Consumer-Driven Demand: Shifting Demographics

Reshaping the landscape: Consumer-driven demand and changing demographics in the UK housing market.

5 minutes to read

Population growth and changing household structure

The UK population is expanding, albeit at a relatively modest annual rate. The UK population in 2023 was estimated to be 67.7 million, an increase of 3.6 million (+5.6%) from the population in mid-2013.

"The UK population in 2023 was estimated to be 67.7 million, an increase of 3.6 million (+5.6%) from the population in mid-2013"

Household sizes are shrinking. Over the past twenty years, the average household size has shrunk from 2.41 persons in 2003 to an estimated 2.37 in 2023 (Oxford Economics) and is expected to decrease further to reach 2.32 in ten years (2033). Rising populations and shrinking household sizes are driving demand for more housing and a greater number of dwellings per head of population. This means more addresses that need to be delivered to.

Urbanisation and housing demand

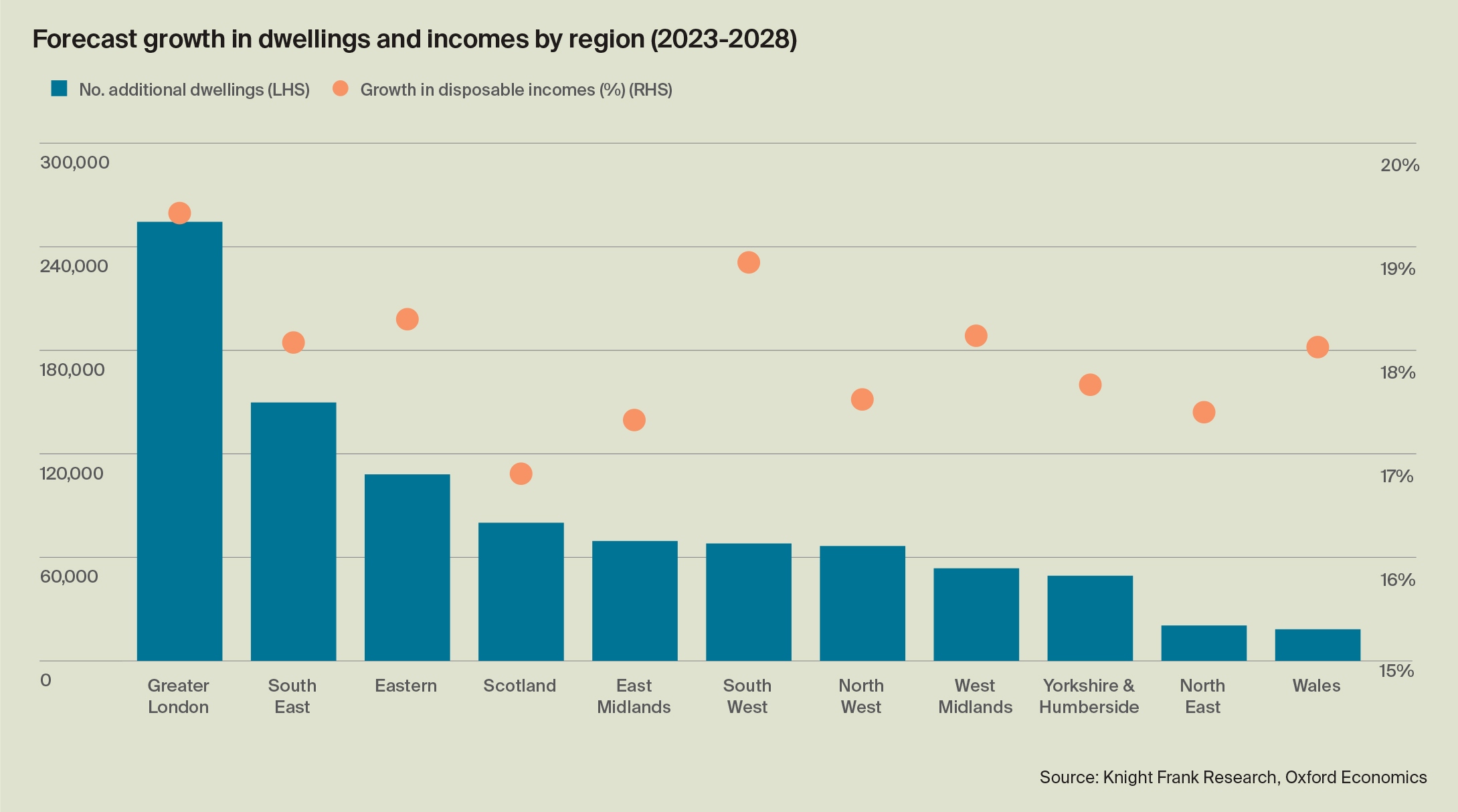

In the year to March 2023, a total of 210,320 homes were completed (ONS). Oxford Economics forecast the number of dwellings to rise by 958,640 over the next five years (to 2028), broadly in line with current delivery levels. However, in October 2023, the Labour Party announced they would reinstate mandatory housing targets, setting a housing target of 1.5 million homes over five years, or 300,000 per annum. This is the same level set by the Conservative government in 2021, though they have since declared this an advisory rather than a mandatory target.

Our report uses the Oxford Economics forecasts as a base case for estimates of floorspace per dwelling. However, if these housing targets were met, this could mean an additional 541,460 homes and even greater demand for industrial and logistics floorspace to service these additional homes.

Download Future Gazing 2024

While all regions are expected to see a rise in the number of dwellings over the next five years, London is expected to record the strongest growth, with an additional 254,450 dwellings anticipated by the end of 2028, or 6.7% growth (Oxford Economics). The South East region is also expected to see strong growth, with an extra 149,770 dwellings expected (+3.6%) by the end of 2028, as is the East of England region, with an additional 108,110 dwellings (+3.8%). Greater London is also expected to record the strongest growth in disposable incomes (+19.3%), followed by the South West and then the East of England regions.

"While all regions are expected to see a rise in the number of dwellings over the next five years, London is expected to record the strongest growth, with an additional 254,450 dwellings anticipated by the end of 2028, or 6.7% growth (Oxford Economics)"

Our modern lives are increasingly urban. While the urban population is rising, rural populations are shrinking. Currently, around 84.5% of the population is urban (57.7 million people). This compares to 82.1% or 52.7 million people ten years ago (2013), and by 2033, the urban population is expected to reach 59.5 million, or 85.6% (Oxford Economics).

"Our modern lives are increasingly urban. While the urban population is rising, rural populations are shrinking. Currently, around 84.5% of the population is urban (57.7 million people)"

Growing urban populations will mean greater pressures on industrial and logistics land in UK towns and cities due to housing needs. It also means a greater need for urban industrial and logistics property to service the growing population and rising demand for deliveries and services. There will be a greater need for both last-mile logistics (B2C) and facilities catering to the growing food and beverage, leisure and hospitality sectors in these cities (B2B).

Download Future Gazing 2024

People in urban areas typically receive higher incomes than those living in rural UK regions. In 2020, median workplace-based earnings in Predominantly Urban areas (excluding London) were £25,400, while Predominantly Rural areas were lower at £22,900 (ONS). There are also major differences in shopping behaviours and consumption patterns. When it comes to online retail, rural consumers have more limited options; click-and-collect from-store options are less likely to offer convenience, and they may have to pay a premium for deliveries.

Those who live, work or visit in urban environments will have more shops and services on their doorstep, with far greater choice; there will also be more online delivery options and Q-commerce available. Urban residents, city centre workers, and tourists are likely to go to restaurants more often, have takeout food delivered, grab a coffee or sandwich on the go, and require dry cleaning or laundry services. Space is at a premium in city centres, and locating goods or performing some services offsite can enable firms to make more efficient use of their city centre floorspace. Storing goods or performing services close to the city centre means a need for industrial and logistics property to be located in the suburbs of the city or within close proximity.

The changing distribution of the UK’s dwellings and household incomes will impact the distribution of both online and in-store retail spend. Along with a greater proportion of urban residents, there are regional variations in terms of forecasts for additional dwellings and growth in household incomes. A greater number of homes in London, the South East and Eastern regions will drive proportionately greater growth in demand for distribution and logistics facilities in these regions. The impact on the locations of national distribution hubs is likely to be relatively limited. Though the centre of gravity in terms of consumer demand may shift slightly further south, rising rent costs may lead some operators to look further north. The main impact will be felt in terms of demand for last-mile logistics facilities.

Aside from consumer-driven shifts, migration and demographic changes will also impact the workforce, and this, in turn, will impact locations for industrial and logistics operations. Increasing use of technology, data and automation in warehouses is impacting the types of employment found in warehouses, with a need for more highly educated workers or ones with specialist skillsets. Attracting this type of talent may influence the locations of warehouse operations.