Production-Driven Demand

Driving growth: The dynamics of manufacturing demand and changing landscape in the UK industrial sector.

9 minutes to read

The manufacturing sector and the wider economy

Being further up the supply chain, manufacturing industries, unlike logistics operators servicing retail demand, can often, but not always, locate further away from the customer or final place of sale. High operating costs in the UK have meant many firms locate their manufacturing operations overseas.

The distance between manufacturing parts of the supply chain and the end user can make a link to households more difficult to define and more prone to external factors such as geopolitics and currency fluctuations. However, various supply chain issues in recent years, combined with rising tariffs for imported products, have led both private firms and the UK government to want to increase supply chain resilience and manufacturing capabilities at home, particularly for critical industries.

High-value manufacturing is of strategic importance for the UK government. In 2023, the UK government published its Advanced Manufacturing Plan, setting out its priorities of boosting investment, international cooperation, building supply chain resilience and reducing costs and barriers to competitiveness.

Manufacturing is an important source of employment in the UK, with average salaries 10% higher than the UK average. There are currently approximately 2.6 million employed in the manufacturing sector, with average weekly wages of £710 compared with £648 across the whole economy (October 2023, ONS).

"An additional 33.8 million sq ft of industrial and logistics space will be needed by 2028 to accommodate the forecast growth in manufacturing"

In November 2023, the UK government announced £4.5 billion in funding for British manufacturing to increase investment in strategic manufacturing sectors, including automotive, aerospace, life sciences and clean energy. The funding will be available from 2025 for five years. The funding forms part of the Prime Minister's pledge to grow the economy, attract private investment, boost energy security, create more skilled, high-paid jobs, and enable the UK to seize growth opportunities through the transition to net zero.

Download Future Gazing 2024

In 2021, the UK ranked as the eighth-largest manufacturing economy in the world. Despite only accounting for 10% of GDP, the manufacturing sector accounts for 43% of all UK exports. The sector is, therefore, critical to the government’s Export Strategy’s aim of reaching £1 trillion in exports by 2030. This would require growth of 20% compared with 2022 figures when exports totalled £834 million.

Rising output and improving efficiencies

Manufacturing output has risen faster than occupied stock. Manufacturing output is anticipated to have risen 11.5% in the ten years to 2023 (based on forecast 2023 figures from Oxford Economics) but only 2.1% in the last five years. Meanwhile, occupied manufacturing industrial space has risen 5.8% in ten years and only 0.4% in the past five years.

This could indicate improving capacity utilisation in the sector; that is, a greater economic output is being generated using a smaller real estate footprint. This is likely due in part to a change in the make-up of the UK manufacturing sector, with high-value manufacturing comprising a greater proportion of both economic output and industrial floorspace.

There has been a rise in the proportion of manufacturing take up in recent years, accounting for 25% of take up in the last two years, compared with just 15% in the previous two.

Demand for space has come from a variety of manufacturing firms, both traditional manufacturing and advanced manufacturing. Engineering firms, electronic manufacturers, automotive and aerospace manufacturers, food manufacturers, and life science manufacturing firms all took space in 2023. For example, Siemens Healthineers took just over 600,000 sq ft in Bicester, and Pelican Healthcare took 82,000 sq ft in Cardiff.

Each £ billion of manufacturing output (GDP) requires around 3.39 million sq ft of floorspace (based on an average from the past ten years). In 2013, each £ billion (2023 prices) required around 3.47 million sq ft. However, this has trended downwards over the last ten years, and in 2023, £1 billion of manufacturing output is expected to be generated with only 3.29 million sq ft of floorspace.

"£1 billion of manufacturing output is expected to be generated with only 3.29 million sq ft of floorspace"

Manufacturing output is forecast to grow 4.3% over the next five years to 2028 (Oxford Economics). If capacity utilisation rates remain at around £1 billion output per 3.29 million sq ft, then an additional 33.8 million sq ft of industrial and logistics space will be needed by 2028 to accommodate the forecast growth in manufacturing.

Download Future Gazing 2024

However, improving capacity utilisation rates may reduce this figure. Greater capacity utilisation in the manufacturing sector could make it possible to grow output without the same proportional increase in occupied industrial floorspace. Based on the downward trend over the past ten years, it could be expected to improve further over the next five and ten years in manufacturing.

Regional variations

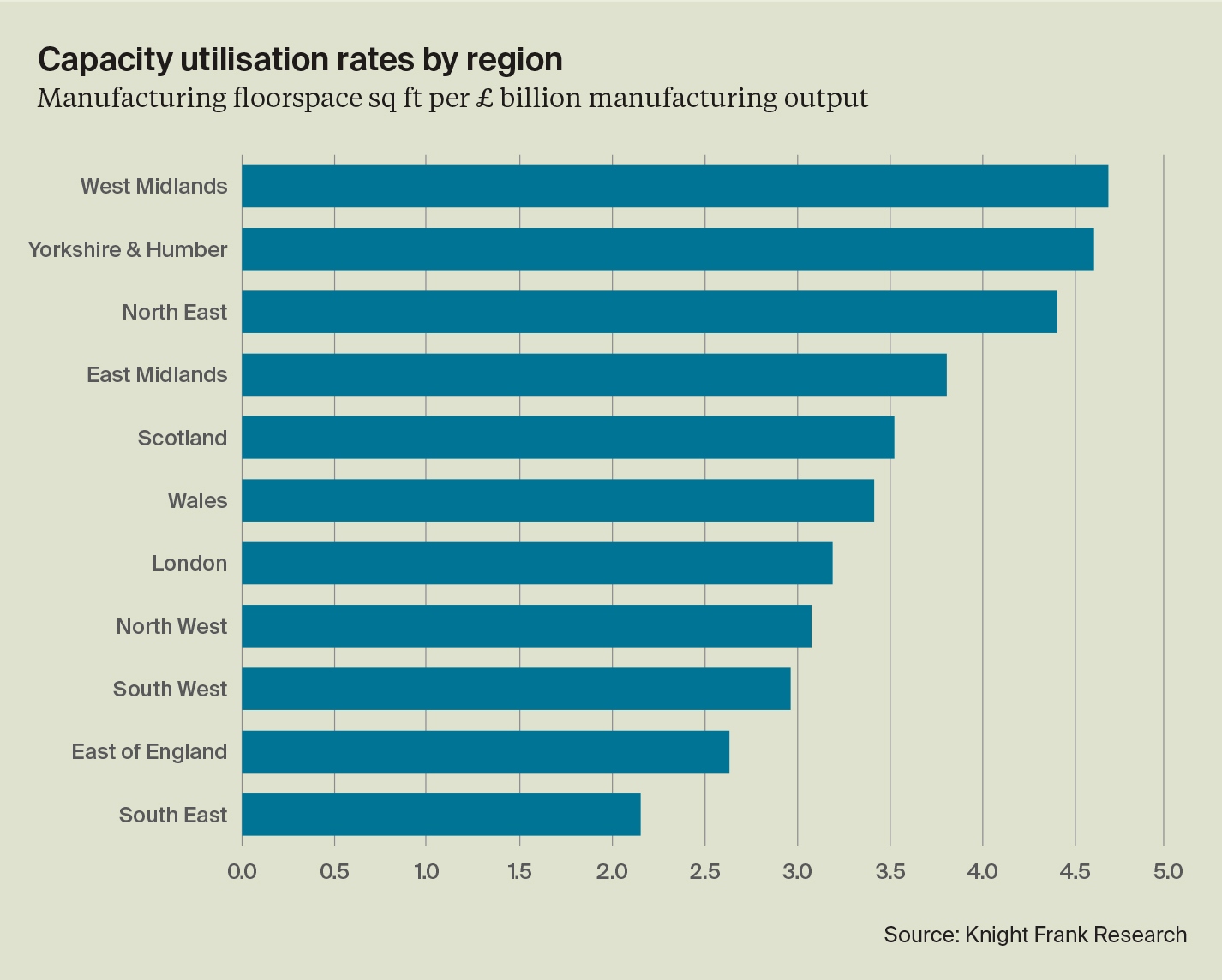

On a regional basis, capacity utilisation rates are highest in the South East region, where £1 billion of manufacturing output was generated with just over 2 million sq ft of floorspace. East England and South West regions also have high capacity utilisation rates. At the other end of the scale, the West Midlands, North East and Yorkshire & Humber have much lower capacity utilisation rates, with a larger floorspace needed per £1 billion of manufacturing output.

These variations will be partly due to the different types of manufacturing in these regions. Computers, electronics, and pharmaceuticals are key manufacturing sectors in the South East region. These sectors also have a strong presence in the East of England region. The South West has a significant aerospace engineering presence. These high-value sectors are likely to have a high output per sq ft of floorspace.

It may also reflect differences in operational costs (particularly rents) and variations in the availability of new facilities. Prime rents in West London are currently £27.50, compared with £11.00 in Birmingham and £8.75 per sq ft in Leeds (Q4 2023, units over 50,000 sq ft).

In locations where occupiers are paying a higher rate per sq ft, they may seek to use the asset more intensively. At the same time, there is less incentive to improve operational efficiencies in a location with cheaper rents. In areas with low levels of industrial stock available, there may be limited scope for expansion to larger facilities.

The forecast floorspace requirements by region do not consider changes in the composition of manufacturing in terms of subsectors. There will be variations in capacity utilisation rates by subsector, and a shift towards more high-value manufacturing is likely to mean improving capacity utilisation rates.

Requirements per dwelling

There is currently 25.6 sq ft of occupied manufacturing floorspace per dwelling in the UK. This number has trended downwards over the past ten years (averaging 26.7 between 2013-2018), as the increase in manufacturing floorspace has not kept pace with rising numbers of dwellings.

An additional 958,640 dwellings are forecasted in the UK by 2028 (Oxford Economics). Achieving the forecast growth in manufacturing output (at current capacity utilisation rates) would require an additional 35.3 sq ft of manufacturing floorspace for each additional dwelling, raising the required manufacturing floorspace per dwelling to 25.9 sq ft by 2028.

Download Future Gazing 2024

Changing lifestyles and composition of the manufacturing sector

The composition of the manufacturing sector in the UK continues to shift away from heavy industry, such as the manufacture of basic metals and metal products, towards a higher concentration of high-value manufacturing sectors – such as computer, electronic and opticalm products. As this shift continues, the capacity utilisation rates will improve, and thus the amount of floorspace needed to generate additional output is likely to decrease.

UK food manufacturing sector

"An additional 3.5 million sq ft will be required across the UK to accommodate growth in the food manufacturing sector"

Food production is the UK’s largest manufacturing subsector (by output), accounting for around 18% of UK manufacturing output. Across the UK, employment in food manufacturing has risen 19% over the past ten years (to 2022).

Download Future Gazing 2024

What we eat is an essential part of our lifestyle choices and well-being. Modern food habits have evolved due to urbanisation, technological advancements, and shifting lifestyles. Busy modern lifestyles have driven a need for speed and convenience. From ready meals to pre-prepared sauces to recipe kits, a growing number of options are available to help us recreate haute cuisine with minimal time and effort. Demand for these products and for processed food more broadly has led to growth in food manufacturing in the UK.

In London, the food products, beverages and tobacco subsectors account for around 32% of manufacturing output for the region. Food and beverage manufacturers are needed close to urban centres, providing freshly prepared items or dishes to the cities’ hospitality industries and food retailers.

Despite continued inflationary pressures (prices for food and non-alcoholic beverages rose 9.2% in the year to November 2023) and lower office occupancy levels in many cities post-Covid, long-term trends, including urbanisation and growing consumer need for convenience will support the growth of the sector long term.

Download Future Gazing 2024

The food products, beverages and tobacco manufacturing subsector is forecast to grow faster than the manufacturing sector overall, with 4.7% growth forecast over the next five years, with an additional £1.9 billion of output expected by 2028 (2023 prices) (Oxford Economics).

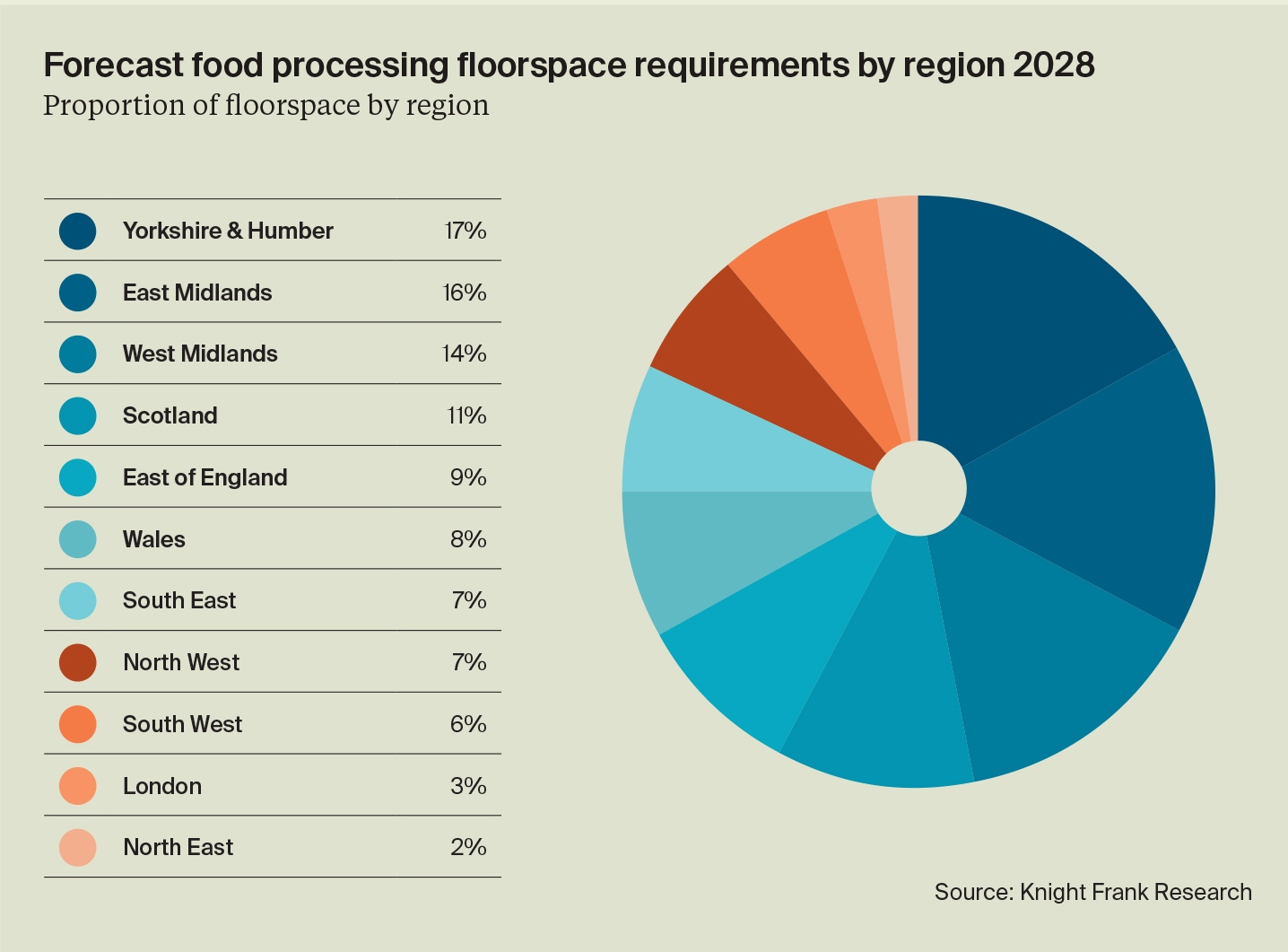

The strongest growth in percentage terms is forecast for Wales, with 5.7% growth by 2028. However, in absolute terms, the strongest growth is expected in Scotland, with an additional £316 million output per annum expected by 2028, accounting for 17% of the total growth across the UK. The East Midlands and Yorkshire & Humber regions are also expected to see strong growth in absolute terms.

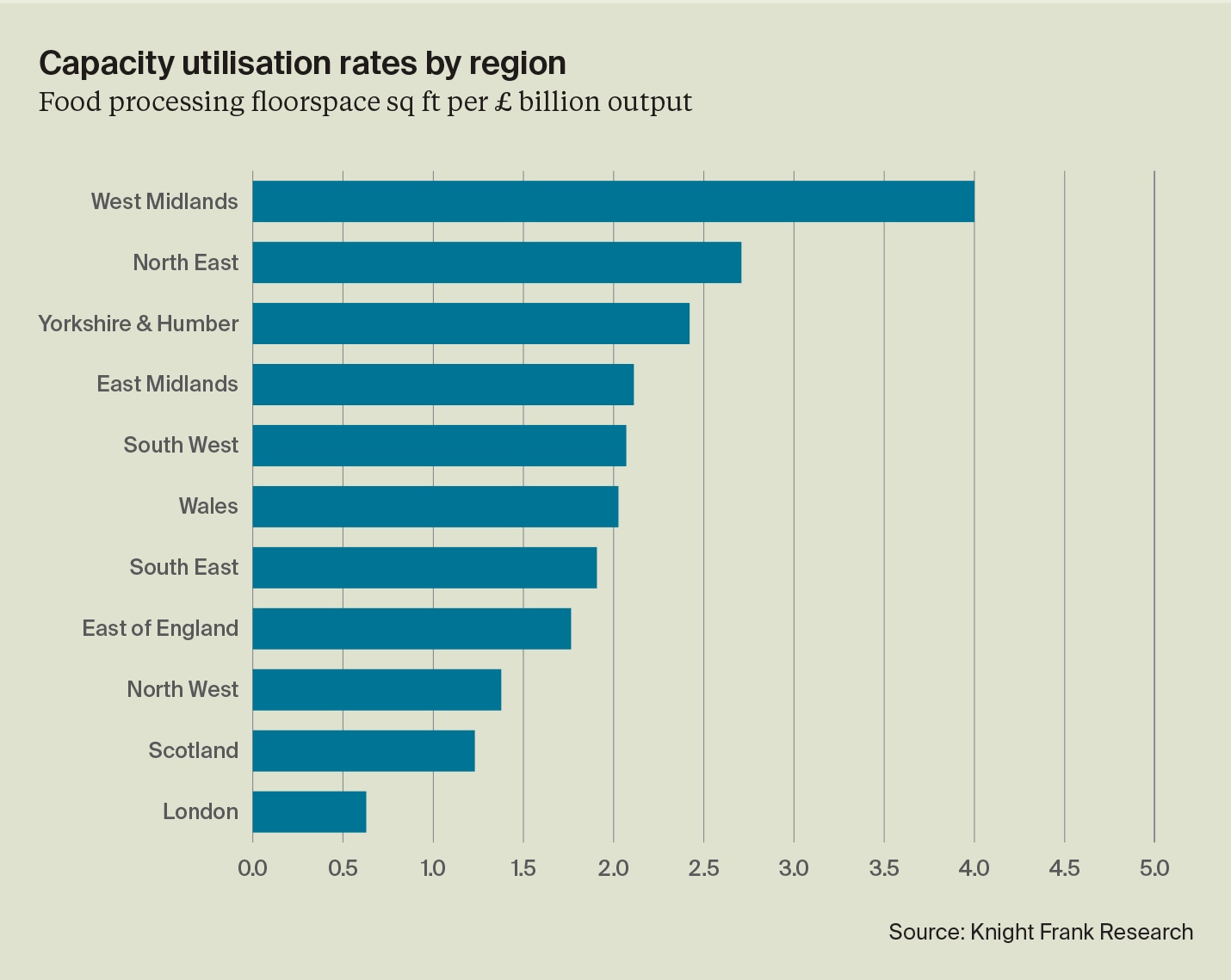

The food processing industry is highly varied. Small, urban multi-let units house a variety of producers, from artisan chocolate makers, micro-breweries, bakeries and coffee roasters. The largest food manufacturing firms that make and supply household food brands to UK supermarkets, including Associated British Foods, Boparan Holdings and Arla Foods occupy large, highly automated facilities. There will be great variation in operating costs, which is reflected in the differences in capacity utilisation across the regions. In London, small units with high rents will necessitate a high output per sq ft area. Occupiers in the capital are constrained in terms of space and with low vacancy rates, there are limited options for expansion. In locations such as the West Midlands and North East, huge facilities will house large, highly automated facilities producing foods for the national and international consumer markets.

An additional 3.5 million sq ft will be required across the UK to accommodate growth in the food manufacturing sector. The amount of floorspace per region is determined by both the forecast rise in output and the current capacity utilisation rates.