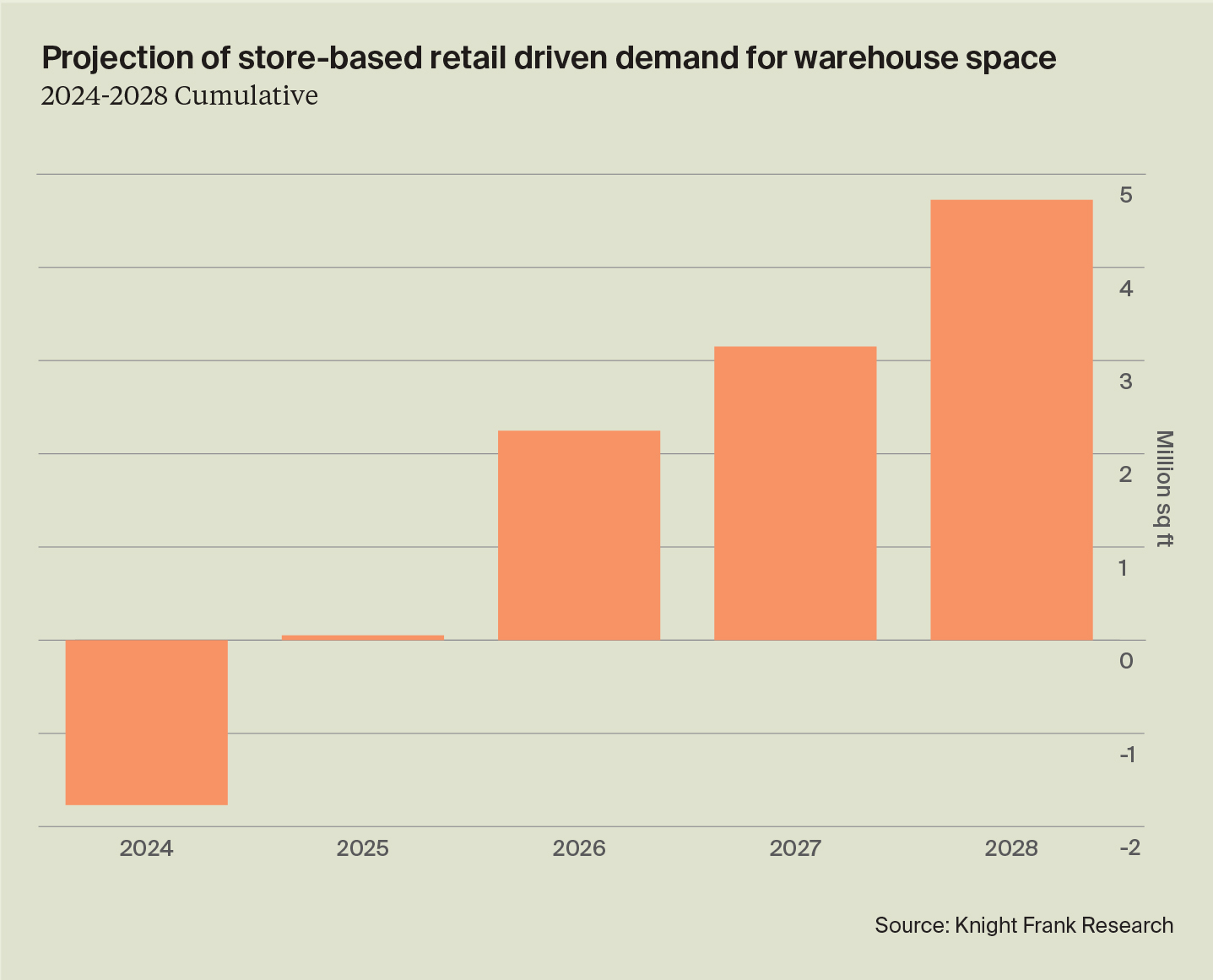

Based on this relationship and using retail sales forecasts from Oxford Economics (subtracting forecast online retail and fuel sales), we have calculated the expected growth in in-store retail sales volumes over the next five years. We find that an additional 4.7 million sq ft of warehouse space is required to support the growth in store-based retail sales over the next five years.

"4.7 million sq ft of warehouse space is required to support the growth in store-based retail sales over the next five years"

Each dwelling spends approximately £11,184 (2023) on retail (excluding fuel and online sales) and therefore requires 5.0 sq ft of industrial and logistics space to service these purchases. Retail sales volumes (excluding online sales and fuel sales) are forecast to rise in line with the number of dwellings. Therefore, the floorspace needed per dwelling will remain broadly stable over the next five years, with each additional dwelling forecast needing an extra 4.9 sq ft of industrial and logistics space to support store-based retail purchases.

Distribution to retail store networks is well established with fixed routes and predictable order volumes and locations. This type of distribution is not prone to the same flux as B2C deliveries. Locations are based on the store network, which is relatively fixed. Therefore, additional floorspace requirements may result in extensions of additional facilities or selective upsizing rather than significant network expansions.

Retail store distribution networks have seen limited network modernisation in recent years. The recent softening in capital values and rental growth rates may prompt some retailers to take the opportunity to get fit for purpose and upgrade or expand.

Download Future Gazing 2024

It is worth noting that this analysis only considers the top retailers and looks only at their own distribution channels. This analysis doesn’t consider direct store delivery (DSD) from suppliers. The list of top retailers is dominated by grocery stores, including Tesco and Sainsburys, Asda, Morrisons, Aldi, as well as John Lewis, M&S and Co-Op. Some suppliers to grocery retailers will often deliver their products directly to the stores as a way to reduce the time it takes fresh produce to reach the customers. For example, bread is often distributed in this way.

This analysis does not consider suppliers to retailers, either direct-to-store distribution or other business-to-business (B2B) parts of the supply chain. The further back in the supply chain we go, the further from the final delivery point or customer we are. Proximity to the customer tends to be less critical, and production or operating costs more important.

Wholesale/distributive trade demand

Global supply chains are essential to modern life, and wholesalers and B2B trade and distribution firms form the critical link between production and consumer, wherever they may be.

The modern marketplace is now global. As well as consumers, B2B trade is increasingly taking place through online platforms. Digital technologies have allowed consumers and wholesalers to look further afield for goods and to compare prices across a global platform. Logistics enables these businesses and markets around the world to connect.

This part of the supply chain is varied in terms of markets, locations, types of facilities and drivers of demand. A rise in retail sales (both domestic and international) will have a knock-on impact on wholesalers and traders who supply retailers. A rise in manufacturing output could also have a positive impact on demand. Many wholesalers or B2B distribution firms will be connected to international trade, either importing or exporting goods. Global markets, international supply chains, trade relationships, and currency movements will also therefore influence demand.

Modern consumers have high expectations, expecting timely and reliable deliveries. However, supply chains have been badly impacted by various factors in recent years from the Covid pandemic, and more recently hijackings of cargo ships and a drought affecting the Panama Canal, forcing cuts in vessel traffic, with a 40% reduction of vessels expected by February 2024.

These issues have prompted many retailers and manufacturers to reassess their supply chain strategies, seeking to improve resilience, responsiveness and visibility. Some firms are now looking closer to home for suppliers and components and increasing investment into supply chain technologies. Some wholesalers and distributors are opting to hold additional stock to protect against delays and ensure they can meet customer demand.

Demand from service activities

Particularly in urban locations, industrial property uses have evolved away from traditional manufacturing towards an occupier base now dominated by ‘clean’ and more service-based activities. In London, a large proportion of the activities taking place on industrial land are not industrial activities. The service sector accounts for 16% of occupied industrial floorspace across the UK but 25% in Greater London, 39% across Inner London boroughs, and in Manchester it accounts for 30%.

Download Future Gazing 2024

The expansion of the service sector in industrial and logistics premises can be partly explained by the high occupancy costs and limited availability of well-located commercial premises in city centres. But there is also growing demand for facilities or hybrid premises that don’t fit neatly into one of the traditional property sector classifications. Many occupiers of urban industrial space today are ‘clean’ activities that provide the expanding city centre population and businesses with services such as catering, cleaning, courier services, laundry services, hospitality services, property maintenance, vehicle maintenance, media production, storing office supplies, printing and many others. These types of businesses are often collectively referred to as ‘servicing the services’.

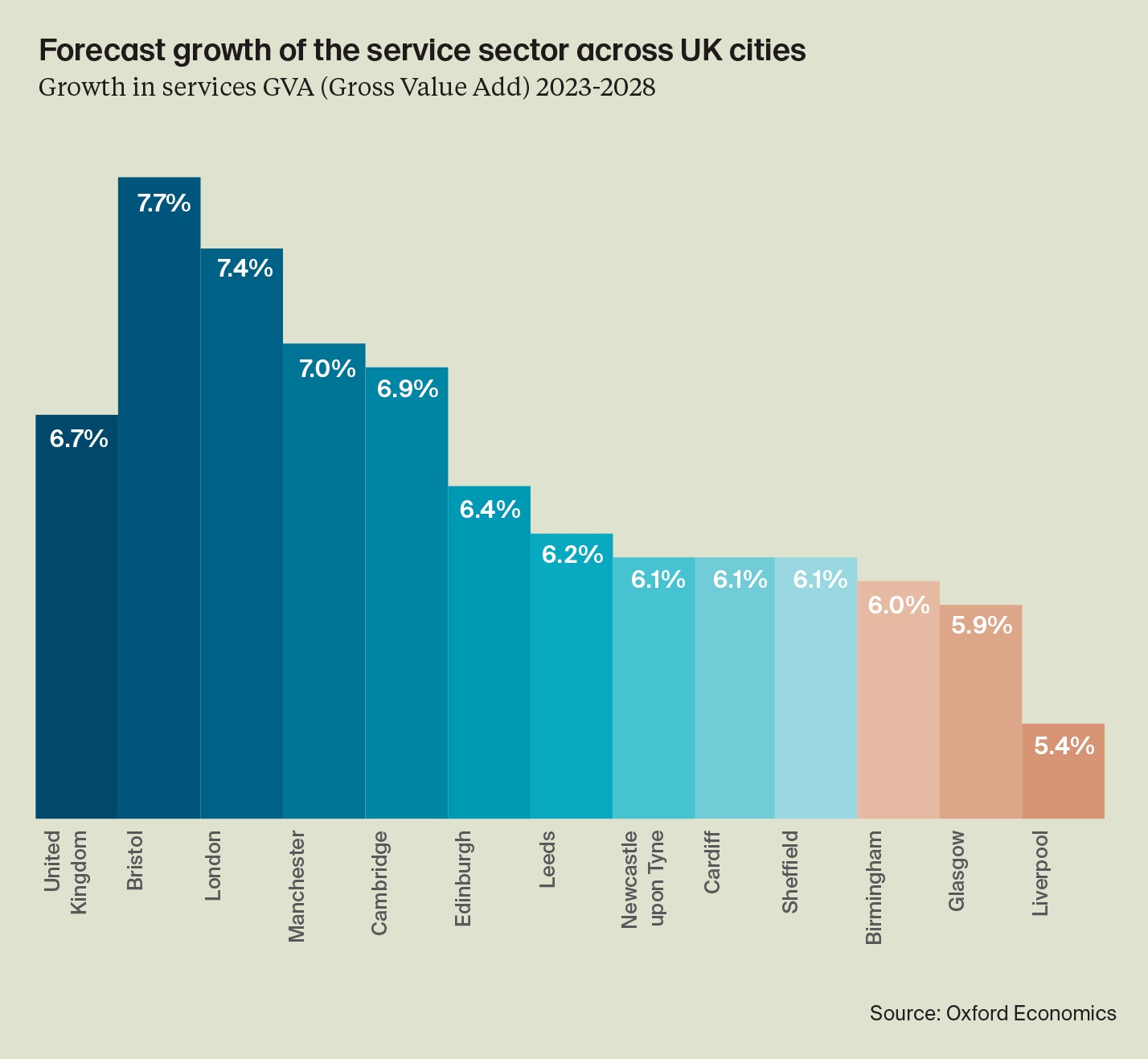

Demand for this type of space will continue to grow. The UK's economy is dominated by service industries, which include retail, hospitality, and finance, as well as public services like health and education. Service sectors accounted for 81% of UK output in 2022, though the proportion is higher in many cities. In London, the service sector accounts for 91% of output, 88% in Edinburgh and 83% in Bristol. The service sector is forecasted to see strong growth over the next five years, with output expected to rise 6.7% across the UK, but London, Bristol, and Manchester are expected to see growth rates in excess of 7% (Oxford Economics).

"If the need for industrial and logistics space for service activities grew in line with these forecasts, there would be a need for an additional 36.5 million sq ft across the UK, with 3.9 million sq ft of this space needed in Greater London"

Policymakers seeking to support the growth of UK city economies must consider the needs of these ‘servicing the services’ businesses and their demands upon urban industrial land. And whether they should be accommodated on existing industrial land or perhaps instead incorporated as part of new mixed-use developments.

Non-traditional/alternative sources of demand

Alternative or non-traditional uses of industrial and logistics floorspace and land have been rising. Non-traditional uses include film studios and data centres, as well as research and development. Though these alternative uses represent a small proportion of occupied stock, there has been significant growth in these sectors. There is also rising demand for hybrid facilities that can be used for various functions, for example, facilities that can be used for both R&D and manufacturing.

The South East and East of England regions have the largest concentrations of industrial and logistics stock occupied by non-traditional uses. Wales and the North East also have relatively high proportions of stock in non-traditional uses, while the Midlands and North West have the lowest proportions.

Our increasing use of telecommunications and digital data drives demand for data centres, which tend to be situated on industrial (or light industrial) sites. Increased demand for data centres is therefore putting demand pressures upon industrial sites and restricting the supply of land and properties for other industrial uses. Flexible industrial spaces are also used as laboratory space for research and development.

How we consume television and media is changing, with households increasingly turning to streaming platforms over terrestrial television. The rise of streaming platforms is driving demand for content, which in turn has meant increased demand for film studio space. Limited amounts of purpose-built studio space and the versatile nature of warehouse space, typically with large column-less expanses, have meant they can offer a suitable alternative for studios to adapt and convert into filming space.

Alternative sources of demand for industrial sites can be exemplified through Slough Trading Estate, an industrial estate to the west of London. Alongside logistics, food processing and automotive sectors, tenants of the park include telecoms, biotechnology, pharmaceuticals, IT, R&D, and data centres.

Warehouses are also used for alternative leisure uses, such as trampolining or climbing centres. Vacant second hand space in urban areas may be taken by leisure operators, particularly if they can secure the premises at a competitive price.