Construction surges, rate hikes ahead and the impact of new lockdowns

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Growth

UK GDP rebounded by 0.8% in January following December's 0.2% contraction, leaving the economy 0.8% larger than it was at the outset of the pandemic, according to data released Friday by the ONS.

Global events are moving so quickly that January feels like a distant memory, but there are nuggets in the release worth drawing out. Monthly construction output increased by 1.1% in volume terms and is now at its highest level since September 2019, for example. Supply chain constraints that impacted the latter half of 2021 continue to ease and the volume of new orders is now above pre-pandemic levels, suggesting demand is robust for all types of work.

Consumer-facing services remain 6.8% below their pre-coronavirus levels, while all other services are 3.4% above, revealing the degree to which the recovery has been unevenly distributed, yet the big picture remains the fact that the economy had largely shrugged off Omicron by the start of the year.

Interest rates

The ONS data strengthens the hand of the Bank of England's Monetary Policy Committee for its meeting later this week, the results of which will be published Thursday. The Bank is expected to raise interest rates for the third time in three months. An increase to 0.75% will return us to the level of March 2020.

The first two hikes had little impact on housing market activity. The number of offers accepted in the first week of March was up by 81% compared to the five year average, according to Knight Frank data. Tom Bill explores why the market is so active, despite the current economic and political backdrop:

"The first reason is easily overlooked – the end of the pandemic. The lifting of final restrictions and return to normality is spurring people to take decisions about how and where they live. Crucially, it means demand is more needs-driven and less susceptible to external events...

See the piece for more.

Prime property

February's data from London's prime property markets reveals price growth at multi-year highs with central and outer London following their own paths to recovery.

Average prices rose 4% in the 12 months to February in prime outer London, the highest figure since May 2015. It was the eleventh consecutive month of annual growth and underlines the continued appetite for space and greenery even as offices re-open. Prime central London prices rose 1.9% in the year to February, which was the strongest rate of growth since July 2015. Prices are recovering after a seven-year period of tax changes and political uncertainty, a process that has been slowed down by the pandemic.

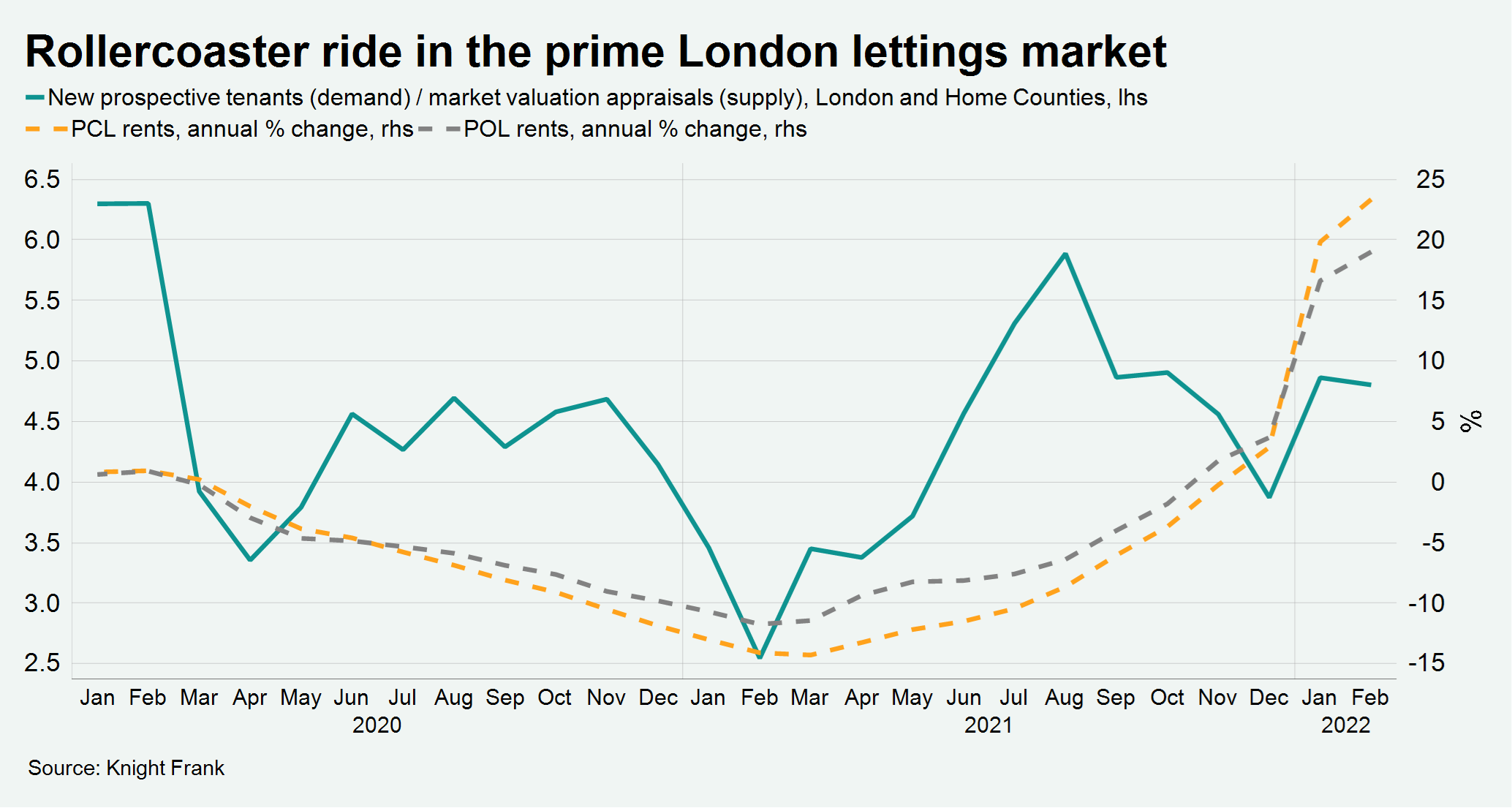

Meanwhile, rental value growth in prime London markets climbed to the highest levels on record in February as the recovery from the depths of the pandemic continued. Annual growth was 23.3% in prime central London while it reached 19% in prime outer London, underlining the precipitous nature of the drop that bottomed out last April (see chart).

Zero Covid

Chinese authorities put Shenzhen’s 17.5 million residents into lockdown on Sunday, while strict restrictions on movement were placed on residents of Shanghai. The National Health Commission reported 3,122 new cases yesterday, up from 1,524 on Saturday and 1,100 on Friday.

Risks to global supply chains remain elevated while China sticks to its "zero Covid" policy. Apple supplier Foxconn immediately suspended its operations in Shenzhen yesterday and other manufacturers in the technology hub are likely to follow suit.

Should key provinces along the coast follow Shenzhen's lead the economic costs will be substantial. As of March 9, 14 provinces were considered high or medium-risk, accounting for more than half of China's GDP, according to Bloomberg Economics.

In other news...

In a new Rural Market Update, Andrew Shirley has the latest from commodity markets following Russia's invasion of Ukraine.

Elsewhere - record numbers of UK manufacturers raise prices (Reuters), cladding talks hit a wall (Telegraph), US and allies move to further isolate Russia (NYT), food shortage warning as fertiliser rationed (Times), and finally, is the UK economy heading back to the 1970s? (FT)